Spot gold declines on Ukraine peace talks, fed policy outlook

MG News | August 11, 2025 at 03:40 PM GMT+05:00

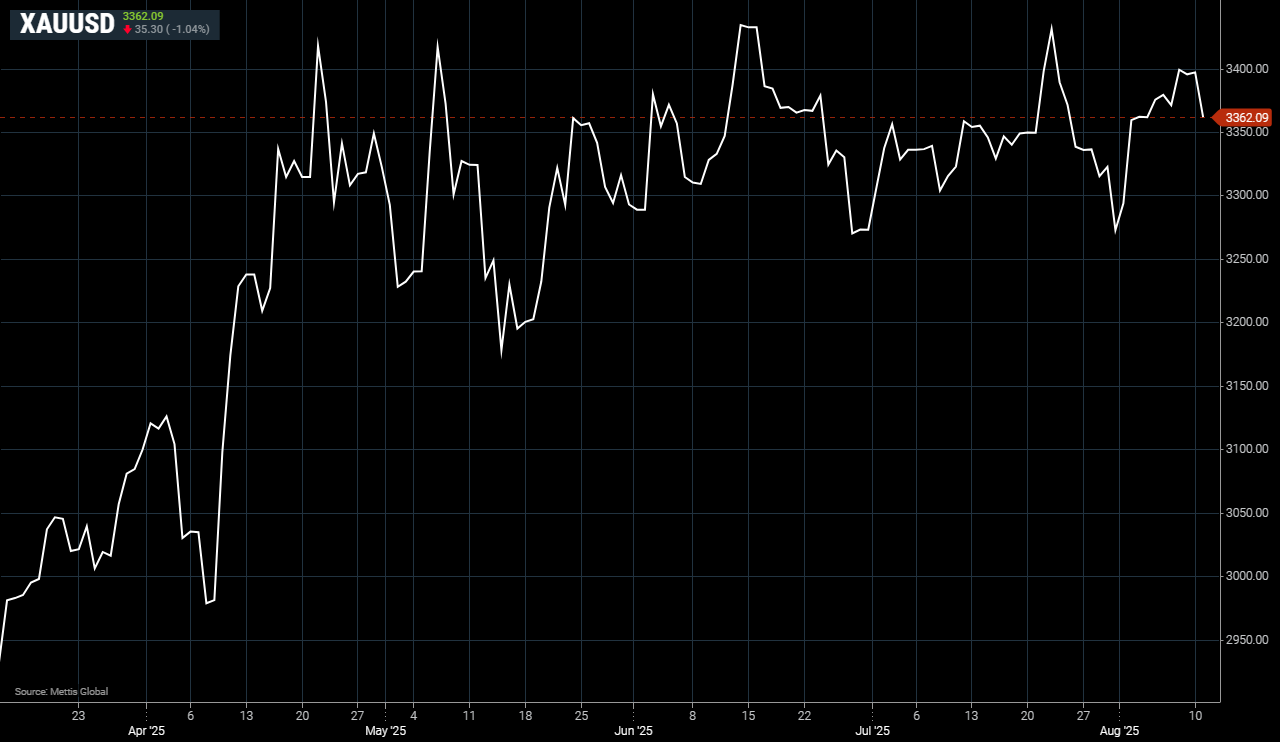

August 11, 2025 (MLN): Spot gold was down 1.04% at $3362.09 an ounce as of [3:25 pm] PST on Monday, according to data reported by Mettis Global.

Gold prices fell as investors turned their attention to upcoming

U.S.-Russia discussions on the Ukraine conflict and awaited July inflation

figures for clues on the Federal Reserve’s future interest rate policy.

U.S. gold futures for December delivery slid 1.4% to $3,441.20 on

Monday.

City Index senior analyst Matt Simpson attributed the decline to easing

geopolitical tensions over the Ukraine conflict noting that prices extended

losses after Friday’s news that former President Donald Trump plans to meet

Russian President Vladimir Putin in the U.S.

Simpson said the two leaders are scheduled to hold talks in Alaska on

August 15 aimed at ending the war.

Investor attention is also fixed on U.S. consumer price figures set for

release on Tuesday.

Analysts anticipate that the effect of tariffs will push the core

inflation rate up by 0.3% to an annual pace of 3.0%, moving it further from the

Federal Reserve’s 2% target.

Simpson cautioned that a stronger than expected reading could lift the

dollar and limit gold’s upside although he believes bargain hunting may keep a

floor under prices.

Expectations for a September Fed rate cut have grown following a softer

than forecast U.S. jobs report with markets pricing in roughly a 90% chance of

easing next month and at least one more cut before year end.

Lower interest rates typically benefit non-yielding assets such as gold.

Markets are also watching developments in Sino-U.S. trade talks ahead of

Trump’s August 12 deadline for an agreement between Washington and Beijing.

Meanwhile data from the Commodity Futures Trading Commission showed COMEX

gold speculators boosted their net long positions by 18,965 contracts to

161,811 in the week ending August 5.

In other precious metals, spot silver dipped 0.5% to $38.13 per ounce,

platinum fell 1.1% to $1,317.90, and palladium edged up 0.1% to $1,127.37.

Copyright Mettis Link

News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 92,620.00 89,800.00 | 1925.00 2.15% |

| BRENT CRUDE | 62.51 | 63.96 62.34 | -1.24 -1.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.85 | 60.30 58.68 | -1.23 -2.05% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|