Weekly Market Roundup

_20251026092106500_9b2621.jpeg?width=950&height=450&format=Webp)

MG News | October 26, 2025 at 02:20 PM GMT+05:00

October 26, 2025 (MLN): The Pakistan Stock Exchange (PSX) spent much of the week trading in a narrow range, reflecting a tug of war between optimism over improving macroeconomic indicators and anxiety over regulatory and earnings-related developments.

The benchmark KSE-100 Index ultimately closed at 163,304.13 points, marking a decline of 502 points or 0.31% week-on-week from last week’s 163,806.22.

This week’s decline is attributed to a combination of profit-taking, disappointing earnings, and regulatory uncertainty following the revised K-Electric tariff, as investors adopt a cautious stance ahead of rollover week.

The week kicked off on a strong footing, fueled by easing geopolitical concerns and renewed confidence after Pakistan posted a current account surplus of $110 million in September 2025, reversing from a $325m deficit in August.

However, the positive sentiment could not hold as the week progressed.

Market activity turned cautious after NEPRA’s extensive revisions to K-Electric’s Multi-Year Tariff (MYT) for FY2024–30 drew sharp criticism from the utility’s CEO, Syed Moonis Abdullah Alvi, who termed the “large-scale reductions and modifications” unsustainable for operations.

The development triggered a sell-off in K-Electric’s stock, which plunged 5.59%, leading the volume chart with over 109m shares traded.

The uncertainty surrounding the revised tariff spooked investors, prompting them to trim positions, particularly in the power, utilities, and banking sectors.

Adding to the pressure, weak corporate earnings further dented sentiment.

Kot Addu Power Company Limited (KAPCO) reported a 99.6% YoY plunge in profit to just Rs4.88m, while Bank Islami Pakistan Limited (BIPL) posted a 50% drop in nine-month earnings to Rs5.07bn.

Despite the weak close, macroeconomic indicators offered some silver linings. The current account balance turned positive in September, while the Real Effective Exchange Rate (REER) rose to 101.73, with a modest 1.64% appreciation month-on-month.

The Pakistani rupee held firm, closed the week at 281.02 against the USD. Meanwhile, SBP reserves inched up to $14.45bn.

On the external front, FDI inflows for September clocked in at $186m, slightly above August’s $175m, though 1QFY26 inflows fell 34% YoY to $569m.

Meanwhile, profit and dividend repatriation surged 85.8% YoY to $751.7m in the quarter, despite a steep monthly drop of 54.4% MoM.

Market Cap:

The market capitalization contracted to Rs4.83 trillion, down from Rs4.86tr a week earlier, while in USD terms, it fell to $17.20 billion from $17.3bn, translating into a 0.59% weekly loss._20251026081419031_71d72e.jpeg)

The USD-based return turned negative at -0.27%, compared to +0.45% last week._20251026081401129_96438b.jpeg)

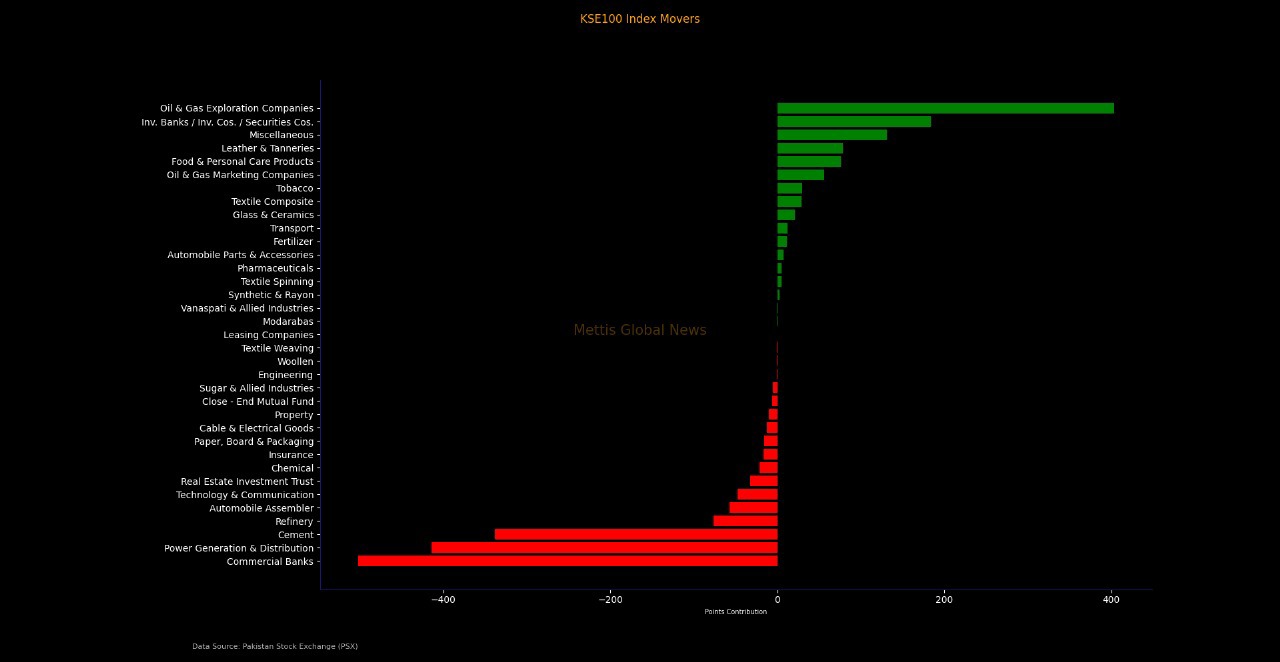

Major Index Movers:

The Commercial Banks sector led the decline, erasing 502 points from the index on the back of heavy profit-taking and weak earnings outlook.

Power Generation & Distribution followed with a 414-point drag, largely reflecting the sell-off in K-Electric after NEPRA’s tariff revisions.

The Cement sector was also under pressure, shedding 338 points amid volatile coal prices and expectations of slower construction demand.

On the brighter side, energy-linked counters offered resilience. Oil & Gas Exploration Companies added a solid 404 points, buoyed by gains in PPL (+288 points) and OGDC (+240 points).

The Oil & Gas Marketing Companies sector contributed another 56 points, while Food & Personal Care Products, Leather & Tanneries, and Miscellaneous sectors collectively added over 285 points.

The Investment Banks/Investment Cos. sector also stood out, contributing 184 points, supported by active buying in PSX (+124 points).

Among individual performers, PPL emerged as the week’s top mover with a 288-point contribution, followed by OGDC (+240), MCB (+209), HBL (+133), and PSX (+124).

On the losing end, BAHL (-404), MEBL (-172), KEL (-164), and HUBC (-148) dragged the index lower.

Cement giants LUCK (-112) and POL (-106) also contributed to the downside as investors rotated out of cyclicals amid muted earnings prospects._20251026081408915_d1d718.jpeg)

FIPI/LIPI:

Foreign investors continued to trim exposure, recording net outflows of $7.09m, led by foreign corporates (-$4.87m) and overseas Pakistanis (-$2.16m).

Local investors absorbed most of this pressure, with individuals emerging as net buyers of $12m, followed by insurance companies (+$2.24m).

On the flip side, mutual funds (-$3.7m) and companies (-$2.7m) remained on the selling side, while banks and DFIs offloaded $0.43m._20251026081713544_ff6470.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,202.86 341.59M | -0.20% -384.80 |

| ALLSHR | 112,423.22 745.46M | -0.07% -79.96 |

| KSE30 | 57,956.48 141.89M | -0.12% -70.41 |

| KMI30 | 267,375.33 135.18M | -0.39% -1043.48 |

| KMIALLSHR | 72,363.20 391.84M | -0.20% -146.78 |

| BKTi | 53,485.97 53.11M | 0.26% 139.85 |

| OGTi | 38,916.61 17.01M | 0.72% 278.13 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,690.00 | 88,985.00 87,550.00 | 105.00 0.12% |

| BRENT CRUDE | 66.17 | 66.78 65.00 | 0.58 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.22 | 61.86 60.14 | 0.59 0.97% |

| SUGAR #11 WORLD | 14.93 | 14.98 14.74 | 0.14 0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market