Haleeb Foods suffers declining trend in sales and profits due to reduced demand for tea whiteners: JCR-VIS

MG News | January 13, 2019 at 03:09 PM GMT+05:00

January 13, 2019 (MLN): JCR-VIS Credit Rating Company Limited (JCR-VIS) has reaffirmed the entity ratings of Haleeb Foods Limited (HFL) at ‘A/A-2’ (Single A/A-Two). Outlook on the assigned ratings is ‘Stable’.

The rating agency suggests that the medium to long-term rating of ‘A’ denotes good credit quality coupled with adequate protection factors, whereas the short-term rating of ‘A-2’ denotes good certainty of timely payments.

The assigned ratings take into account moderate business risk profile of the company, underpinned by positive demand dynamics of the dairy industry, established brand equity in the tea whitener and UHT milk categories and further diversification into new variants of fruit juices and flavored milk products.

The ratings also factor in low financial risk of the company as depicted by low leveraged capital structure and adequate coverages. The liquidity position of HFL is supported by investments in cash and money market mutual funds.

The ratings are constrained by increasing intensity of competition in value-added dairy and challenging operating environment of the organized dairy segment. Moreover, the declining trend in sales and profits was mainly on account of reduced demand for tea whiteners, which is the major sales driver of the company.

Meanwhile, effective implementation of strategic initiatives to halt the declining trend in sales remains to be seen in a scenario where increasing pressure of commodity inflation has been witnessed recently due to devaluation of local currency. The ratings will remain dependent on maintenance of debt leverage at prudent levels, profit margins, and sponsors’ support, going forward.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,605.00 | 118,705.00 117,905.00 | 985.00 0.84% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.35 | 70.37 70.18 | 0.35 0.50% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

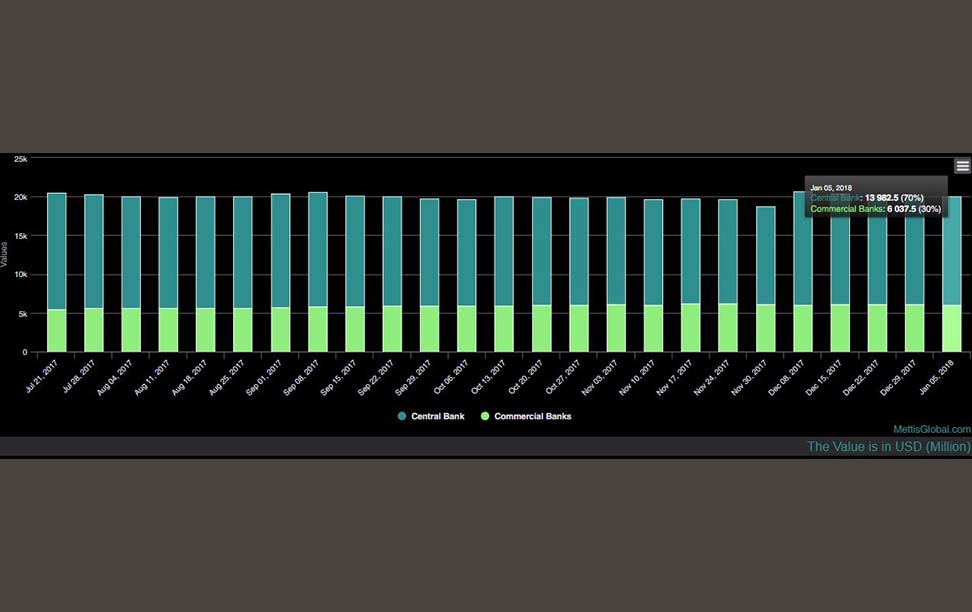

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|