TOMCL targets 10% growth, eyes solar transition

MG News | November 11, 2025 at 03:09 PM GMT+05:00

November 11, 2025 (MLN): The Organic Meat Company Limited (PSX:

TOMCL) has set a conservative growth target of 10% for the upcoming

fiscal year, a focused approach toward sustainable expansion and

operational efficiency.

To optimize costs and improve energy efficiency, TOMCL is

actively pursuing a solar transition to address its 1.8 MW power

requirement. Discussions are underway with several suppliers to implement

solar solutions, with management expecting 10–15% savings in power costs

and a positive impact on overall operational expenses, as highlighted in the company's corporate briefing session.

Currently, 98% of TOMCL’s Gaddap operations rely on

diesel.

However, the Korangi facility operates on an energy

mix of approximately 70% solar, 20% grid, and 10% diesel,

The company also aims to become completely leverage-free

by next few years, marking a major milestone in its ongoing financial

restructuring efforts.

TOMCL is actively supplying meat products to companies

operating in the fast food industry and is working to expand its frozen beef

offerings specifically tailored for fast food applications.

With a 20% share of Pakistan’s meat export market,

TOMCL stands among the leading players in the sector.

A major breakthrough in the retail segment has been

the company’s partnership with Carrefour, which management highlighted

as a significant step forward in expanding its customer base.

In addition, TOMCL is collaborating with the government

to establish a Foot and Mouth Disease–free (FMD-free) compartment, a

critical step toward meeting global export standards and unlocking access to

higher-value international markets.

The company is also expanding its product portfolio in

the pet chews segment, which management expects to become a significant

contributor to both volume and value growth over the next two to three years.

On the export front, TOMCL has strengthened its global

presence by securing major international contracts, including a $12m deal

for frozen cooked beef exports to China and an $8.1m agreement

with Gold Crest Trading FZE for frozen boneless beef exports to the

UAE.

The company’s geographic

diversification has also improved, with China’s contribution to revenue

increasing from 5% to 17%, while the UAE continues to represent 56%

of total sales.

In October 2025, TOMCL commenced operations at its Karachi

Export Processing Zone (EPZ) facility through its wholly owned

subsidiary, Mohammad Saeed Mohammad Hussain Limited. Additionally, the

company completed Phase 2 of its expansion, adding 300 metric tons

per month of production capacity for frozen cooked beef.

For FY 2025, TOMCL reported net sales of Rs 14bn,

up 18.72% from the previous year’s Rs 11.8bn. Despite strong

revenue growth, profit after tax declined to Rs 430m from Rs

497m in FY 2024, resulting in earnings per share (EPS) of Rs 2.76,

compared to Rs 3.35 a year earlier a 17.61% year-on-year decrease.

Management attributed the margin pressure to volatile

livestock prices, inflationary impacts on raw materials and

packaging, higher energy costs, and a significant increase in

taxation from 1% of turnover to 39% of profit.

While gross margins have been contracting annually

due to cost pressures and taxation, management clarified that sales tax

changes have not affected operations.

Regarding market expansion, TOMCL stated that entry

into Malaysia remains challenging, as the market primarily demands buffalo

meat, while Brazilian and Australian suppliers hold advantages in cow

meat shelf space. The company will instead focus on regions where it can

more effectively leverage its competitive strengths.

Management further indicated that no stock split is

currently under consideration.

In recognition of its improved financial position, TOMCL’s credit rating was upgraded by VIS from ‘A-/A-2’ to ‘A/A-1’, reflecting enhanced creditworthiness.

Additionally, TOMCL became the first Pakistani meat exporter approved by Carrefour outlets across the UAE, Qatar, and Oman, emphasizng its commitment to quality, export excellence, and international market growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 156,177.12 289.65M | 6.62% 9696.97 |

| ALLSHR | 93,623.09 484.05M | 5.91% 5221.94 |

| KSE30 | 48,043.06 141.71M | 6.77% 3046.55 |

| KMI30 | 225,069.58 124.56M | 7.16% 15030.17 |

| KMIALLSHR | 60,866.01 284.12M | 6.19% 3550.28 |

| BKTi | 45,102.26 59.40M | 6.46% 2737.76 |

| OGTi | 33,122.47 17.00M | 5.22% 1641.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,850.00 | 71,510.00 68,485.00 | 1645.00 2.38% |

| BRENT CRUDE | 91.36 | 95.04 88.05 | -7.60 -7.68% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.60 -15.04% |

| ROTTERDAM COAL MONTHLY | 128.50 | 129.25 128.50 | -4.00 -3.02% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 88.25 | 91.48 84.43 | -6.52 -6.88% |

| SUGAR #11 WORLD | 14.40 | 14.45 14.17 | -0.19 -1.30% |

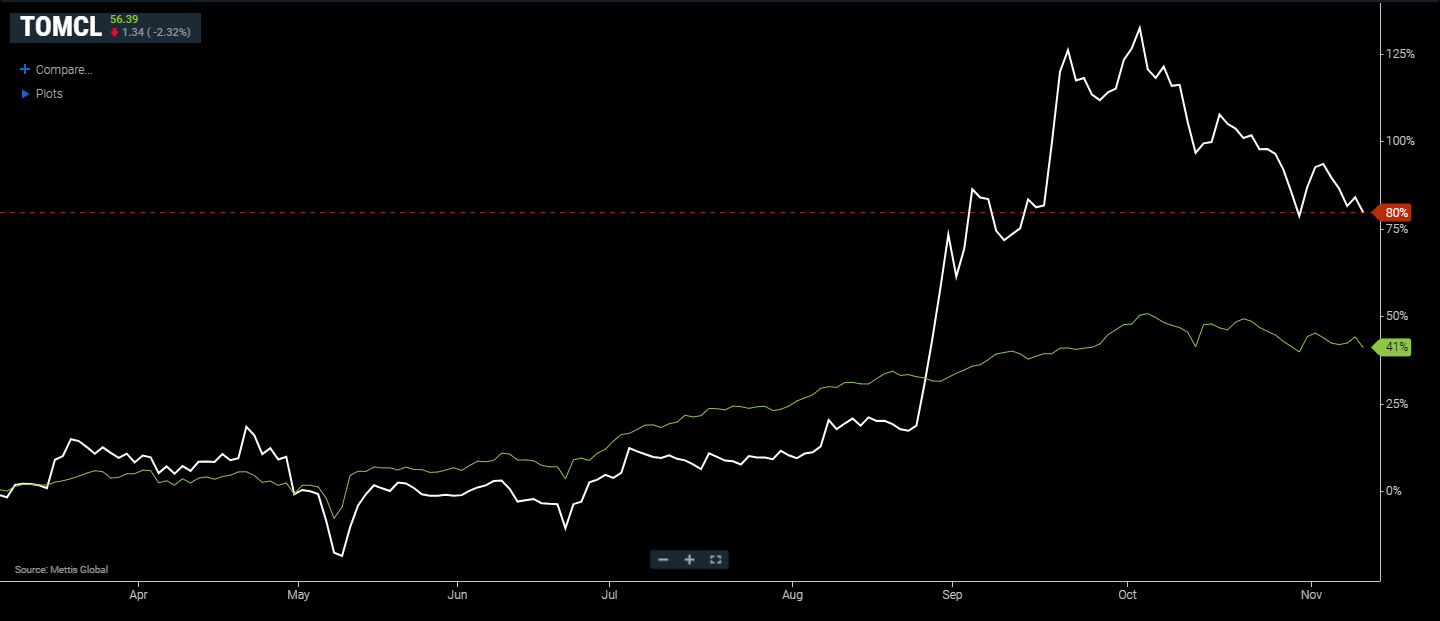

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Business Confidence Survey

Business Confidence Survey