BOP's profit after tax plunges by 21% to Rs5.97bn in 9MCY23

MG News | October 30, 2023 at 10:59 AM GMT+05:00

October 30, 2023 (MLN): The Bank of Punjab (PSX: BOP) announced its results for the nine months of 2023, wherein the bank’s profit after tax went down by 21.29% YoY to Rs5.97 billion [EPS: Rs1.78] compared to Rs7.58bn [EPS: Rs2.29] profit recorded in the same period last year (SPLY).

Going by the income statement made available by the company on the PSX, the bank’s net markup income soared by 22.57% YoY, to clock in at Rs28.13bn against Rs22.95bn incurred in the SPLY.

Similarly, the bank’s total non-markup interest income improved by 36.52% YoY to Rs8.79bn as compared to Rs6.44bn in SPLY.

This was due to an increase in Fee and commission income of 28.17% YoY to Rs6.49bn in 9MCY23.

Moreover, BOP incurred a foreign exchange loss of Rs377.06m, compared to a gain of Rs1.59bn in the SPLY, this further contributed to the decline in the bank’s profitability.

The profit and loss statement further shows that the nine months’ total non-mark-up/interest expenses stood at Rs27.74bn, up by 33.3% YoY.

However, despite the increased flow of income, expenses rose by a greater proportion, resulting in a decline in profit after tax.

During the 9MCY23, the bank incurred a provision reversal of Rs296.22m, compared to a provision expense worth Rs3.85bn reported in the SPLY.

On the taxation front, the bank incurred a tax of Rs2.91bn, 39.93% YoY lower than the tax of Rs4.85bn recorded in SPLY.

| Consolidated Profit and Loss Account for the nine months ended September 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Mark-up/return/interest earned | 223,983,989 | 94,618,446 | 136.72% |

| Mark-up/return/interest expensed | 195,849,587 | 71,664,463 | 173.29% |

| Net mark-up/return/interest income | 28,134,402 | 22,953,983 | 22.57% |

| NON MARK-UP/INTEREST INCOME | |||

| Fee and commision income | 6,487,736 | 5,061,681 | 28.17% |

| Dividend income | 336,848 | 389,521 | -13.52% |

| Foreign exchange (loss) income | -377,056 | 1589421 | - |

| Income/(loss) from derivatives | - | - | |

| Gain / (loss) on securities - net | 336,268 | -811,797 | -141.42% |

| Other income-net | 2,003,572 | 207,762 | 864.36% |

| Total non mark-up/interest income | 8,787,368 | 6,436,588 | 36.52% |

| Total Income | 36,921,770 | 29,390,571 | 25.62% |

| NON MARK-UP/INTEREST EXPENSES | |||

| Operating expenses | 27,616,408 | 20,569,116 | 34.26% |

| Workers welfare fund | 119,675 | 210,631 | - |

| Other charges | 8,806 | 34,556 | -74.52% |

| Total non mark-up/interest expenses | 27,744,889 | 20,814,303 | 33.30% |

| Profit before provisions | 9,176,881 | 8,576,268 | 7.00% |

| Provisions and write offs - net | 296,217 | -3,854,897 | -107.68% |

| Extraordinary/unusual items | - | - | - |

| Profit before taxation | 8,880,664 | 12,431,165 | -28.56% |

| Taxation | 2,912,850 | 4,849,096 | -39.93% |

| Profit after taxation | 5,967,814 | 7,582,069 | -21.29% |

| Earnings per share - Basic and Diluted (in Rupees) | 1.78 | 2.29 | - |

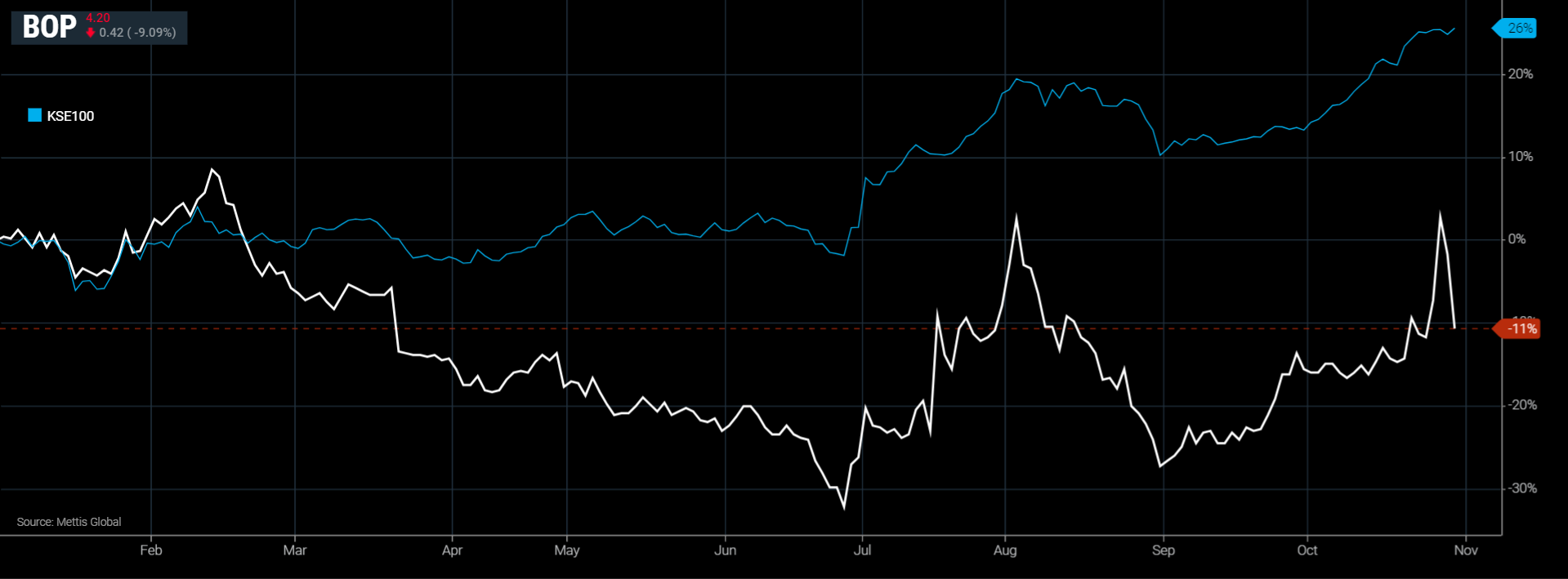

BOP and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 140,066.08 70.23M | 1.19% 1653.83 |

| ALLSHR | 86,705.90 149.45M | 1.17% 1002.94 |

| KSE30 | 42,810.64 40.39M | 1.32% 555.79 |

| KMI30 | 197,565.75 45.18M | 1.78% 3456.15 |

| KMIALLSHR | 57,574.27 77.59M | 1.52% 860.60 |

| BKTi | 38,138.92 3.94M | 0.81% 307.58 |

| OGTi | 28,421.63 19.75M | 3.58% 980.99 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,215.00 | 119,430.00 117,905.00 | 1595.00 1.36% |

| BRENT CRUDE | 72.18 | 72.82 72.17 | -1.06 -1.45% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.82 | 70.41 69.80 | -0.18 -0.26% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|