Closing Bell: Calm before the calm?

By MG News | January 27, 2020 at 04:57 PM GMT+05:00

January 27, 2020 (MNL): Following a week full of disappointing performances, the KSE-100 yet again failed to incite the market spectators as it lost 93 points in today's session and closed at 42,539-mark.

The sentiments of investors remained repressed throughout the session, despite today being the eve of Monetary Policy Announcement, as the expectation of the central bank maintaining status quo continued to dampen sentiment.

The Index traded in a range of 266.83 points or 0.63 percent of previous close, showing an intraday high of 42,737.90 and a low of 42,471.07.

Of the 92 traded companies in the KSE100 Index 45 closed up 46 closed down, while 1 remained unchanged. Total volume traded for the index was 126.38 million shares.

Sector wise, the index was let down by Oil & Gas Exploration Companies with 93 points, Power Generation & Distribution with 37 points, Textile Composite with 15 points, Commercial Banks with 14 points and Inv. Banks / Inv. Cos. / Securities Cos. with 8 points.

The most points taken off the index was by OGDC which stripped the index of 41 points followed by HUBC with 31 points, POL with 24 points, PPL with 22 points and MEBL with 15 points.

Sectors propping up the index were Fertilizer with 40 points, Cement with 19 points, Transport with 9 points, Automobile Assembler with 7 points and Paper & Board with 3 points.

The most points added to the index was by ENGRO which contributed 29 points followed by HBL with 15 points, FFC with 15 points, PIBTL with 9 points and MLCF with 8 points.

All Share Volume increased by 25.44 Million to 198.48 Million Shares. Market Cap increased by Rs.0.14 Billion.

Total companies traded were 350 compared to 350 from the previous session. Of the scrips traded 166 closed up, 169 closed down while 15 remained unchanged.

Total trades increased by 6,941 to 71,835.

Value Traded decreased by 0.16 Billion to Rs.6.57 Billion

| Company | Volume |

|---|---|

| Maple Leaf Cement Factory | 25,961,000 |

| Pakistan International Bulk Terminal | 25,183,500 |

| Fauji Cement Company | 12,145,500 |

| Pakistan International Airlines Corp | 9,892,000 |

| D.G. Khan Cement Company | 9,081,000 |

| Fauji Foods | 8,705,000 |

| Avanceon | 6,366,500 |

| Cherat Cement Company | 5,876,000 |

| Dewan Cement | 5,728,500 |

| Unity Foods | 5,436,000 |

| Sector | Volume |

|---|---|

| Cement | 66,147,200 |

| Transport | 35,086,900 |

| Technology & Communication | 17,312,900 |

| Food & Personal Care Products | 10,813,170 |

| Commercial Banks | 9,556,300 |

| Vanaspati & Allied Industries | 5,436,300 |

| Power Generation & Distribution | 5,140,500 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 4,392,500 |

| Miscellaneous | 4,198,700 |

| Refinery | 4,065,000 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,655.08 111.43M |

1.14% 1455.65 |

| ALLSHR | 80,647.19 304.89M |

1.08% 859.56 |

| KSE30 | 39,667.05 41.67M |

1.44% 562.05 |

| KMI30 | 188,435.82 34.61M |

0.81% 1520.22 |

| KMIALLSHR | 54,533.06 130.50M |

0.61% 331.18 |

| BKTi | 34,553.40 21.61M |

3.22% 1076.72 |

| OGTi | 28,075.53 2.75M |

0.40% 112.95 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,705.00 | 106,760.00 105,440.00 |

955.00 0.90% |

| BRENT CRUDE | 67.18 | 67.29 67.05 |

0.07 0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.50 | 65.65 65.34 |

0.05 0.08% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

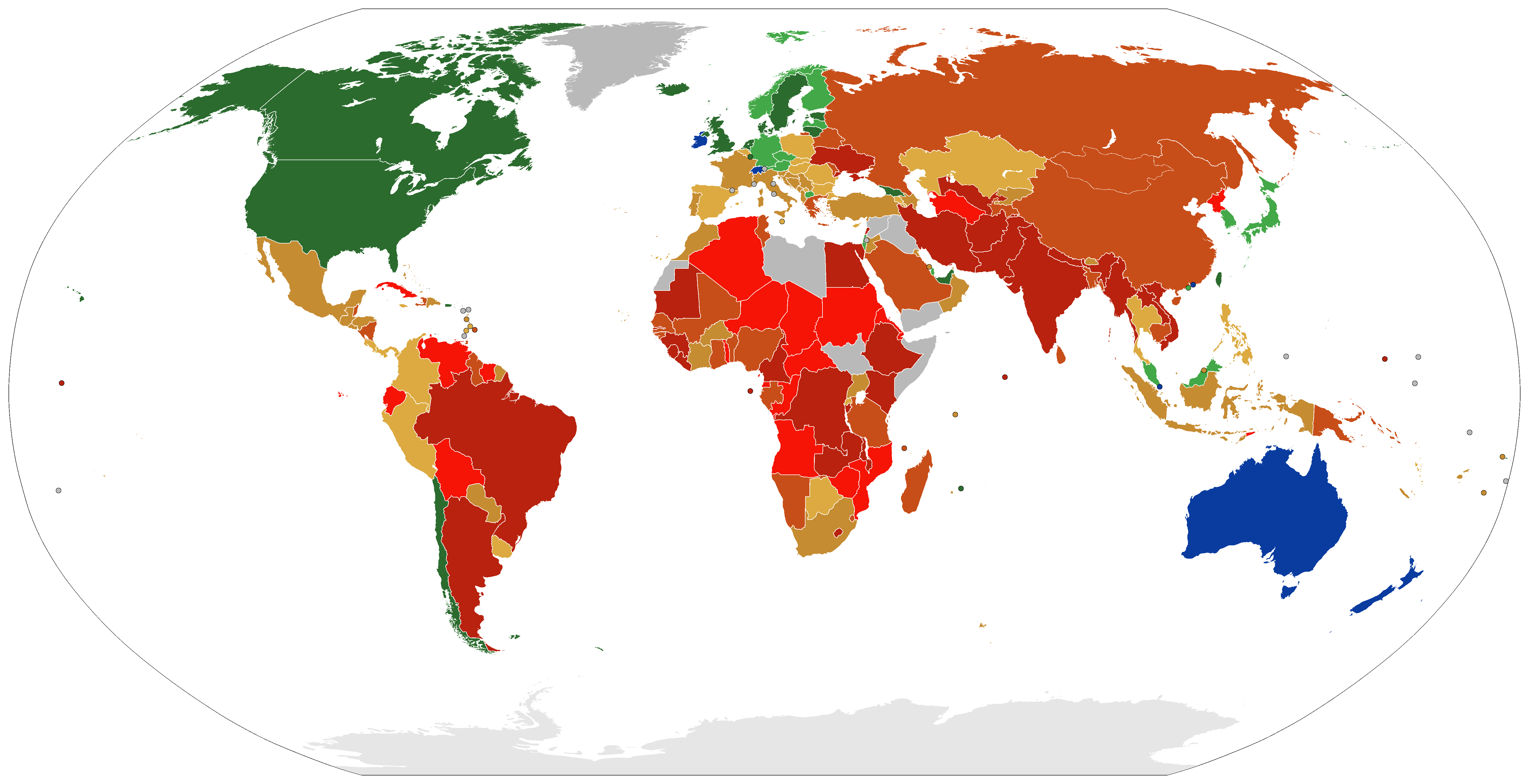

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI