Bulls return to trading floors as benchmark 100 index gains 237 pts amid positive triggers

By MG News | January 21, 2019 at 05:55 PM GMT+05:00

January 21, 2019 (MLN): After their absence from capital markets in the last few sessions, the bulls returned to the trading floors in today’s trade, pulling the KSE - 100 index up by 237 points as it concluded the day at 39,543 points.

Having contributed over 230 points to the benchmark index collectively, Commercial Banks and Oil & Gas Exploration Companies led the day’s gains.

Commercial Banks rallied as the news on removal of withholding taxes (WHT) on cash transactions of above Rs.50,000 for filers gathered attention. Moreover, expectation for a hike in policy rates channeled optimism within markets.

Meanwhile the Energy sector took the nudge from rebounding commodities prices internationally.

In particular, gains on the scrips of HBL (+2.89%), PPL (+2.63%) and FFC (+1.73%) led the index in green region.

Today’s trade began with the index on an overall low of 39, 306 points, after which it gathered pace and mounted to an intraday high of 39,812 points, marking its movement within a window of 505 points.

The market participants observed a trading activity of 77 million shares, traded at a value of PKR 4.74 billion. While the value of trade exceeded previous session’s value, the volume traded fell short considerably.

In total, the shares of 91 companies were traded today, out of which, the share prices of 47 companies registered an increase and that of 41 companies suffered decline.

On the other hand, the broader KSE All share index gained 161 points in today’s trade, marking an increase of 0.56% over last closing value and ending today’s trade at 29, 078 points.

A total of 124.5 million shares of scrips listed within the KSE All Share Index were traded today at PKR 5.96 billion.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,005.00 | 109,565.00 107,195.00 |

520.00 0.48% |

| BRENT CRUDE | 66.60 | 67.20 65.92 |

-0.20 -0.30% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.94 | 65.82 64.50 |

-0.58 -0.89% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

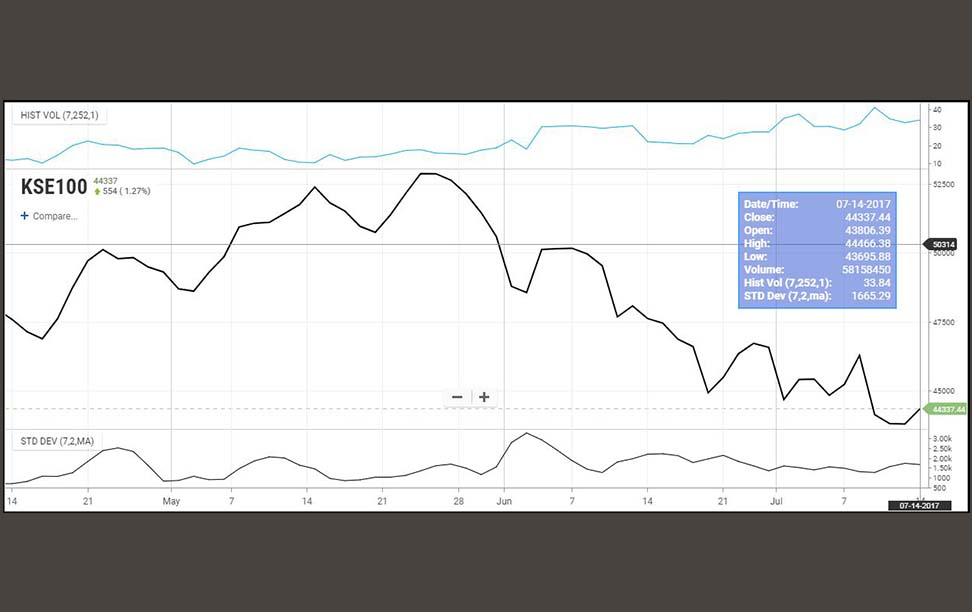

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|