Exchange Traded Funds: How it works?

By MG News | June 06, 2018 at 11:41 AM GMT+05:00

Caveat Emptor, when literally translated, means “let the buyer beware”. Throughout the Roman Empire, this sign appeared in marketplaces to warn the buyer to carefully examine what they were purchasing, so that in case of later disappointment, they themselves and not the seller would be held accountable. With the announcement of the introduction of ETFs in the Pakistani capital markets, it is in our best interests to complete our due diligence on what the product is and how its market functions.

What are ETFs?

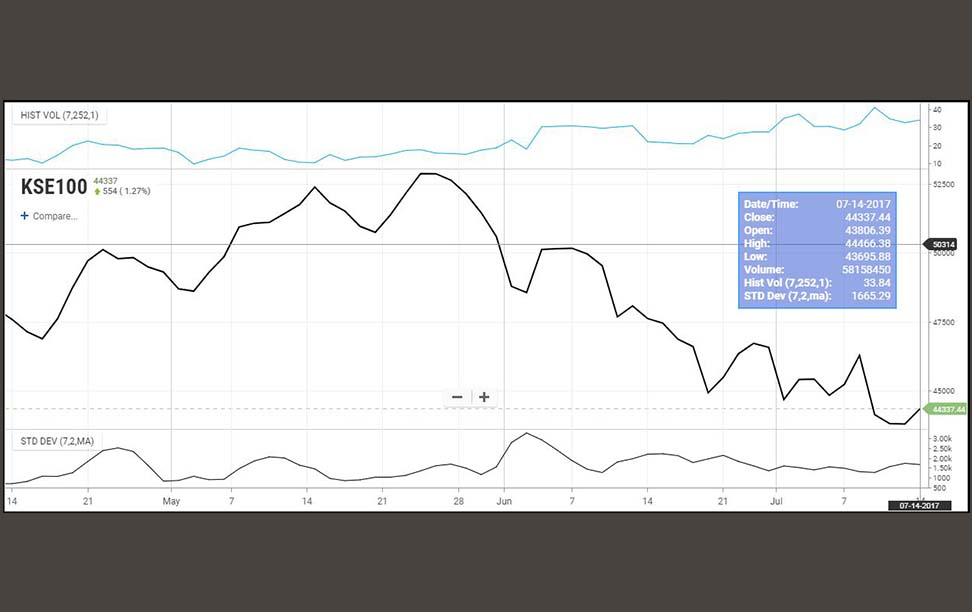

Exchange Traded Funds are essentially Index funds that, as the name implies, are listed and traded on a stock exchange. While we are all familiar with benchmark indexes like the KSE 100 or the KSE 30, we cannot trade them in the same manner as we do stocks. In order to replicate the returns made on these indexes, an investor must replicate the portfolio with exactly the same holdings and weightage within that index. This may come off as a particularly gruesome task to an average investor, and for that reason may seem too impractical a strategy to be used on a regular basis. This issue, thankfully, is now coming to an end with the introduction of exchange-traded funds in the Pakistani market.

Investors would now be able to get exposure to the entire market in the same way they go about purchasing a stock or a commodity and is therefore likely to result in attracting of greater investments in the capital market. Consider a risk averse investor that fears the volatility of the stock market and for that reason prefers to invest in bonds instead. When that investor learns that he could significantly reduce the risks of purchasing a single stock and is now able to get a share in 30 or 100 different stocks at the same time by purchase of just a single product on the stock exchange, he would be more inclined to shift his investments from risk free low return placements to a low risk moderate return investment. In the same manner, capital shifts may occur from other risk free investment channels like the gold market or fixed deposits in banks for instance.

So what exactly are these ETFs that carry such immense potential for changing the dynamics of our capital market?

An ETF is a security that tracks an index, commodity, bonds, or a basket of assets by acquiring ownership of those underlying assets and dividing that ownership into shares that are then traded on the stock exchange like any other stock. ETF shareholders are entitled to a fraction of the profits earned by the underlying securities, such as interest earned in case of bonds or dividends paid in case of stocks. They are also entitled to a residual value in case the fund is liquidated.

Since both the ETF and the basket of underlying assets that it is composed of are tradable on the stock exchange throughout the day, any short-term deviations between their values can be capitalized upon as arbitrage opportunities. For instance, if a trader could purchase the ETF for less than the underlying securities, he will buy the ETF shares, and sell the basket of stocks in order to lock in the differential. Since there are so many traders looking for such risk free arbitrage opportunities, the entire process services the maintenance of the ETF value close to its fair value.

ETFs have gained immense popularity all over the world and are some of the most widely used investment products. There are numerous kinds of ETFs available in the market, with US leading the market for ETFs. There are those that track market indexes such as Spider (SPY) tracking the S&P 500 Index in the US, IWM tracking the Russell 2000 Index, QQQ tracking the Nasdaq 100 or DIA tracking the Dow Jones Industrial Average. In the same manner, there are Sector ETFs that track individual industries such as oil companies (OIH), financial companies (XLF), energy companies (XLE) and so on. Commodity ETFs also exist to track commodity prices such as crude oil (USO), gold (GLD), and many others. Likewise, ETFs could track foreign stock market indices of developed or emerging market countries. The possible combinations with respect to ETF composition are limitless, which is why Pakistan’s first step in this direction is an encouraging move towards setting the tone for the future of our capital markets.

How do ETFs function

Even though ETFs trade on a stock exchange in the same way, as do stocks, they are not brought onto the stock exchange via an initial public offering (IPO) that normally brings in a certain stock to the public for trading.

Instead, the issuer of ETFs contracts with a special group of institutional investors, with significant buying power, to indulge in a creation/redemption mechanism that allows for the continuous creation and destruction of ETF shares. These institutional investors, commonly known as ‘authorized participants’, are large brokers/dealers or banks that have been authorized by the issuer of ETFs to participate in the creation/redemption process. Only they can create or redeem new shares of an ETF.

New shares are created when the AP transacts with the ETF Fund manager or sponsor. It is done by purchasing of the exact basket of securities that the ETF wants to hold and in the same weightage as specified by the ETF manager. The AP can either buy these shares or use up their existing holdings to assemble that basket, which once formed, is then delivered to the ETF Fund manager in exchange for ETF shares of the same value. Once the AP gets the ETF shares, it then makes them available for sale to individual investors in the open market, which is how the AP profits from the deal as it sells them for a profit. In this manner, the sponsor receives the necessary help in creating the fund while the authorized participants get compensated through activity in the secondary market.

Just as they create shares, authorized participants can also redeem ETF shares by doing the opposite, that is, giving ETF shares back to the ETF Fund manager and getting the underlying securities of an equal value back from the ETF Fund manager. Once they have the underlying securities back, authorized participants could sell them in the open market or hold them, which ever suits their needs; but the ETF shares returned to the ETF Fund manager are no longer available for individual investors to purchase.

This continuous process of creation/redemption is essential in order to keep the price of an ETF in a tight range around the Net asset value of the portfolio of securities that it holds. Any significant fluctuations would prompt arbitrageurs to step in bringing the ETF price in line with its fair value. Most investors, big or small, buy ETFs through their brokers and the price they pay for them is largely determined by the supply and demand. When there is greater demand from buyers, the price of the ETF goes up just the way it does with stocks. However, when the price goes up by more than what the true value of the underlying securities suggest is fair, authorized participants and other market makers become active in the market. Knowing that they will be able to buy the underlying securities and create new shares of the ETF at fair value by the end of the day, they can start selling the ETF shares at their inflated value, providing downward pressure on their prices. They would continue this process until prices are in line with the fair value.

An issuer can use the services of one or more authorized participants for a fund. The greater the number of authorized participants, the more liquidity they provide to a particular ETF and the better the functioning of that market. Over reliance on any one authorized participant could create liquidity concerns if that party, for some reason, ceases to be an authorized participant or is impacted by some temporary internal issue that prompts it to cease primary market activities. In a situation like this, a greater number of authorized participants will allow them to step in and fill the gap.

Advantages of ETFs

Exchange traded funds were launched as early as the 1990s, nearly 3 decades ago, and have grown exponentially since then with respect to their usage to become one of the fastest growing segments of the investment management business. Today, they are being used by an ever-growing group of investors, product developers, investment firms and asset owners. According to data from ETFGI, at the end of April 2018, the Global ETF industry had 5,516 ETFs, with 11,482 listings, assets of US$ 4,794 Billion, from 337 providers on 68 exchanges. Such immense growth prompts us to wonder what exactly are the factors that have made these funds so successful?

Lower Costs:

Cost advantage is one of the primary and most cited of advantages that the ETFs offer to investors. As compared to mutual funds that are mostly actively managed, ETFs are primarily index tracking funds and therefore do not bear the costs associated with active asset management. Active asset management is expensive for the reason that it requires a much larger research staff, lots of software and data, along with greater operating and execution costs tied to the active management of a fund. ETFs on the other hand are generally more passive in comparison and for that reason, carry a much lower expense ratio.

Additionally, since the funds are exchange traded, when an investor makes a purchase, the costs of record keeping, distribution of prospectus documents, handling costs and all such relevant expenses are borne their brokers on an exchange who are ultimately dealing with the ETF manager. From the ETF manager’s point of view, they have only a handful of ‘customers’, that is, these brokers that sell in the secondary market. In contrast, as far as the workings of mutual funds go, individual investors are directly interacting with the fund company. Distribution and record keeping costs, therefore, accrue to the fund, which raises the overall cost of ownership in that fund.

Access:

Before the world was introduced to ETFs, owning such varied assets, as emerging market bonds, leveraged securities, inverse and volatility based equity assets, and other alternative investments, was both difficult and costly, except for large institutional investors. With the rise of ETFs, all areas of capital markets have been made accessible to the average investor with a simple brokerage account, allowing them to get diversified exposure at low costs all over the world in their chosen markets and as per their risk appetites. More importantly, due to their exchange-traded nature, ETFs offer a level playing field, providing all investors, regardless of the size of their holdings or time horizon, access to a full suite of products across the financial market place.

Transparency:

Transparency is something that is not on high priority as far as mutual funds or hedge funds are concerned, with majority of them disclosing their portfolio performance and composition only on a quarterly basis, typically a few weeks after the end of the quarter. In between that time, investors are usually clueless as to whether the fund is actually invested in line with its stated investment objectives or if it has drifted away. In practice, funds can and do diverge from their described targets. This phenomenon is known as ‘style drift’. A fund manager may in practice take unexpected risks in reach for higher yields by accumulating significant positions in a particular security, altering leveraged position, or by other means that diverge from their benchmark targets. For any investor that has taken the time to build an asset allocation plan tailored to their specific risk tolerance, this could be a problem with substantial implications since they are not doing what you expect them to be doing. Instead, you are left wondering whether the fund manager you hired has hijacked the level of risk in your portfolio.

In contrast, most ETF providers display their entire portfolios on a daily basis. For those ETFs that do not publish their portfolios on a daily basis, the ETF issuer still publishes the list of securities that the authorized participant must deliver to create new shares, as well as what shares they will get if they redeem shares from the ETF. This, combined with the full holdings of the index an ETF is aiming to track, provides an extremely high level of disclosure, even for those few ETFs that are not required to disclose their daily holdings. In sum, such transparency can be particularly helpful to investors with respect to their individual portfolio construction and analysis.

Liquidity:

In comparison to mutual funds, ETF users include a much broader investor base. Everyone from large institutional investors to traders, including mutual funds and hedge funds, transact with ETFs. Being exchange traded, they can be bought and sold on secondary markets at various times throughout the day. Just like a stock, in foreign markets, ETFs can be held on margin, shorted, optioned, and so on. Basically anything that could be done with a stock could be applied to an ETF as well. Due to such a large user base, ETFs are said to be more liquid than mutual funds.

Additionally, the creation/redemption mechanism that relies on financial intermediaries regularly comparing ETFs with their underlying securities in search of arbitrage opportunities results in the ETFs being priced close to the net asset value of its underlying securities, which is good for investors since it ensures that they get a fair price for their sales or purchases. But with respect to liquidity, these processes ensure that any temporary short fall in supply would be met by the creation of new shares while any short fall in the demand of ETF shares is met by the redemption of shares.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,995.00 | 109,565.00 107,195.00 |

510.00 0.47% |

| BRENT CRUDE | 66.62 | 67.20 65.92 |

-0.18 -0.27% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.98 | 65.82 64.50 |

-0.54 -0.82% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|