Retail payment volumes reach 2.8bn in Q1FY26

MG News | December 30, 2025 at 01:43 PM GMT+05:00

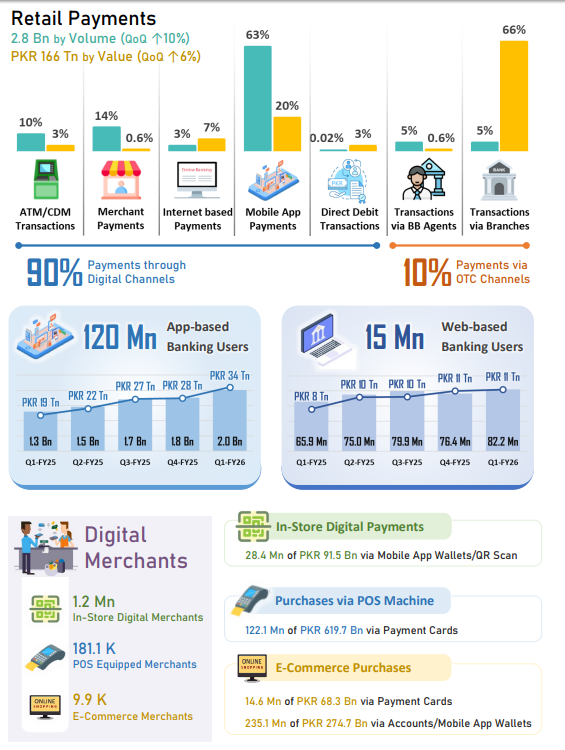

December 30, 2025 (MLN): Retail payment activity in Pakistan climbed to 2.8bn transactions in the first quarter of FY26, with digital channels accounting for 90% of total volumes, showing the accelerating shift toward mobile and app-based banking.

According to first quarterly payment systems review of FY26 published by State Bank of Pakistan (SBP).

The total value of retail payments reached Rs166tr during

the quarter, up 6% from the previous quarter, while transaction volumes rose 10%

on a quarterly basis.

Growth was largely driven by increased usage of mobile banking applications across banks, branchless banking providers and electronic money institutions.

Digital payment channels processed 2.5bn transactions during the quarter, compared to 87% of total retail payments in the same period last year.

The value of transactions routed through digital platforms

stood at Rs55tr, highlighting their expanding role in everyday financial

activity.

Mobile app-based payments remained the dominant digital

channel, handling 2.0bn transactions with a combined value of Rs33.7tr.

These payments accounted for 81% of all digital transactions

and were used for person-to-person transfers, bill payments and merchant

transactions across online and physical retail outlets.

The Raast instant payment system continued to record strong

growth. Person-to-person transactions rose 31% to 535m, valued at Rs11.3tr.

Person-to-merchant transactions doubled to 4.3m, amounting

to Rs17.0bn.

In total, Raast processed 544m transactions worth Rs12.8tr

during the quarter.

Internet banking usage also increased, while the number of

payment cards in circulation reached 61.3m.

Debit cards accounted for 90% of the total, while credit

cards made up around 4%.

Card-based payments at point-of-sale terminals and through

e-commerce platforms averaged 1.5m transactions per day.

The country’s network of 20,527 ATMs processed 267m

transactions worth Rs4.5tr, with each ATM handling an average of 142

transactions daily and an average transaction size of Rs16,800.

Despite the rapid growth in digital payments, physical

channels remained active.

Bank branches processed 137m transactions amounting to Rs110tr,

while 756,480 branchless banking agents facilitated 129m transactions valued at

Rs0.9tr through over-the-counter services.

The data points to a continued structural shift in

Pakistan’s payment ecosystem, with digital platforms increasingly driving

transaction volumes while traditional channels continue to support high-value

and cash-based payments.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 174,468.43 391.47M | 0.33% 572.09 |

| ALLSHR | 104,672.00 794.18M | 0.51% 532.76 |

| KSE30 | 53,494.60 155.47M | 0.41% 218.49 |

| KMI30 | 249,694.21 198.70M | 0.53% 1307.34 |

| KMIALLSHR | 68,063.28 400.10M | 0.46% 310.99 |

| BKTi | 48,380.01 44.08M | 0.48% 231.57 |

| OGTi | 34,894.15 19.10M | 1.77% 607.29 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 88,350.00 | 88,545.00 87,125.00 | 790.00 0.90% |

| BRENT CRUDE | 61.77 | 61.84 60.95 | 0.28 0.46% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -0.10 -0.12% |

| ROTTERDAM COAL MONTHLY | 96.25 | 0.00 0.00 | -0.05 -0.05% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.36 | 58.45 57.60 | 0.28 0.48% |

| SUGAR #11 WORLD | 15.21 | 15.26 15.18 | -0.05 -0.33% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market