AGHA profit plummets by 59% YoY in 9MFY23

MG News | April 27, 2023 at 10:42 AM GMT+05:00

April 27, 2023 (MLN): Agha Steel Mills Limited (PSX: AGHA) reported a profit after tax of Rs704.99 million [EPS: Rs1.17] for the nine months ended 31 March 2023, a significant fall of 59.48% YoY as compared to profit after tax of Rs1.73 billion [EPS: Rs2.88] in the same period last year (SPLY), the company’s stock filings on the stock exchange showed.

In the filing, the company’s top line declined by 17.43% YoY to Rs15.45bn as compared to Rs18.71bn in SPLY, translating into a 15.26% lower gross profit in 9MFY23.

On the cost side, the company observed a 20.15% YoY increase in administrative expenses to clock in at Rs247.8m and a 10.76% YoY increase in selling and distribution costs to stand at Rs338.47m.

The company’s finance costs surged by 60.64% YoY and stood at Rs2.26bn as compared to Rs1.4bn in 9MFY22, mainly due to higher interest rates.

On the tax front, the company paid 22.43% YoY lower taxes worth Rs264.24m as tax payments against the Rs340.67m paid in the corresponding period of last year, which translates into an effective tax rate of 27.26%.

|

Profit or Loss Account for the nine months ended March 31, 2023 (Rupees in '000') |

|||

|---|---|---|---|

|

|

Mar-23 |

Mar-23 |

% Change |

|

Sales |

15,452,020 |

18,712,858 |

-17.43% |

|

Cost of sales |

(11,831,721) |

(14,440,713) |

-18.07% |

|

Gross Profit |

3,620,299 |

4,272,145 |

-15.26% |

|

Administrative expenses |

(247,800) |

(206,249) |

20.15% |

|

Selling and distribution costs |

(338,476) |

(305,582) |

10.76% |

|

Finance costs |

(2,262,505) |

(1,408,444) |

60.64% |

|

Operating profit |

771,518 |

2,351,870 |

-67.20% |

|

Other expenses |

(163,701) |

(478,531) |

-65.79% |

|

Other income |

361,420 |

207,126 |

74.49% |

|

Profit before taxation |

969,237 |

2,080,465 |

-53.41% |

|

Taxation |

(264,247) |

(340,673) |

-22.43% |

|

Net profit for the period |

704,990 |

1,739,792 |

-59.48% |

|

Basic and diluted earnings/ (loss) per share |

1.17 |

2.88 |

-59.38% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

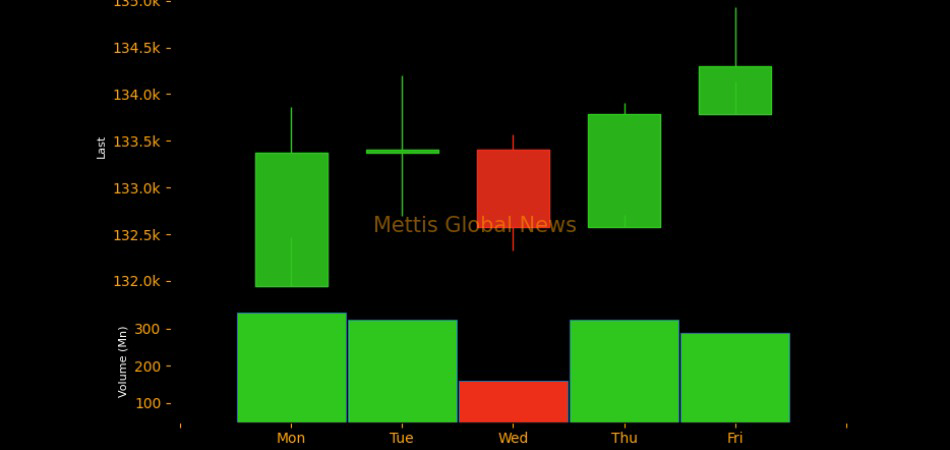

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|