Gold prices in Pakistan rebound despite weak consumer demand

Rafay Malik | May 12, 2024 at 04:57 PM GMT+05:00

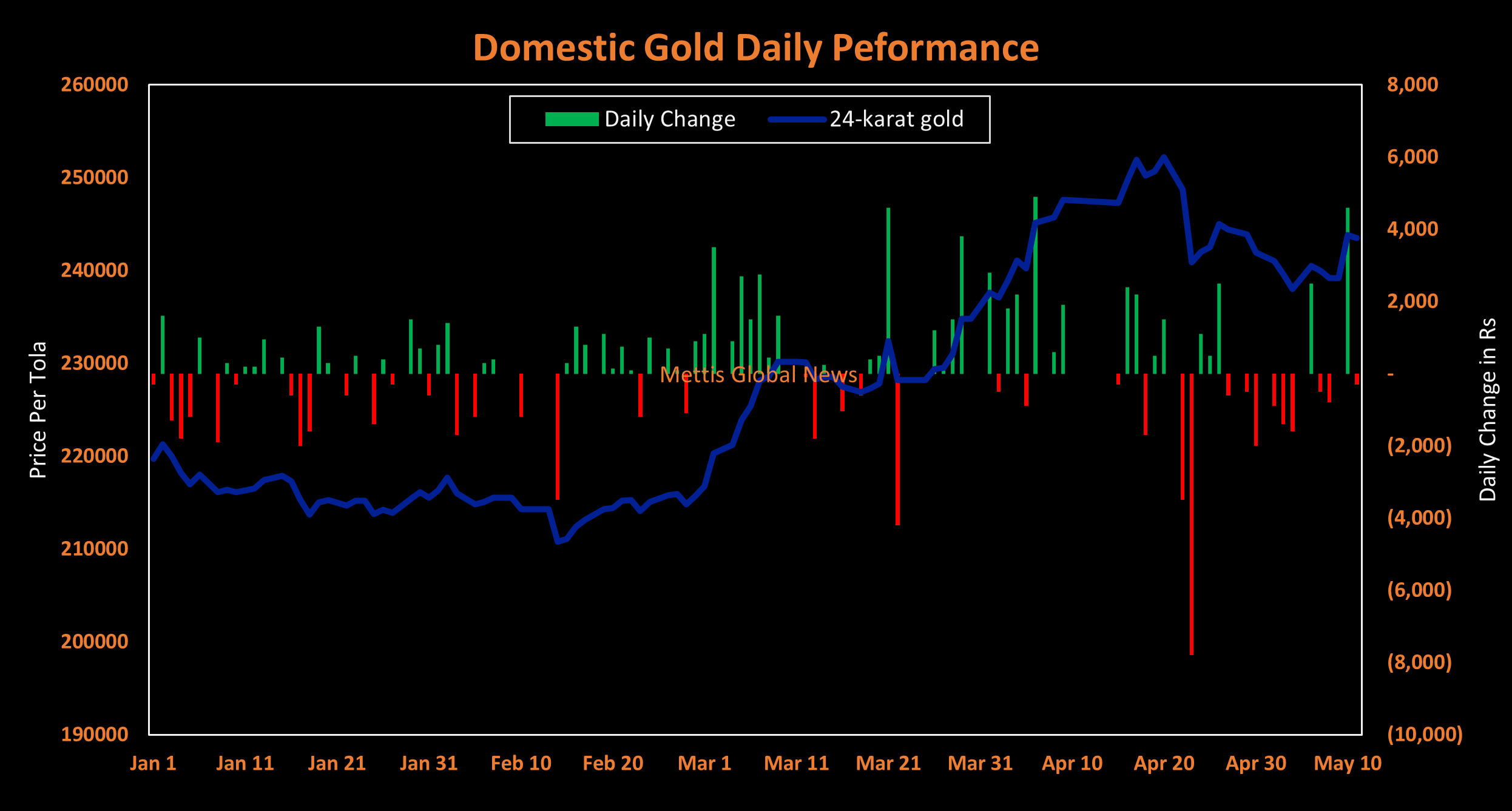

May 12, 2024 (MLN): The domestic bullion market snapped its two-week tragic loss and marked gains this week as the price of 24-karat gold surged by Rs5,500 per tola and settled at Rs243,500.

The yellow metal was under a massive burden, witnessing a cumulative loss of Rs14,200 per tola, or 5.63% over the past two weeks due to reduced purchasing power and dropping international rates.

Conversely, this week has seen a transition towards green changes for the commodity, as international rates rebounded and marked their best week in five.

The Karachi Sarafa Association reported that the price of 24-karat gold also rose to Rs208,762 per 10-gram, up Rs4,715 WoW.

Similarly, the price of 22-karat gold was quoted lower this week at Rs191,365 per 10-gram.

However, purchasing power continues to be a constraint for domestic rates as the association kept gold prices under cost by Rs3,000 in the last session of the week.

On the global front, international spot gold climbed to $2,377 an ounce, up 2.55% over the week.

The latest data for the population filing new claims for unemployment benefits in the U.S. increased by 22,000 to 231,000, the highest level in more than eight months.

The advance number for seasonally adjusted insured unemployment during the week ending April 27 also increased by 17,000 from the previous week's revised level to 1,785,000.

These data points indicated an easing labor market and strengthened the market's expectation for interest rate cuts by the Federal Reserve.

Ultimately, investors' appeal for the zero-yield asset surged, generating gains for the local bullion market.

The upcoming release of U.S. inflation data next week will provide further guidance on interest rate bets and influence the path for the yellow metal.

In the local market, gold prices remain shielded on the currency front as the domestic currency continues to maintain its stable phase against the mighty Dollar.

The Pakistani rupee (PKR) appreciated by around 9 paisa against the US dollar last week as the currency settled the trade at PKR 278.12 per USD, compared to the last week's closing of PKR 278.2 per USD.

Since gold is denominated in U.S. Dollar terms, when PKR appreciates against the greenback, the value of PKR-denominated gold falls.

Hence, this resulted in a marginal loss for local gold rates. However, the global rally overshadowed this slight drop, and the domestic gold market booked gains this week.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account