Earning Preview: POL most likely to post positive growth in net earnings

MG News | October 14, 2019 at 05:07 PM GMT+05:00

October 14, 2019 (MLN): Pakistan Oilfields Limited (POL) is scheduled to announce its financial results for 1QFY20 on Tuesday i.e. tomorrow, where the Board of Directors of the company will review and discuss the company’s financial performance.

According to the projection table given below, out of five brokerage houses, IGI Securities and InterMarket Securities expect the company to post a decline in its earnings by 4% and 1% YoY respectively, whereas, the other research houses expect the company to report an increase in its net earnings by roughly 5% to 18% YoY.

This suggests that there are mixed expectations exist regarding the profitability of POL.

| Research House | 1QFY20 PAT | Earning per share (EPS) | %change YoY |

|---|---|---|---|

|

|

|

|

|

| IGI Securities | PKR 3.7 billion | PKR 13.13 | -4% |

| Darson Securities | PKR 4.47 billion | PKR 15.78 | 16% |

| Arif Habib Limited | PKR 4 billion | PKR 14.26 | 5% |

| Ismail Iqbal Securities | PKR 4.5 billion | PKR 16 | 18% |

| Inter Market Securities | PKR 3.82 billion | PKR 13.47 | -1% |

The decline in company’s bottom-line is expected mainly due to 16% YoY decline in oil prices despite 28% YOY currency depreciation, 4% to 5% drop in oil and gas production and higher exploration expenses.

While the increase in profitability is expected mainly on the back of higher top-line earnings due to currency depreciation, lower finance cost due to absence of exchange losses and lower exploration cost due to lesser activity during the quarter.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,480.00 | 119,440.00 118,260.00 | 185.00 0.16% |

| BRENT CRUDE | 72.20 | 73.17 71.75 | -0.31 -0.43% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 68.88 | 69.79 68.45 | -0.33 -0.48% |

| SUGAR #11 WORLD | 16.42 | 16.58 16.40 | -0.17 -1.02% |

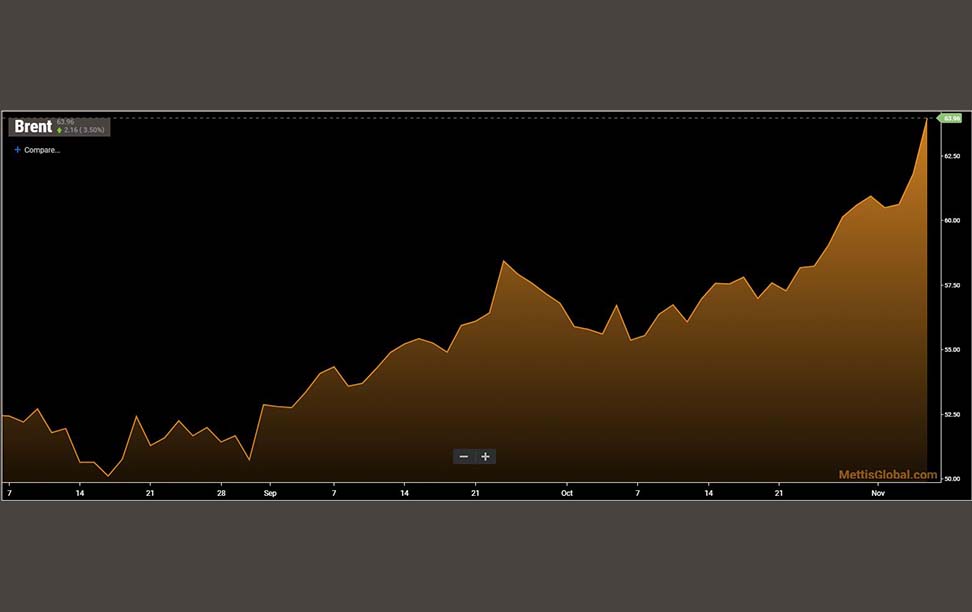

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|