China’s zero-covid policy to intensify global inflation concerns, says Fitch

MG News | May 11, 2022 at 09:32 AM GMT+05:00

May 11, 2022 (MLN): The lockdown in Shanghai will exacerbate global supply-chain pressures and inflation concerns, says Fitch Ratings in its latest Economics Dashboard.

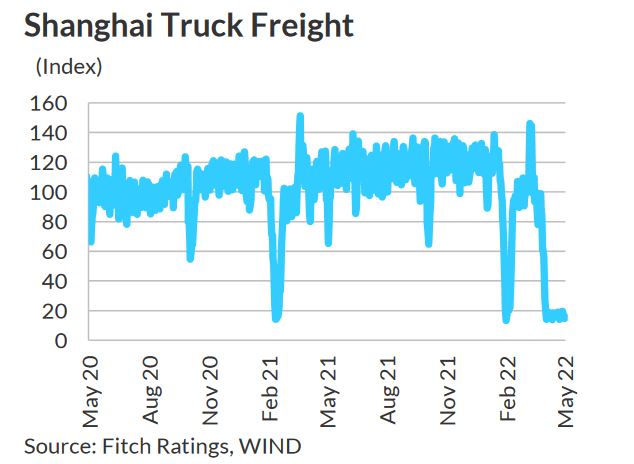

Restrictions imposed as part of China’s zero-Covid-19 policy have led to a plunge in Shanghai freight traffic volume in April and early May. With fewer trucks operating and Shanghai’s port staff unable to load and unload ships at their usual pace, significant backlogs have built up at the Port of Shanghai, it noted.

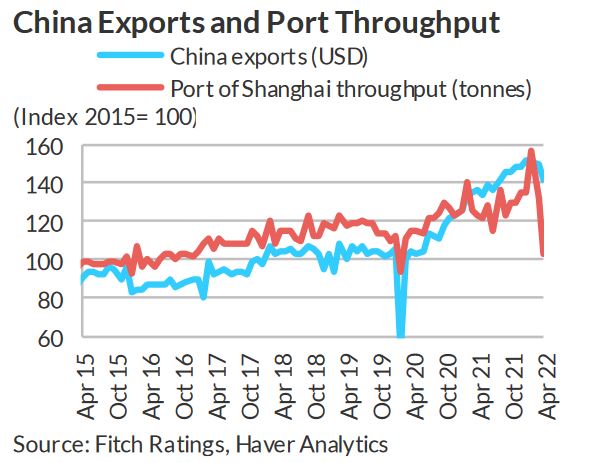

Much of this disruption, however, is yet to be reflected in hard global macro data, although China’s overall exports slowed sharply in April. As supply-chain disruptions persist, container freight rates could remain elevated or increase. With Shanghai handling around a fifth of China’s port volume and China accounting for 15% of world merchandise exports, shortages of manufactured goods could intensify, adding to existing global inflationary pressures.

This channel is likely to outweigh the effect of slower growth in China on global inflation through a weakening of commodity demand and prices.

The Shanghai lockdown comes at a time when there are few signs of improvement in global goods shortages including reported rising lead times for semiconductor deliveries. Even before the latest lockdown in China, the time taken to transport freight from Asia to the US West Coast was twice as long as it was at the start of the pandemic, while shipping rates are six times higher than they were in early 2020.

Congestion at US West Coast ports has eased in recent months but this could prove temporary. The container backlog in Shanghai port eventually will make its way to US West Coast ports, likely causing congestion in the summer months. But with US ports struggling with staffing shortages and constraints on distribution channels while China maintains its zero-Covid policy, supply-chain disruptions are unlikely to be resolved rapidly, it further added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,404.49 326.40M | -0.32% -556.16 |

| ALLSHR | 103,442.24 795.99M | -0.21% -217.04 |

| KSE30 | 52,413.79 113.03M | -0.27% -143.72 |

| KMI30 | 244,645.84 109.10M | -0.15% -378.05 |

| KMIALLSHR | 67,050.27 450.39M | -0.02% -14.08 |

| BKTi | 47,413.54 37.21M | -0.37% -176.81 |

| OGTi | 33,419.75 8.88M | -0.20% -67.52 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,895.00 | 89,510.00 85,135.00 | 3075.00 3.63% |

| BRENT CRUDE | 60.55 | 60.65 59.40 | 0.73 1.22% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 2.30 2.59% |

| ROTTERDAM COAL MONTHLY | 96.90 | 96.90 96.90 | 0.50 0.52% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.54 | 56.72 55.61 | 0.54 0.96% |

| SUGAR #11 WORLD | 14.85 | 14.87 14.45 | 0.37 2.56% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Large Scale Manufacturing (LSM)

Large Scale Manufacturing (LSM)