Cut in RLNG prices to boost liquidity for gas sector and improve fiscal space of the economy

MG News | June 08, 2020 at 03:25 PM GMT+05:00

June 8, 2020 (MLN): The recent decision of OGRA to slash RLNG prices in Pakistan by US$1.4/mmbtu to US$6.1-6.3/mmbtu would boost liquidity for Pakistan Gas sector which has been facing severe liquidity constraints on account of both natural gas and RLNG.

This development will not only benefit the both Sui Companies (SSCG and SNGPL) but also the domestic economy through improved fiscal space, a report by topline securities underscored.

The report stated that, the government had allocated fixed rate of US$6.5/mmbtu RLNG supply to the Textile sector compared 12-month average rate of US$10.1/mmbtu), the differential of which was being pricked up by the government itself.

Currently, Sui companies have receivables of around Rs20 billion against the government under this head. Elimination/reduction of this differential will ease cash flow concerns of Sui companies, the report added.

The government will benefit from this through greater fiscal space as annual subsidy under this head hovers around Rs35-40 billion per annum, which will now reduce substantially for FY21, given the oil prices continue to hover around these levels.

Additionally, SSGC has submitted revised ERR for FY21 after adjusting downward its oil price assumption to US$42.6/bbl for FY21 from US$64/bbl, which resulted in decline in its Revenue Requirement by Rs19 billion, the report highlighted.

Similarly, SNGP has also revised down its Revenue Requirement by Rs15 billion. Together, Sui Companies have lowered their Revenue Requirements by Rs35 billion (or Rs52/mmbtu; oil assumption at US$42/barrel.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

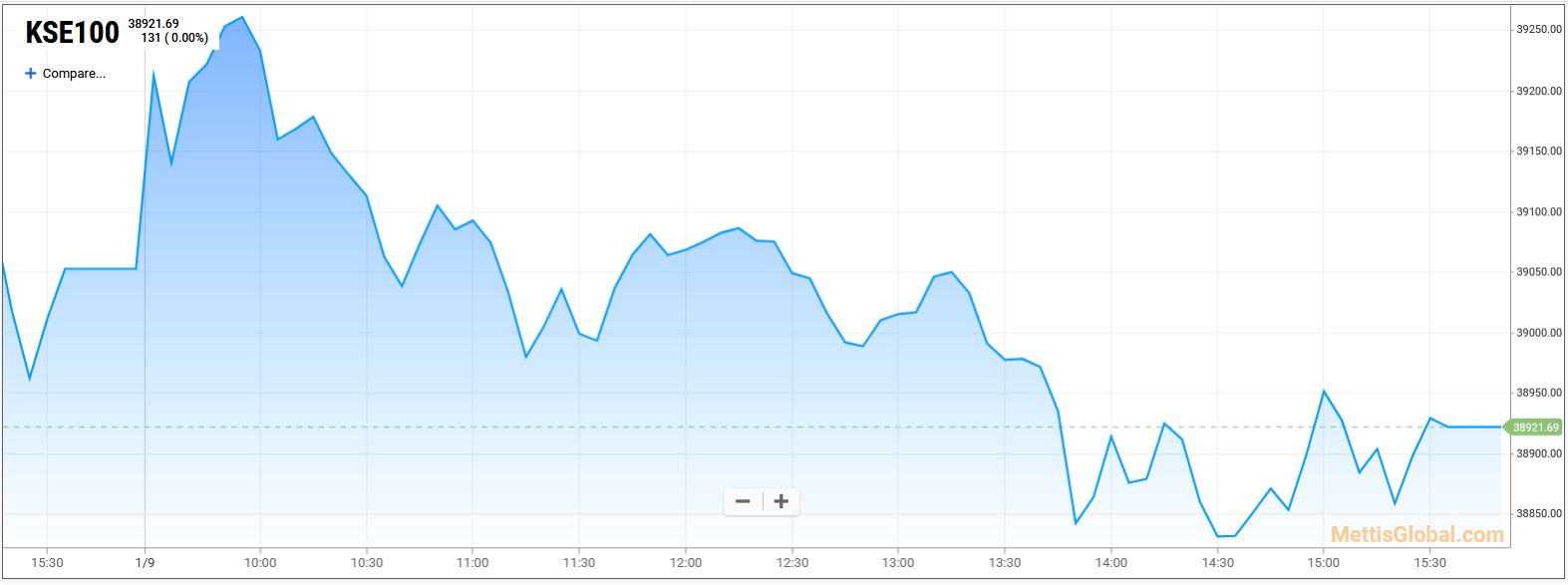

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,905.00 | 119,740.00 116,460.00 | -390.00 -0.33% |

| BRENT CRUDE | 73.52 | 73.63 71.75 | 1.01 1.39% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.39 | 70.51 68.45 | 1.18 1.71% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|