Intraday Report: KSE-100 index in deep red

MG News | June 07, 2024 at 09:53 AM GMT+05:00

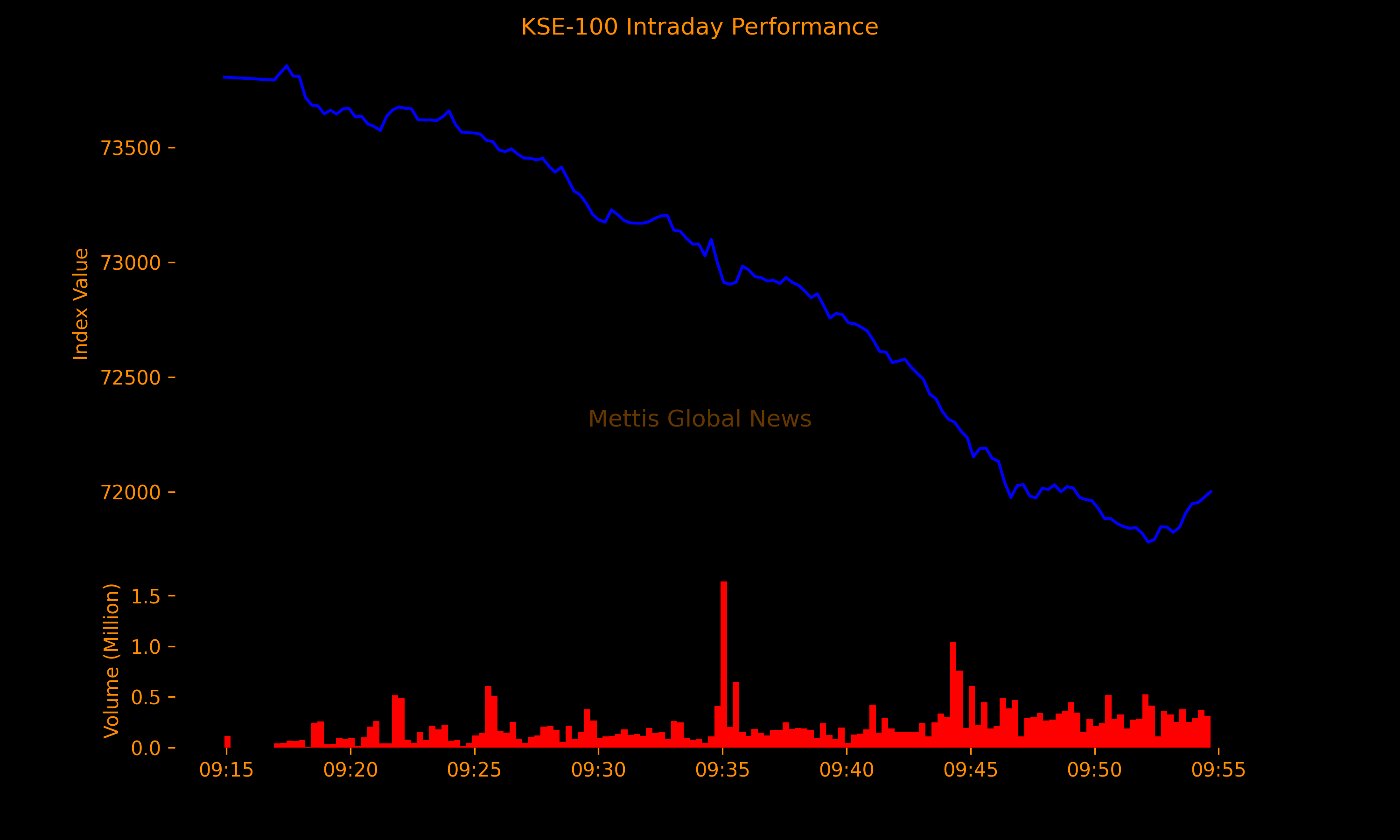

June 07, 2024 (MLN): Heavy selling continued at the Pakistan stock market, with its benchmark KSE-100 index plunging 1,822.4 points or 2.47% to 72,040.51 by 09:54am.

The sell-off comes amidst fears of an increase in Capital Gains Tax (CGT) or dividend tax in the upcoming budget for fiscal year 2024-25.

This takes the current week's decline to over 3,800 points or 5.1%.

Economist Ali Khizar on social media platform X highlighted that the International Monetary Fund (IMF) has put forward stringent proposals for the fiscal year 2024-25 budget, leaving little room for government negotiation.

He stated, "The capital gains tax will likely be equalized to standard personal income (or corporate) income, as applicable, in the upcoming budget."

Additionally, Khizar said that income tax exemptions available on mutual funds and insurance products are likely to be eliminated.

The highest bracket for personal income tax is likely to be at 45%, applicable to those earning over Rs500,000 per month, he said.

Read: History shows CGT hikes don’t scare investors

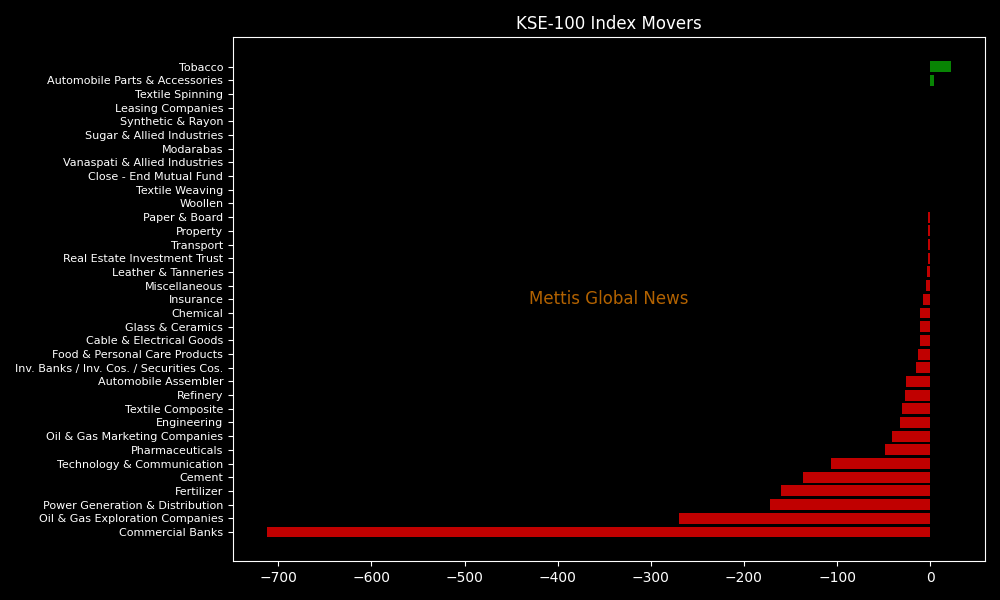

KSE-100 index was let down by Commercial Banks (711.91pts), Oil & Gas Exploration Companies (269.9pts), Power Generation & Distribution (172.41pts), Fertilizer (160.52pts), and Cement (136.67pts).

Companies that dragged the index lower were MEBL (226.01pts), UBL (147.75pts), HUBC (121.83pts), MCB (88.48pts), and SYS (78.85pts).

In the broader market, the All-Share index was at 46,699.98 with a net loss of 970.62 points.

To note, the KSE-100 has gained 30,588 points or 73.79% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 9,589 points, equivalent to 15.36%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,975.00 | 68,215.00 65,685.00 | -320.00 -0.47% |

| BRENT CRUDE | 106.71 | 119.50 99.00 | 14.02 15.13% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 103.27 | 119.48 98.00 | 12.37 13.61% |

| SUGAR #11 WORLD | 14.44 | 14.44 14.25 | 0.34 2.41% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|