Intraday Report: KSE-100 Index gains 336pts

MG News | November 07, 2023 at 12:52 PM GMT+05:00

November 07, 2023 (MLN): The benchmark KSE-100 Index has added another 335.97 points or 0.62% intraday, currently trading at 54,196.34 [12:52pm PST].

The total traded volume of the KSE-100 Index as of now is 144.639 million shares.

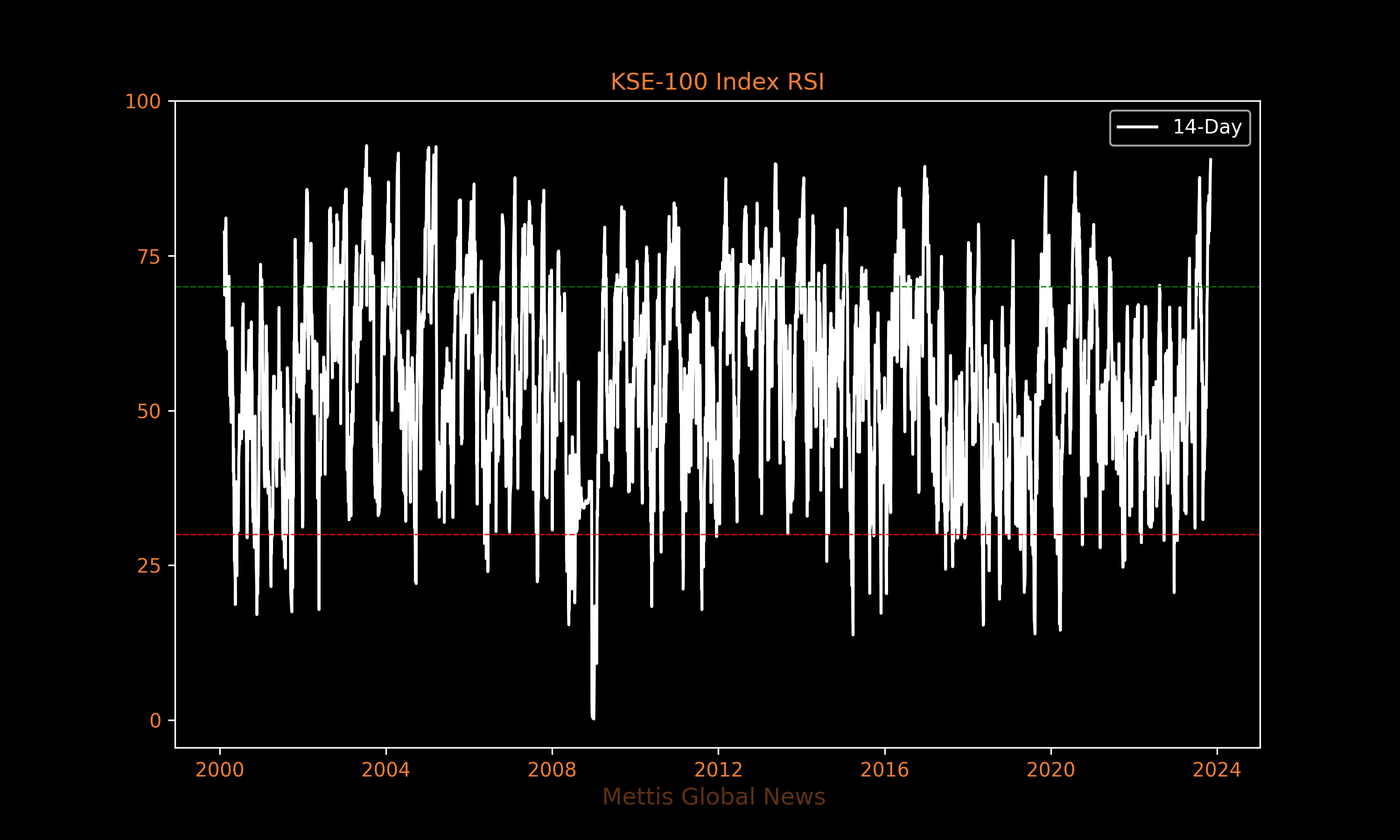

To note, the KSE-100 index 14-day relative strength index has exceeded 90 for the first since March 2005.

In technical terms, the index has reached an overbought territory. However, it is important to note that RSI is a single indicator and relies solely on historical data for analysis.

Moreover, during times of strong trending markets, RSI can stay in overbought/oversold territory for a long time without much correction.

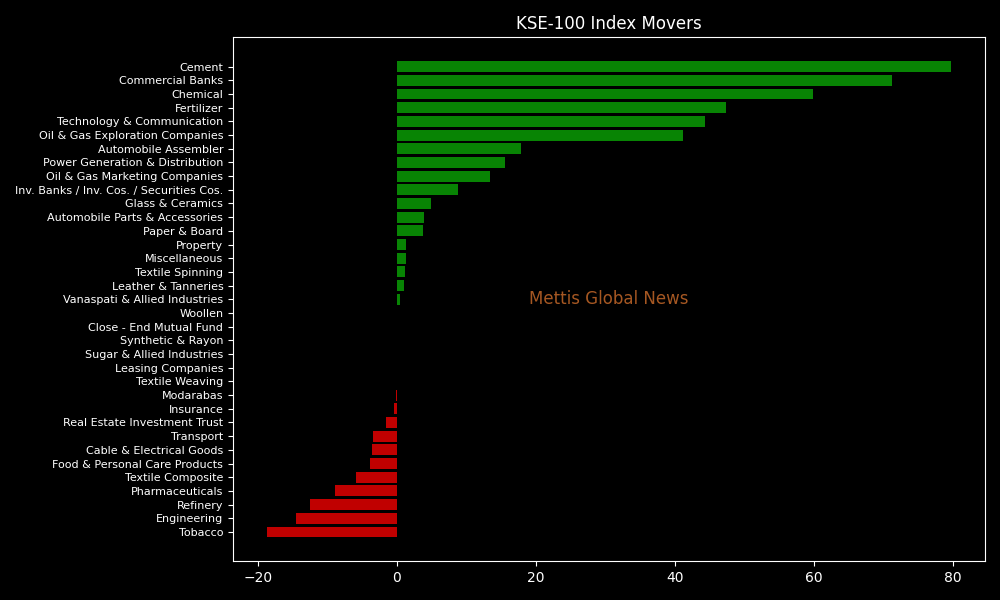

In today's session, KSE-100 index is being supported by Cement with 79.74, Commercial Banks with 71.29, Chemical with 59.89, Fertilizer with 47.36, and Technology & Communication with 44.33 points.

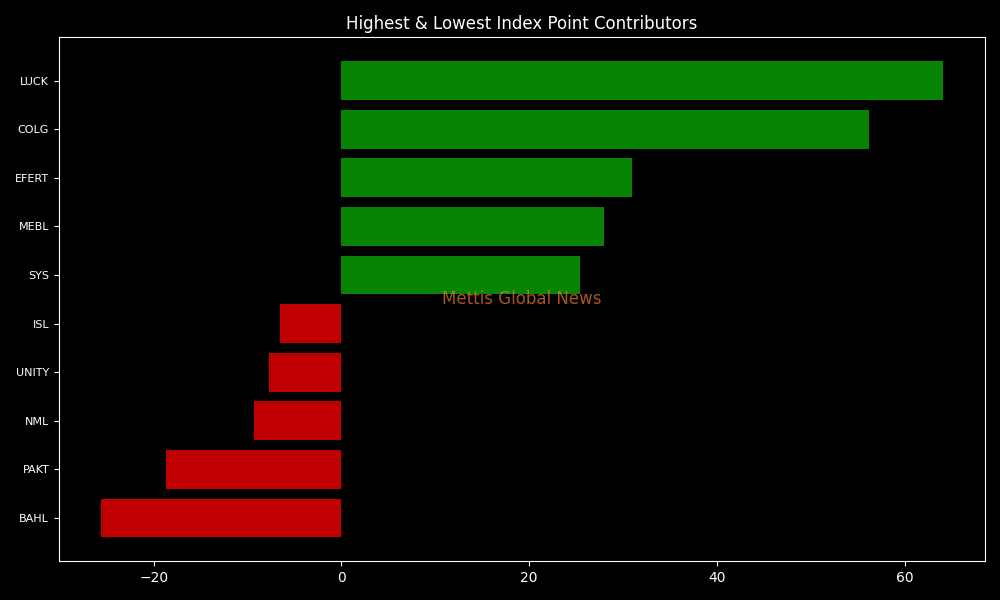

Companies adding points to the index are LUCK with 64.09, COLG with 56.25, EFERT with 30.96, MEBL with 27.96, and SYS with 25.44 points.

KSE-100 Index is being let down by Tobacco with 18.67, Engineering with 14.56, Refinery with 12.45, Pharmaceuticals with 8.87, and Textile Composite with 5.83 points.

Companies dragging the index lower are BAHL with 25.62, PAKT with 18.67, NML with 9.29, UNITY with 7.73 and ISL with 6.55 points.

In the broader market, the All-Share index is currently trading at 36,078.31 with a net gain of 179.51 points.

| Company | Volume |

|---|---|

| HUMNL | 22,948,000 |

| CNERGY | 22,280,366 |

| PRL | 20,372,894 |

| FCCL | 12,717,000 |

| KEL | 9,698,725 |

| MLCF | 8,307,354 |

| OGDC | 6,826,904 |

| WTL | 6,520,734 |

| PIBTL | 6,493,500 |

| KOSM | 6,118,000 |

To note, the KSE-100 has gained 12,744 points or 30.74% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 13,776 points, equivalent to 34.08% in the KSE-100.

The Pakistan stock market has been enjoying a remarkable rally ever since the $3 billion Stand-By Arrangement (SBA) was reached with the International Monetary Fund (IMF) towards the end of FY23, which saved the country from a sovereign debt default.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,650.00 | 118,705.00 117,905.00 | 1030.00 0.88% |

| BRENT CRUDE | 72.76 | 72.82 72.71 | -0.48 -0.66% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.36 | 70.41 70.18 | 0.36 0.51% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|