Closing Bell: Dimming of the Day

MG News | November 13, 2020 at 06:11 PM GMT+05:00

November 13, 2020 (MLN): The benchmark KSE-100 remained range bound today due to spike in Covid-19 cases and lack of fresh triggers. However, it managed to close in green by gaining only 4 points and ended the trading at 40,569 points, mainly on the back of continuous uptick in remittances and strengthening SBP’s FX reserves.

Moreover, LSMI index has been increased by 7.65% in Sep-20 which reflects resumption of economic activities at full pace in the country also supported investors’ confidence, a report by Ismail Iqbal Securities highlighted.

The Index traded in a range of 431.58 points or 1.06 percent of previous close, showing an intraday high of 40,690.68 and a low of 40,259.10.

Of the 92 traded companies in the KSE100 Index 51 closed up 37 closed down, while 4 remained unchanged. Total volume traded for the index was 120.41 million shares.

Sectors propping up the index were Commercial Banks with 38 points, Cement with 27 points, Technology & Communication with 24 points, Power Generation & Distribution with 15 points and Chemical with 9 points.

The most points added to the index was by SYS which contributed 31 points followed by HBL with 16 points, HUBC with 13 points, NBP with 12 points and LUCK with 10 points.

Sector wise, the index was let down by Oil & Gas Exploration Companies with 75 points, Oil & Gas Marketing Companies with 44 points, Pharmaceuticals with 10 points, Automobile Parts & Accessories with 3 points and Fertilizer with 3 points.

The most points taken off the index was by POL which stripped the index of 33 points followed by OGDC with 27 points, SNGP with 25 points, PPL with 20 points and PSO with 17 points.

All Share Volume decreased by 85.21 Million to 243.08 Million Shares. Market Cap increased by Rs.1.50 Billion.

Total companies traded were 387 compared to 400 from the previous session. Of the scrips traded 199 closed up, 165 closed down while 23 remained unchanged.

Total trades decreased by 23,902 to 89,665.

Value Traded decreased by 3.42 Billion to Rs.7.90 Billion

| Company | Volume |

|---|---|

| Pakistan Refinery | 28,267,000 |

| Unity Foods | 19,558,500 |

| TRG Pakistan | 15,295,500 |

| K-Electric | 13,110,500 |

| Maple Leaf Cement Factory | 11,996,554 |

| Kohinoor Spinning Mills | 10,058,000 |

| Hascol Petroleum | 9,802,143 |

| Al Shaheer Corporation | 9,633,000 |

| Power Cement | 8,104,000 |

| BankIslami Pakistan | 6,168,000 |

| Sector | Volume |

|---|---|

| Refinery | 38,954,000 |

| Technology & Communication | 26,576,400 |

| Cement | 26,211,518 |

| Vanaspati & Allied Industries | 19,591,700 |

| Oil & Gas Marketing Companies | 17,629,573 |

| Power Generation & Distribution | 16,953,462 |

| Textile Spinning | 16,712,250 |

| Food & Personal Care Products | 15,815,550 |

| Commercial Banks | 13,738,450 |

| Engineering | 7,041,700 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,520.00 | 73,880.00 67,615.00 | 5055.00 7.38% |

| BRENT CRUDE | 81.39 | 84.48 80.30 | -0.01 -0.01% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.25 | 124.00 121.25 | -6.75 -5.27% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 74.51 | 77.23 73.28 | -0.05 -0.07% |

| SUGAR #11 WORLD | 13.74 | 14.07 13.72 | -0.19 -1.36% |

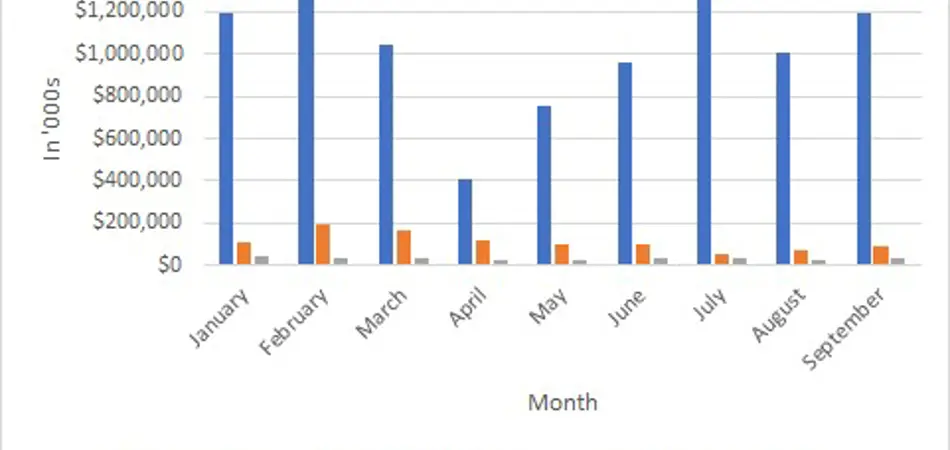

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction