Cement sector profits rise 6.7% YoY in Q1 amid economic challenges

By Abdur Rahman | May 07, 2024 at 06:00 PM GMT+05:00

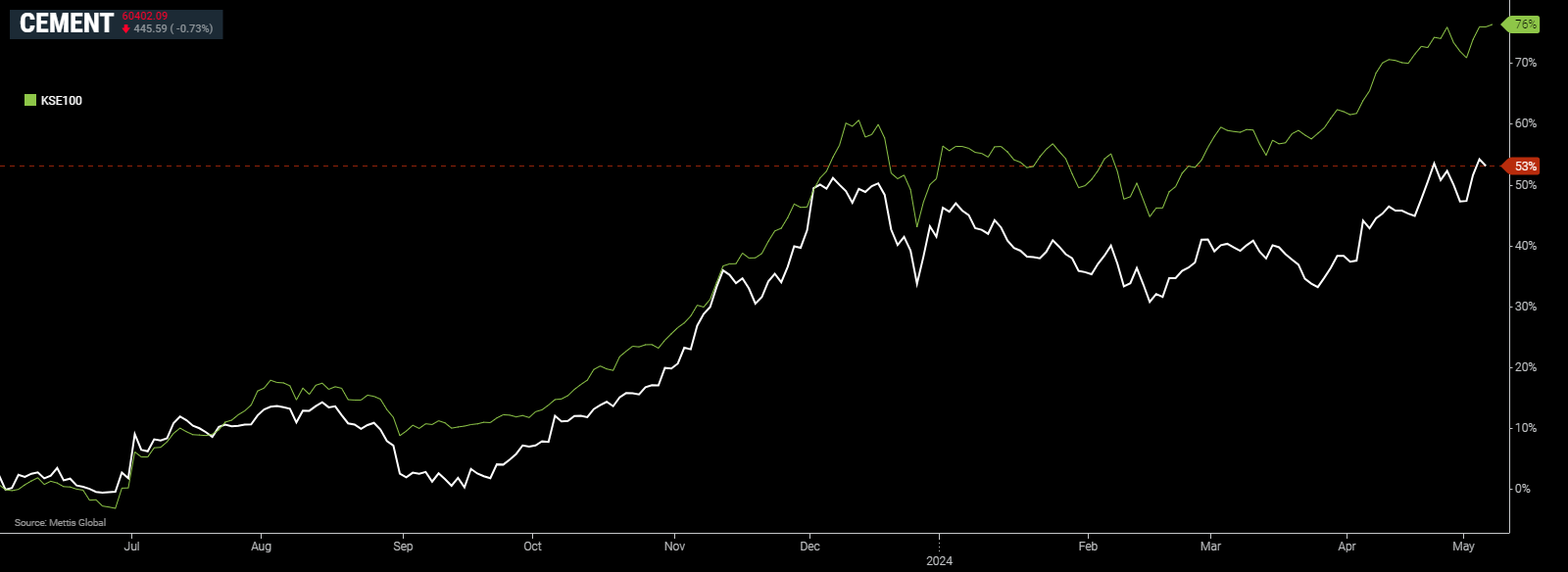

May 07, 2024 (MLN): The cement sector showed modest performance in the first quarter of 2024, as it continued to absorb the impact of last year’s economic decisions.

The KSE-100 listed sector recorded a 6.7% YoY growth in net profits, which clocked in at Rs17.06 billion as against Rs15.99bn in the same quarter of last year.

Fiscal year 2024 has so far remained largely conservative on the economic front, with stringent measures to meet International Monetary Fund pre-conditions leading to widespread impact.

Persistent inflation has kept the discount rate high at 23%, affecting public consumption and buying habits, and resulting in subdued economic activity.

As per the results compiled by Mettis Global of the income statements of the eight KSE-100 listed cement companies, the sector saw a fall of 0.8% YoY in its sale revenue, worth Rs127.72bn as compared to Rs128.77bn in SPLY.

To note, the compiled sector result includes BWCL, CHCC, DGKC, FCCL, KOHC, LUCK, MLCF, and PIOC.

The overall cement industry’s total dispatches were recorded at 10.62 million tonnes during the quarter, down 10.3% YoY, according to All Pakistan Cement Manufacturers Association (APCMA) data.

The review quarter's cement dispatches were affected by unexpected heavy rains, the holding of general elections, and the Eid holidays.

Exports grew 11.2% YoY while domestic dispatches fell 12.9% YOY during the review quarter.

However, higher sales prices offset most of the decline as sales remained largely stable despite a fall in overall dispatches.

On the cost front, the cost of sales also fell by 6.5% YoY, which improved the gross profit by 16.5% YoY to Rs37.13bn in Q1 2024.

The gross margins of the sector improved to 29.07% as compared to 24.75% in SPLY.

On the expense side, the sector's selling and distribution expenses rose 60.2% YoY to Rs5.23bn, administrative expenses rose 6.9% YoY to Rs2.27bn, and other operating expenses rose 18.1% YoY to Rs1.73bn.

During the period under review, other income of the sector increased by 45.6% YoY to stand at Rs5.47bn in Q1 2024 as compared to Rs3.75bn in SPLY.

The sector's finance cost grew by 22.6% YoY and stood at Rs8.73bn as compared to Rs7.12bn in SPLY, mainly due to higher interest rates.

On the tax front, the sector paid a higher tax worth Rs9.04bn against the Rs6.76bn paid in the corresponding period of last year, depicting a rise of 33.8% YoY.

| Unconsolidated (un-audited) Financial Results for quarter ended March 31, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Mar 24 | Mar 23 | % Change | |

| Sales | 127,718,453 | 128,769,905 | -0.82% |

| Cost of sales | (90,592,978) | (96,903,442) | -6.51% |

| Gross Profit/ (loss) | 37,125,475 | 31,866,463 | 16.50% |

| Selling And Distribution Expenses | (5,225,702) | (3,261,974) | 60.20% |

| Administrative Expenses | (2,274,728) | (2,128,621) | 6.86% |

| Other operating expenses | (1,734,158) | (1,468,377) | 18.10% |

| Other Income | 5,465,868 | 3,754,331 | 45.59% |

| Finance Cost | (8,734,642) | (7,124,448) | 22.60% |

| Others | 1,482,470 | 1,116,324 | 32.80% |

| Profit/ (loss) before taxation | 26,104,583 | 22,753,698 | 14.73% |

| Taxation | (9,044,752) | (6,760,270) | 33.79% |

| Net profit/ (loss) for the period | 17,059,831 | 15,993,428 | 6.67% |

Amount in thousand except for EPS

Outlook

Pakistan's economy is showing signs of gradual improvement, but challenges such as elevated inflation and high interest rates are impeding the growth.

Additionally, the government's stringent measures against smuggling and illegal currency outflows have yielded positive outcomes, contributing to exchange rate stability.

Formation of the federal and provincial governments, engagement with IMF to conclude the Stand-By Arrangement (SBA) facility, and discussions for a new program have improved the confidence of the business community.

"With inflation expected to soften going forward, we expect interest rates to decline in the coming months," said Cherat Cement Company Limited (PSX: CHCC).

This should provide some relief and stimulate the economy.

Nonetheless, high inflation and interest rates will continue to pose challenges for the domestic demand of cement in the short-term, it said.

The company said that it hopes once monetary easing begins with a reduction in inflation, the government will increase spending on infrastructure development projects to spur growth which will boost cement demand also.

Meanwhile, escalation in tensions in the Middle East may further impact supply chains, and result in increased oil and commodity prices. Pakistan is especially vulnerable to these supply side shocks.

Fauji Cement Company Limited (PSX: FCCL) stated that domestic dispatches are expected to improve with signs of economic stability and improved weather conditions in the second quarter of 2024.

Exports to Afghanistan are also likely to improve post-winter during the next quarter.

On the other hand, Maple Leaf Cement Factory Limited (PSX: MLCF) was of the view that cement demand in the domestic market would fall slightly owing to reduced public spending in construction sectors.

Given Pakistan’s economic situation, import restrictions are unlikely to lift in the near future, the company said.

To avoid future power sector arrears, the government aims to raise electricity rates and streamline fuel price increases in response to rising pressure from the IMF.

As a result, National Grid tariffs are projected to climb further, resulting in higher power expenses for the sector.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,005.00 | 109,565.00 107,195.00 |

520.00 0.48% |

| BRENT CRUDE | 66.62 | 67.20 65.92 |

-0.18 -0.27% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.98 | 65.82 64.50 |

-0.54 -0.82% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|