Pakistan’s September inflation expected at 3.5-4.5%

MG News | September 30, 2025 at 07:00 PM GMT+05:00

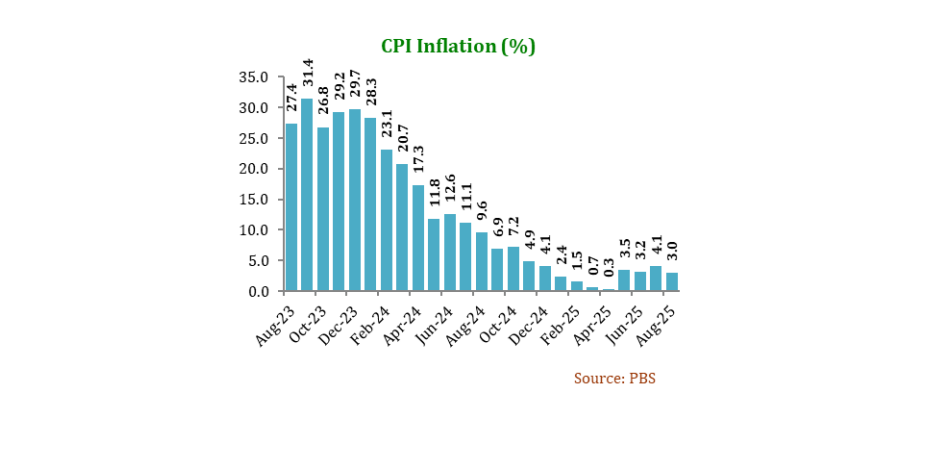

September 30, 2025 (MLN): Pakistan's inflation is

expected to rise temporarily but remain contained within the 3.5–4.5% range in

September 2025., according to

the Economic Update and Outlook by the Finance Division.

In August 2025, YoY

CPI inflation was recorded at 3%, compared to 9.6% in August 2024.

On an MoM basis, inflation declined by 0.6%, following a 2.9% increase in July and a 0.4% increase in August 2024.

Major contributing

factors to YoY inflation included Education (10.9%),

Health (10.6%), Clothing & Footwear (8.1%), Restaurants & Hotels

(7.2%), Housing, Water, Electricity, Gas & Fuels (3.6%), Furnishing &

Household Equipment Maintenance (3.5%), Alcoholic Beverages & Tobacco

(3.6%), Transport (2.5%), Non-Perishable Food (1.9%) and Communication (0.5%

Meanwhile, declines were observed in Perishable food items (21.6%) and Recreation & Culture (2.3%).

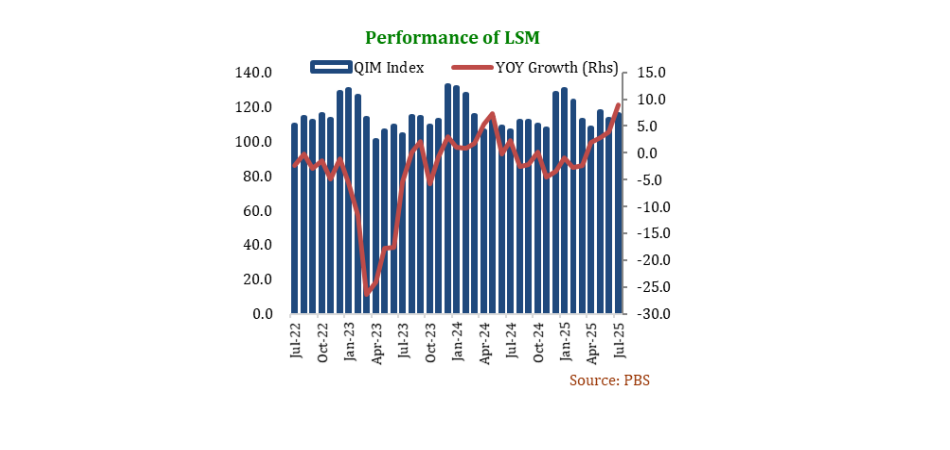

The outlook for Large Scale Manufacturing (LSM) in the coming months appears positive, supported by encouraging trends in high-frequency indicators such as cement dispatches and automobile sales.

LSM posted strong recovery, recording 9% YoY growth in July 2025 and 2.6% MoM growth.

Overall, 16 out of 22

sectors showed positive growth, including textiles, wearing apparel, coke &

petroleum products, non-metallic mineral products, and pharmaceuticals.

The automobile sector

performed exceptionally well during Jul–Aug FY2026, with production of cars up

100.9%, trucks & buses up 69.5%, and jeeps & pick-ups up 50.1%.

Cement dispatches

during Jul–Aug FY2026 totaled 7.84m tonnes, reflected 20.9% YoY growth. Domestic sales stood at 6.090mi

tonnes (+14.2%), while exports surged 51.3% to 1.75m tonnes.

During Kharif 2025 (Apr–Aug), urea offtake

reached 2.67m tonnes, up 12.4% from Kharif 2024, while DAP offtake stood at 552,000

tonnes, showing an increase of 8.7%.

During Jul–Aug FY2026, agricultural credit

disbursement increased by 19.5% to Rs404.2 bn compared to Rs338.2bn last year. Imports

of agricultural machinery and implements rose sharply by 66.7%, reaching $29.4m.

The ongoing 2025 floods are expected to

adversely impact the agriculture sector. The assessment of damages to Kharif

crops and livestock is underway, while the government has declared nationwide climate

and agriculture emergencies to address escalating challenges and support

affected farmers.

The Monetary Policy

Committee (MPC), in its meeting held on September 15, 2025, decided to keep the

policy rate unchanged at 11%.

Although inflation

remains moderate and high-frequency indicators show improvement, the MPC opted

for caution amid ongoing flood-related uncertainties.

During Jul 1–Aug 29

FY2026, money supply (M2) contracted by 2.3%, compared to a contraction of 2.5%

last year. Within M2, Net Foreign Assets (NFA) increased by Rs34.6 bn, while Net

Domestic Assets (NDA) declined by Rs990.0bn.

The government retired

Rs2,328.2bn in budgetary borrowing, against net borrowing of Rs733.3 bn last

year, while the private sector retired Rs214.8bn.

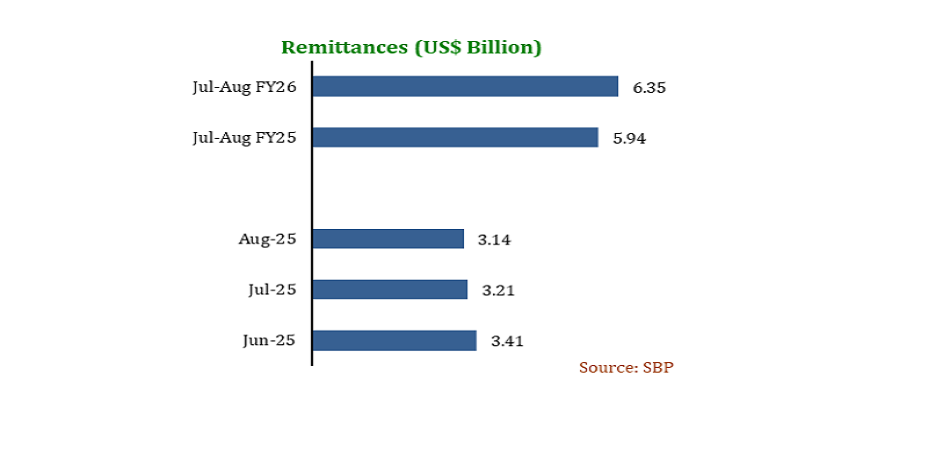

The current account posted a deficit of

$624m during Jul–Aug FY2026, compared to $430m recorded last year.

Remittances recorded an increase of 7%, reaching $6.4bn during the period, led by inflows from Saudi Arabia (24.6% share) and the UAE (20.6%).

Net FDI inflows stood at $364.3m, with

China contributing $120m and Hong Kong $60m.

According to the

Global Economic Outlook (GE0) of September 2025 Fitch Ratings , global growth

is expected at 2.4% in 2025 and 2.3% in 2026.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,165.00 | 68,625.00 65,685.00 | -130.00 -0.19% |

| BRENT CRUDE | 104.36 | 119.50 99.00 | 11.67 12.59% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 101.71 | 119.48 96.25 | 10.81 11.89% |

| SUGAR #11 WORLD | 14.30 | 14.48 14.25 | 0.20 1.42% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260126121902577_b63c19.webp?width=280&height=140&format=Webp)