Weeky Market Roundup

MG News | April 30, 2022 at 02:43 PM GMT+05:00

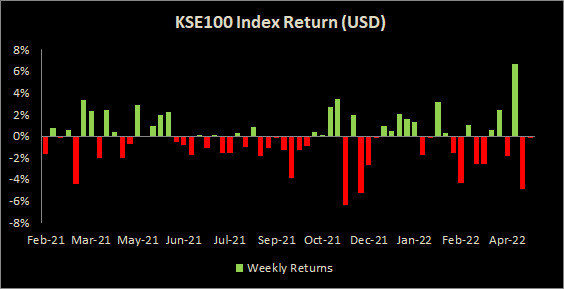

April 30, 2022 (MLN): Following the last week’s 1,049pts sell-off, domestic equities remained under selling pressure during the departed week, losing 305 points or down by 0.67% WoW to settle at the 45,249 points level.

The market commenced the week on a positive note, as the investors welcomed better than expected corporate results along with a successful agreement with IMF to extend the stalled bailout programme by up to one year and potentially increase the loan size to $8bn.

Albeit the momentum could not be maintained mid-week amid concerns over further monetary tightening, given the KIBOR touched its 13 year high which signaled another interest rate hike. This, together with PKR 3.2trn fiscal deficit posted during Jul-Mar’22, and widened current account deficit, dented the investors’ confidence and thereby caused the bourse to close in red, a note by Arif Habib Limited said.

In USD terms, the index was down by 0.22% WoW.

During the week, the bourse witnessed three sessions in the favor of bears and 1 session in favour of bulls. The KSE-100 index oscillated between high and low of 46,200 and 44,657 points, respectively, before settling the week at 45,249 levels.

From the sector-specific lens, Cement, Technology, Oil & Gas Exploration Companies, Power Generation & Distribution, and Engineering kept the index in red territory as they snatched 117, 99, 69, 68, and 33 points from the index respectively.

Contrary to that, Commercial Banks, Fertilizers, Chemicals, Automobiles, and Glass & Ceramics during the week collectively contributed 205 points to the bourse.

Scrip-wise, TRG, HUBC, LUCK, PPL, and FFC were the worst-performing stocks during the week as they took away 67, 55, 50, 38, and 28 points from the index respectively. whereas EFERT, ENGRO, LOTCHEM, EPCL, and MCB added 213 points to the index.

Meanwhile, the KSE All Share market cap decreased by Rs88.4 billion or 1.16% over the week, being recorded at Rs7.5trillion as compared to a market cap of Rs7.6tr recorded last week.

Flow-wise, foreigners were the net buyers during the week, buying stocks worth $3mn compared to a net purchase of $0.97mn last week. Sector-wise, major selling was witnessed in Technology & Communication ($1.64mn) and Textile Composite ($1.01mn).

On the local side, the majority of the selling was reported by Insurance Companies, Mutual Funds, and Companies amounting to $6.7mn, $4.9mn, and $2.9mn respectively. However, Individuals stood on the other side with a net buying of $5.8mn.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,680.00 | 119,740.00 116,460.00 | -615.00 -0.52% |

| BRENT CRUDE | 73.63 | 73.63 71.75 | 1.12 1.54% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.36 | 70.51 68.45 | 1.15 1.66% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|