HUBC doubles its earnings in first quarter, declares Rs5 dividend

MG News | October 25, 2023 at 11:22 AM GMT+05:00

October 25, 2023 (MLN): Hub Power Company Limited (PSX: HUBC) almost doubled its profits in 1QFY24, with the company's after-tax profits rising to Rs18.32 billion [EPS: Rs13.17], compared to a profit of Rs9.47bn [EPS: Rs7.01] in the same period last year (SPLY).

Along with the results, the company announced an interim cash dividend for the first quarter ended September 30, 2023 at Rs5 per share i.e. 50%.

Going by the results, the company's turnover expanded by 13.99% YoY to Rs33.73bn as compared to Rs29.59bn in SPLY.

Moreover, the operating costs fell by 14.47% YoY, which improved the gross profit substantially by 72.15% YoY to Rs16.74bn in 1QFY24.

During the period under review, other income shrunk by 31.88% YoY to stand at Rs280.85 million in 1QFY24 as compared to Rs412.28m in SPLY.

On the expense side, the company observed a rise in general and administration expenses by 22.80% YoY and other operating expenses by 4.6x YoY to clock in at Rs345.91m and Rs150.14m respectively during the review period.

The company’s finance costs soared by 3.03x YoY and stood at Rs7.07bn as compared to Rs2.33bn in 1QFY23, mainly due to higher interest rates.

On the tax front, the company paid a higher tax worth Rs3.21bn against the Rs1.1bn paid in the corresponding period of last year, depicting an increase of 2.91x YoY.

| Consolidated (un-audited) Financial Results for Quarter ended 30 September, 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Turnover | 33,729,891 | 29,589,832 | 13.99% |

| Operating Costs | (16,993,732) | (19,868,103) | -14.47% |

| Gross Profit | 16,736,159 | 9,721,729 | 72.15% |

| General and administration expenses | (345,909) | (281,675) | 22.80% |

| Share of profit from associates and joint venture - net | 12,034,539 | 3,091,177 | 289.32% |

| Insurance claim against alternator damage and consequent loss of revenue | 38,122 | - | - |

| Other Income | 280,850 | 412,284 | -31.88% |

| Other expenses | (150,137) | (32,636) | 360.03% |

| Finance cost | (7,068,648) | (2,334,117) | 202.84% |

| Profit before taxation | 21,524,976 | 10,576,762 | 103.51% |

| Taxation | (3,206,520) | (1,103,133) | 190.67% |

| Net profit for the period | 18,318,456 | 9,473,629 | 93.36% |

| Basic earnings/ (loss) per share | 13.17 | 7.01 | - |

Amount in thousand except for EPS

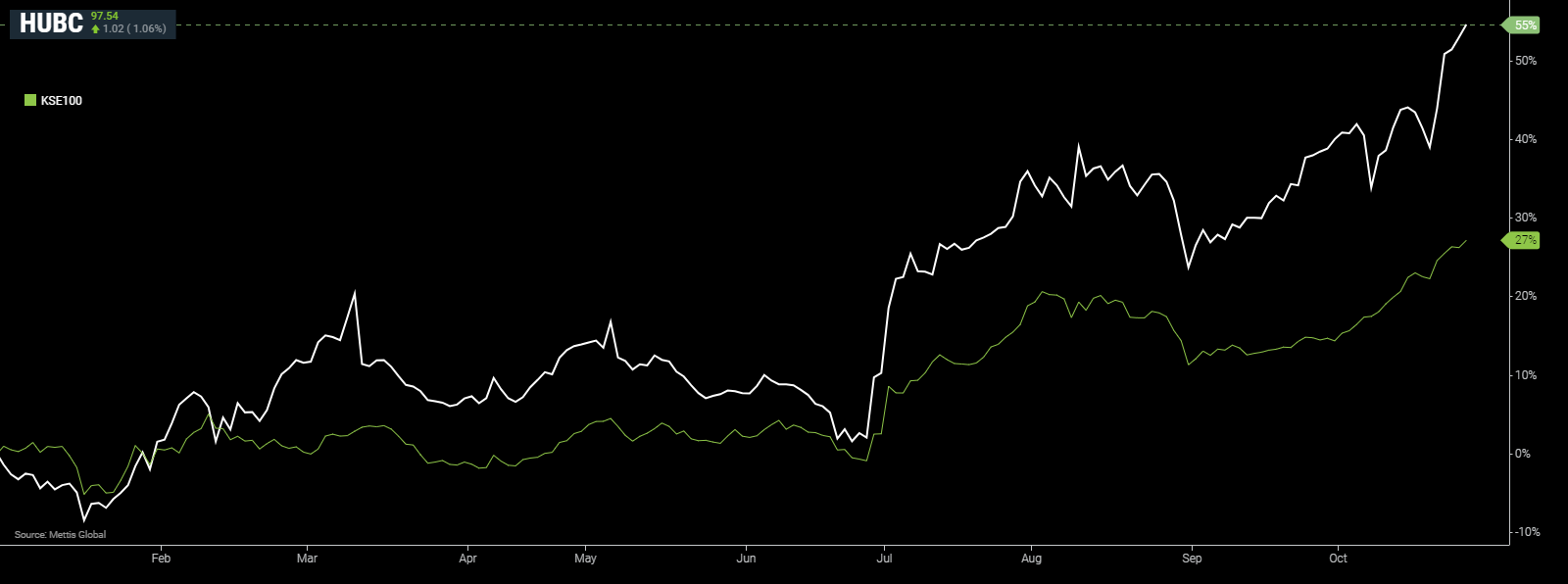

HUBC and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,756.39 194.53M | 0.97% 1344.14 |

| ALLSHR | 86,587.59 352.26M | 1.03% 884.63 |

| KSE30 | 42,706.15 80.85M | 1.07% 451.31 |

| KMI30 | 196,999.41 82.30M | 1.49% 2889.82 |

| KMIALLSHR | 57,472.44 152.08M | 1.34% 758.77 |

| BKTi | 37,945.09 13.09M | 0.30% 113.75 |

| OGTi | 28,363.74 35.39M | 3.36% 923.11 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,535.00 | 119,785.00 117,905.00 | 1915.00 1.63% |

| BRENT CRUDE | 72.61 | 72.82 72.16 | -0.63 -0.86% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.23 | 70.41 69.80 | 0.23 0.33% |

| SUGAR #11 WORLD | 16.46 | 16.52 16.45 | 0.01 0.06% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey