CPI Preview: No Silver Linings

Nilam Bano | August 31, 2023 at 11:45 PM GMT+05:00

August 31, 2023 (MLN): Sparing no one, the soaring prices are cutting through with merciless cruelty, as the rising cost of living has grown far greater than the monthly earnings of an ordinary citizen in Pakistan. In such a scenario, scarcely a gaze is expecting an easy or modest Consumer Price Index (CPI) number for the month of August 2023.

Although the eagerness to learn about the inflation numbers has waned, we have made our estimations, and unsurprisingly, they lean towards the higher end.

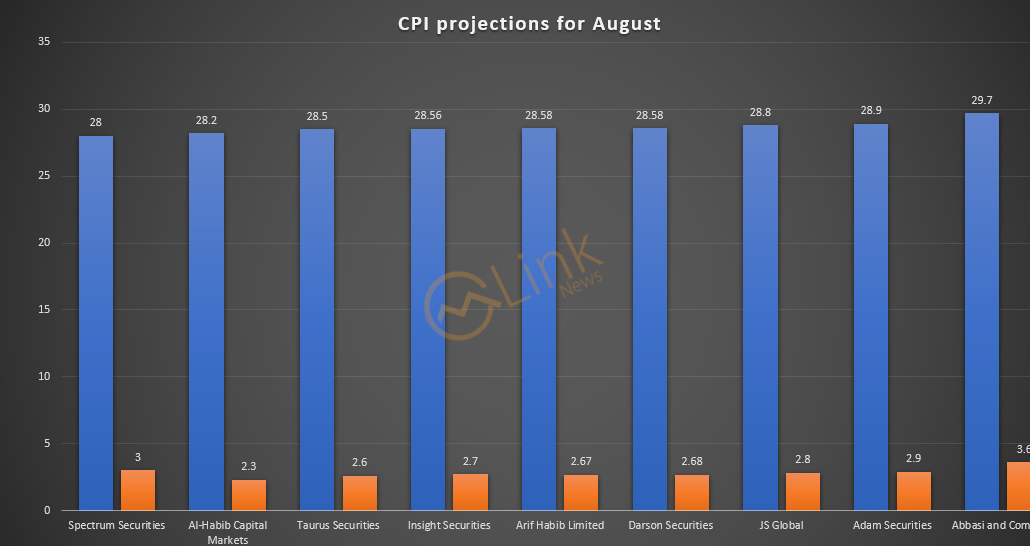

Accordingly, the headline inflation for August 2023 is expected to settle around 28% – 29.75% with an average estimate of 28.51% YoY compared to 28.3% YoY in the last month and 27.3% YoY in August 2022.

This will take the average inflation of 2MFY24 to 28.4% YoY compared to 26.1% YoY in 2MFY23.

On a sequential basis, the CPI would likely surge by around 2.8% MoM compared to the 3.5% MoM increase in the month of July 2023.

Undoubtedly, the YoY surge in inflation is attributed to the burden of excessive electricity bills and the doubled cost of basic necessities specifically food prices over a mere 1.6 years of PDM government casts a dull hue over every meal.

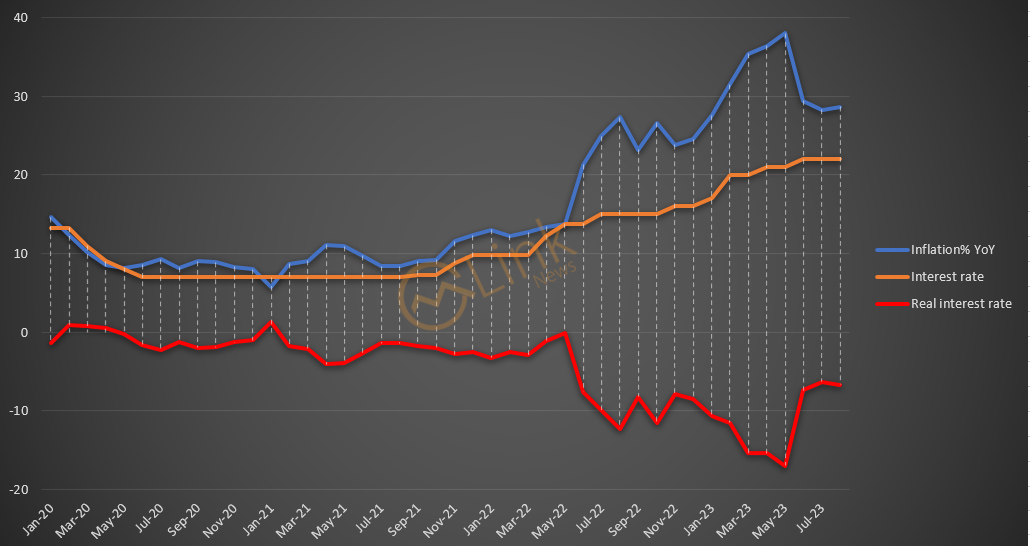

On the policy front, the State Bank of Pakistan (SBP) attempted to reign inflation by adopting the contractionary monetary policy. Since September 2022, SBP has been increasing the policy rate by 1,450 basis points but the real interest rate is still hovering in the negative territory at 6.5%.

In the last MPC meeting, the central bank kept the policy rate at 22% on the back of lower inflation caused by the high base effect and ease in international commodity prices.

However, due to PKR depreciation and rising inflationary pressure, thanks to the “Having no fiscal space” slogan by the government, the economic landscape of the country would likely force MPC to increase the policy rate by over 200 bps, according to market consensus.

Outlook:

After enduring all the political and economic mess, the economy is caught under the dark tunnel of hopelessness with no silver linings. Going forward, the outlook is bleak for the short and medium term as the country is in the so-called Standby Agreement with IMF, and that too on stricter terms pertaining to energy tariff, rolling up subsidies, and increasing revenue collection.

The results of this SBA program are here in the face of countrywide protests due to excessive billing linked to fuel adjustment charges and taxes.

Besides, the hike in interest rates will add extra pressure on the cost of production of the major sectors which will ultimately be transferred to the end consumer, posing a threat of another inflationary peak.

In addition, the global volatile prices of commodities mainly oil in the international market will remain the key component to aggravate and calm the inflation tides.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,621.78 454.30M | 0.46% 860.09 |

| ALLSHR | 113,265.46 1,222.28M | 0.52% 588.60 |

| KSE30 | 57,731.36 174.99M | 0.36% 209.01 |

| KMI30 | 266,571.54 213.89M | 0.69% 1828.09 |

| KMIALLSHR | 72,784.85 721.80M | 0.67% 484.82 |

| BKTi | 54,331.72 55.38M | -0.31% -167.91 |

| OGTi | 39,151.92 18.57M | 1.31% 507.38 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,020.00 | 89,310.00 87,875.00 | -645.00 -0.72% |

| BRENT CRUDE | 64.12 | 64.30 63.89 | -0.80 -1.23% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.85 -2.09% |

| ROTTERDAM COAL MONTHLY | 98.75 | 98.75 98.75 | 1.40 1.44% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.73 | 59.89 59.46 | -0.63 -1.04% |

| SUGAR #11 WORLD | 14.73 | 14.98 14.70 | -0.23 -1.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Lending and Deposit Rates

Lending and Deposit Rates