E&Ps: PPL to lead earnings growth

By MG News | January 24, 2020 at 02:36 PM GMT+05:00

January 24, 2020 (MLN): The benefits from currency devaluation, oil price increase and rising interest rates have been in play for E&Ps and are likely to uphold sector’s earnings growth robust for 1HFY20.

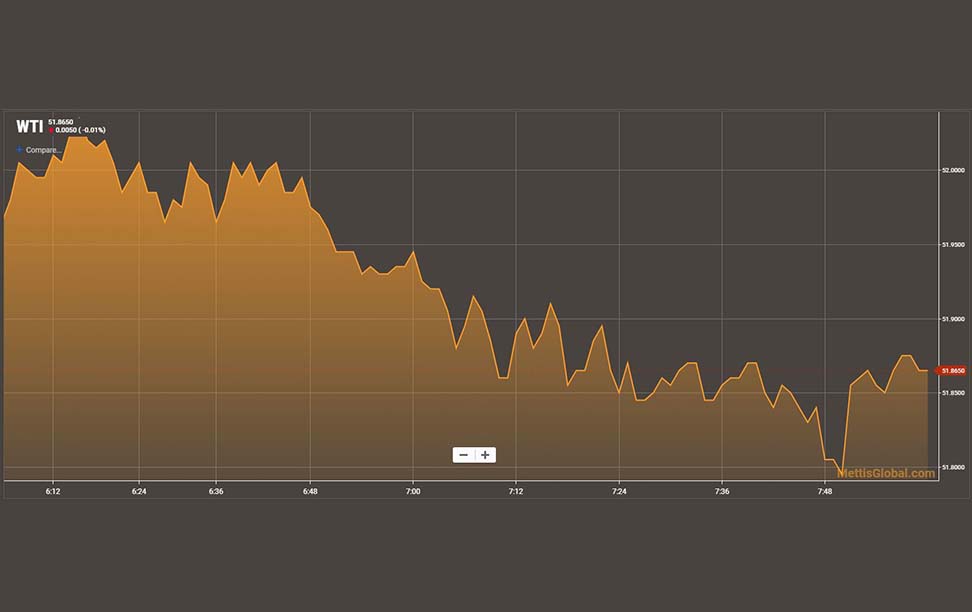

However, currency’s stability, peaked interest rate and the ongoing downward trend in oil prices in the 2Q of the current fiscal year would limit the growth going forward, says a research report by Ismail Iqbal Securities.

In the 2QFY20, the revenues of the E&P sector are expected to remain flattish as benefits from increase in oil production would be diluted by decline in gas production. The oil production during the quarter increased by 2.7% QoQ while gas production declined by 5.5%. Nevertheless, a minor rise in sector’s profitability is still expected mainly due to lower quantum of exchange losses as compared to 1QFY20, the report underscored.

Company-wise, Pakistan Petroleum Limited (PPL) is expected to lead earnings growth due to absence of impairment charge of 769m booked during 1Q pertaining to PPLA and lower dry well expense, the report added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,535.00 | 108,105.00 107,505.00 |

-700.00 -0.65% |

| BRENT CRUDE | 66.41 | 66.63 66.34 |

-0.33 -0.49% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.77 | 65.02 64.67 |

-0.34 -0.52% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|