EPCL’s profits surge on higher PVC margins

By MG News | April 19, 2021 at 11:19 AM GMT+05:00

April 19, 2021 (MLN): Engro Polymer and Chemicals Limited (EPCL) has unveiled its financial results for the first quarter ended March 31, 2021. As per results, the company has posted consolidated net profits of Rs 4.14 billion, depicting a massive growth of 21.5 times YoY when compared to net profits of Rs 192 million in the same period last year.

The basic and diluted earnings per share of the company for the 1QCY21 have been reported to Rs 4.56 and Rs 3.42, respectively.

Alongside financial results, the Board of Directors of the company announced an interim cash dividend for ordinary shareholders for the period ended March 31, 2021 Rs 0.80 per share i.e.,8% while Interim cash dividend for preference shareholders for the period ended March 31, 2021, Rs. 0.27 per share i.e., 2.7%.

The rise in earnings is attributable to a 64% increase in PVC margins to an average of USD 834/ton along with lower production during 1QCY20 due to gas leakage incident and COVID-19 situation, Arif Habib research highlighted.

During the 1QCY21, the company registered over a two-fold increase in revenues year on year to Rs 15 billion, led by higher PVC ethylene margins, resulting in an upsurge in gross margins to 40% despite a 63% YoY increase in the cost of sales.

Meanwhile, the company witnessed a drop in finance cost by 47.6% YoY to Rs 402 million which also contributed to the financial performance of the company.

|

Consolidated Profit and Loss Account for the Quarter ended March 31, 2021 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Mar-21 |

Mar-20 |

% Change |

|

Net revenue |

15,671,459 |

7,057,942 |

122.04% |

|

Cost of sales |

(9,435,754) |

(5,776,915) |

63.34% |

|

Gross profit |

6,235,705 |

1,281,027 |

386.77% |

|

Distribution and marketing expenses |

(91,945) |

(72,325) |

27.13% |

|

Administrative expenses |

(166,504) |

(113,924) |

46.15% |

|

Other operating expenses |

(122,908) |

(538,283) |

-77.17% |

|

Other income |

291,211 |

415,744 |

-29.95% |

|

Operating profit |

6,145,559 |

972,239 |

532.10% |

|

Finance cost |

(402,507) |

(767,660) |

-47.57% |

|

Profit before taxation |

5,743,052 |

204,579 |

2707.25% |

|

Taxation |

(1,600,082) |

(11,739) |

13530.48% |

|

Profit for the period |

4,142,970 |

192,840 |

2048.40% |

|

Earnings per share - basic (Rupees) |

4.56 |

0.21 |

2071.43% |

|

Earnings per share - diluted (Rupees) |

3.42 |

0.21 |

1528.57% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 120,615.38 78.23M |

0.51% 612.79 |

| ALLSHR | 75,259.95 215.50M |

0.49% 367.82 |

| KSE30 | 36,684.37 22.76M |

0.67% 242.63 |

| KMI30 | 178,444.40 28.59M |

0.93% 1650.35 |

| KMIALLSHR | 51,661.22 122.80M |

0.70% 361.41 |

| BKTi | 30,302.54 2.77M |

0.56% 170.23 |

| OGTi | 27,102.54 3.21M |

0.94% 251.63 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,685.00 | 106,725.00 104,005.00 |

2720.00 2.62% |

| BRENT CRUDE | 77.26 | 77.67 76.10 |

-1.59 -2.02% |

| RICHARDS BAY COAL MONTHLY | 88.00 | 0.00 0.00 |

-3.70 -4.03% |

| ROTTERDAM COAL MONTHLY | 103.85 | 0.00 0.00 |

0.35 0.34% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 74.05 | 75.74 72.57 |

0.55 0.75% |

| SUGAR #11 WORLD | 16.68 | 16.73 16.51 |

0.37 2.27% |

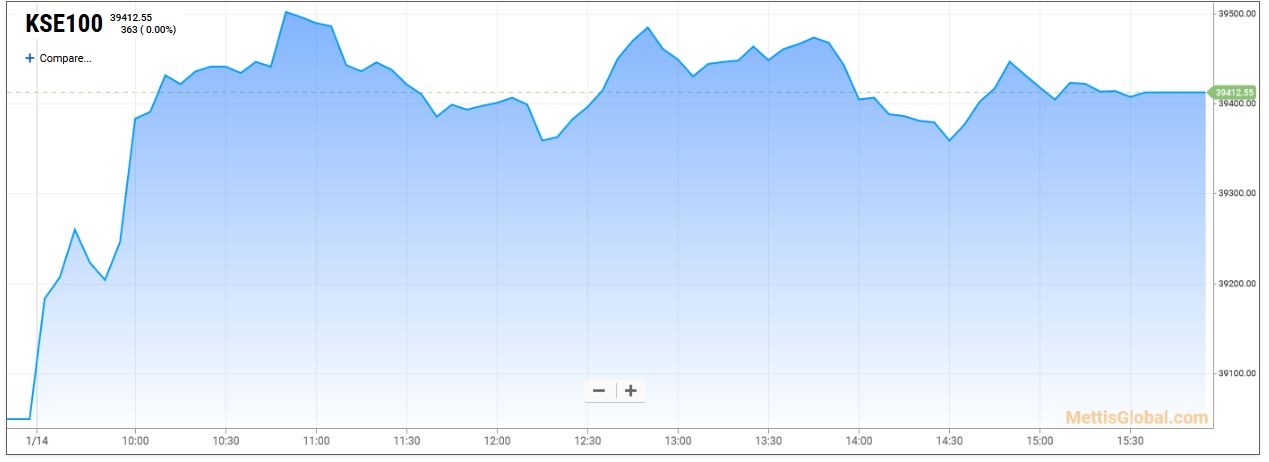

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)

.jpg)

Summary of Foreign Investment in Pakistan

Summary of Foreign Investment in Pakistan