PSX Closing Bell: Fading Out on Friday

MG News | October 24, 2025 at 05:06 PM GMT+05:00

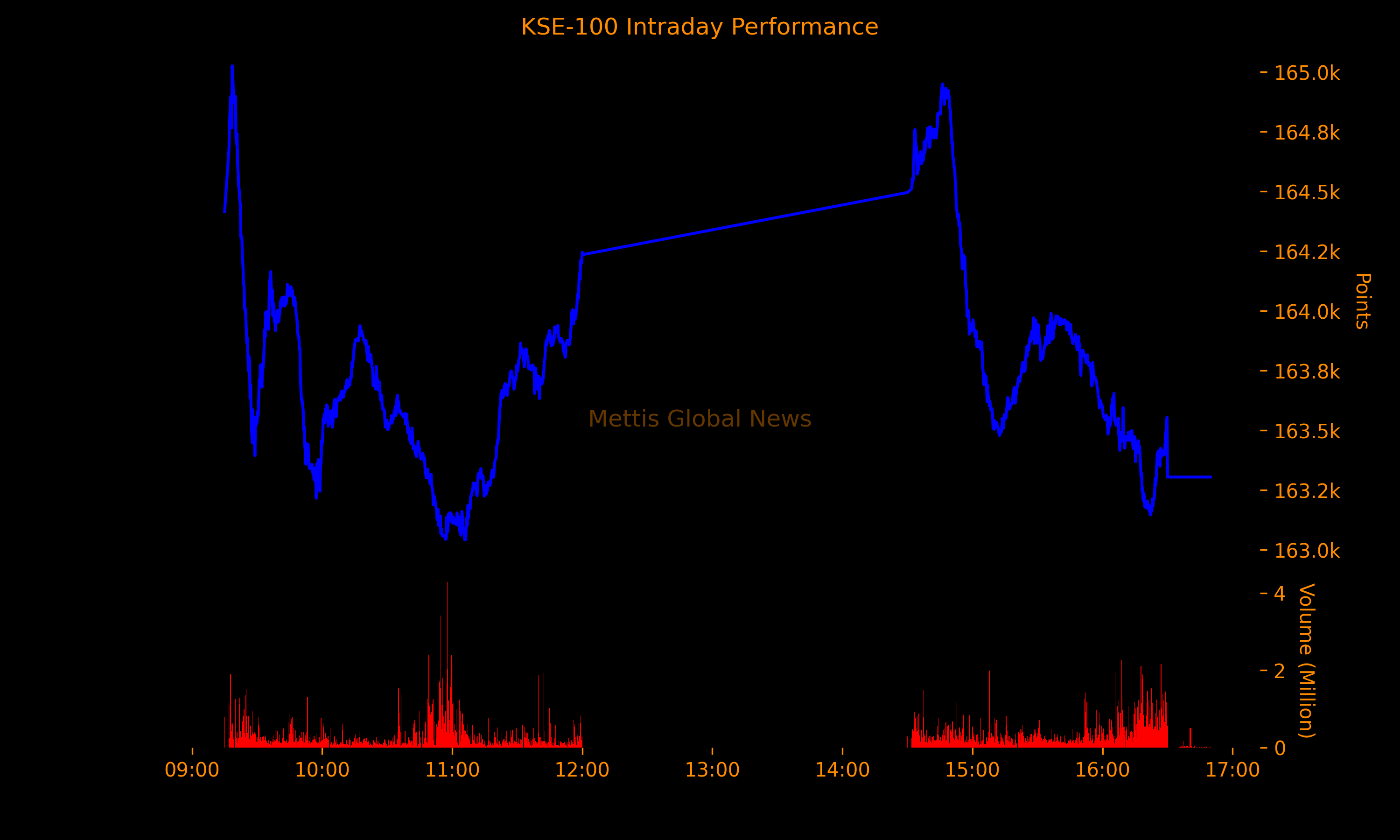

October 24, 2025 (MLN): The benchmark KSE-100 Index concluded Friday's trading session at 163,304.13, showing a decrease of 1,286.28 points or 0.78%.

The index traded in a range of 1,983.88 points showing an intraday high of 165,025.85 (+435.44) and a low of 163,041.97 (-1,548.44) points.

Market went red after NEPRA’s extensive revisions to K-Electric’s Multi-Year Tariff (MYT) for FY2024–30 drew sharp criticism from the utility’s CEO, Syed Moonis Abdullah Alvi, who termed the “large-scale reductions and modifications” as unsustainable for operations.

The development triggered a sell-off in K-Electric’s stock, which plunged 5.59%, leading the volume chart with over 109 million shares traded.

Adding to the pressure, weak corporate earnings further dampened investor confidence. Kot Addu Power Company Limited (KAPCO) reported a 99.6% year-on-year plunge in profit to just Rs4.88 million, while Bank Islami Pakistan Limited (BIPL) posted a 50% drop in nine-month earnings to Rs5.07 billion.

The total volume of the KSE-100 Index was 424.61 million shares.

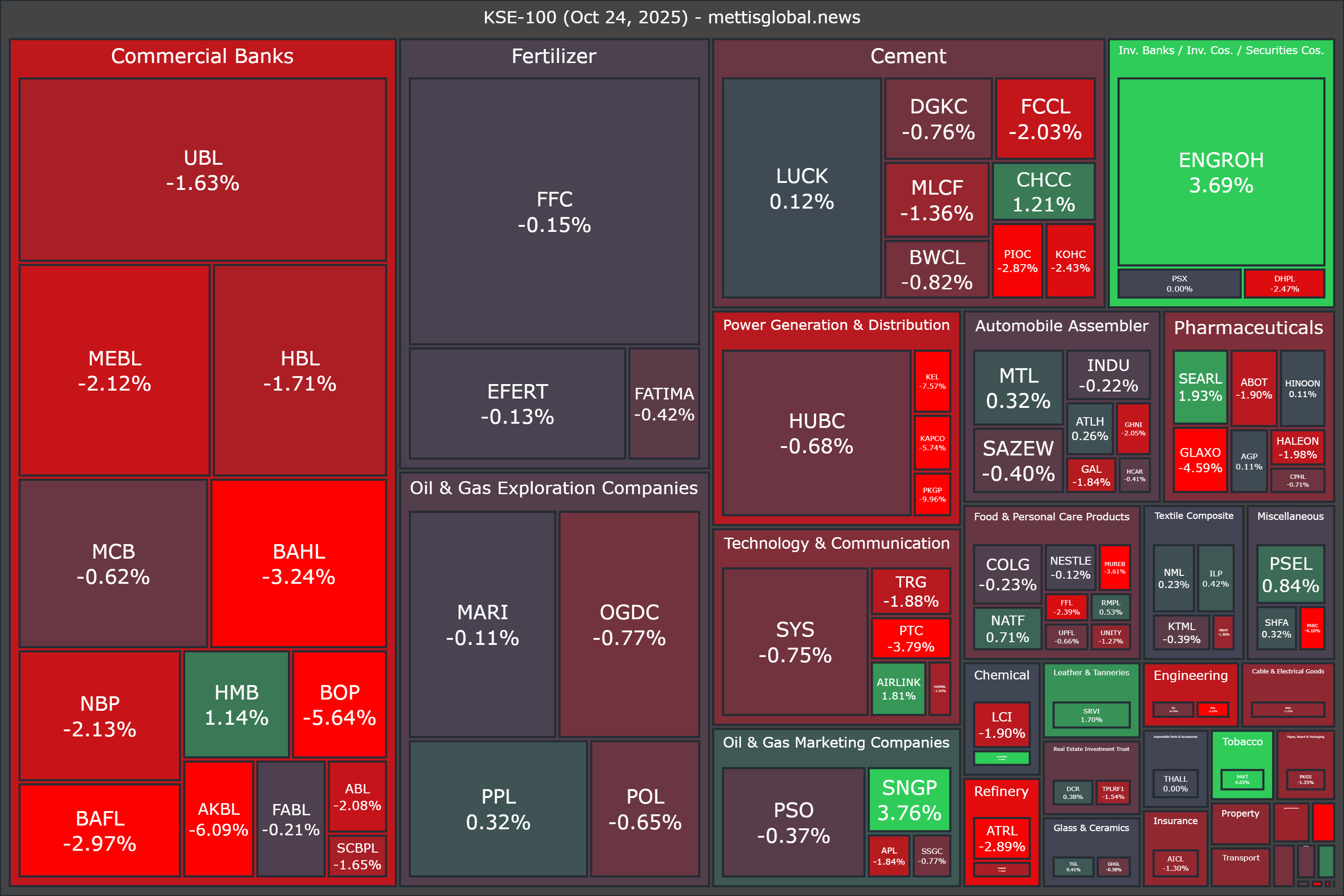

Of the 100 index companies 25 closed up, 73 closed down, while 2 were unchanged.

Top losers during the day were PKGP (-9.96%), KEL (-7.57%), AKBL (-6.09%), KAPCO (-5.74%), and BOP (-5.64%).

On the other hand, top gainers were LOTCHEM (+5.30%), PAKT (+4.03%), SNGP (+3.76%), ENGROH (+3.69%), and SEARL (+1.93%).

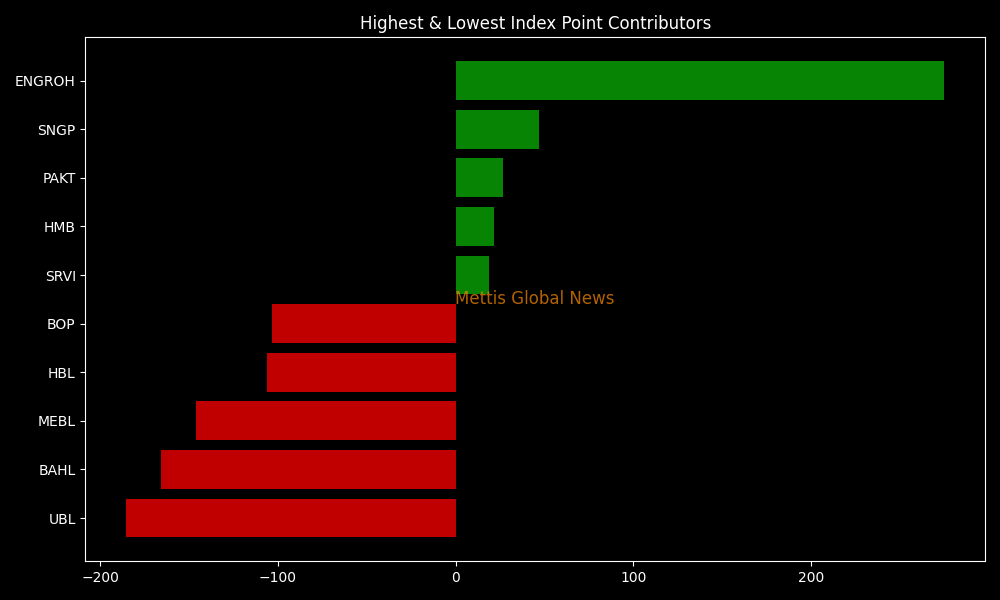

In terms of index-point contributions, companies that dragged the index lower were UBL (-185.37pts), BAHL (-166.12pts), MEBL (-146.15pts), HBL (-106.25pts), and BOP (-103.17pts).

Meanwhile, companies that added points to the index were ENGROH (+275.03pts), SNGP (+47.05pts), PAKT (+26.62pts), HMB (+21.82pts), and SRVI (+18.90pts).

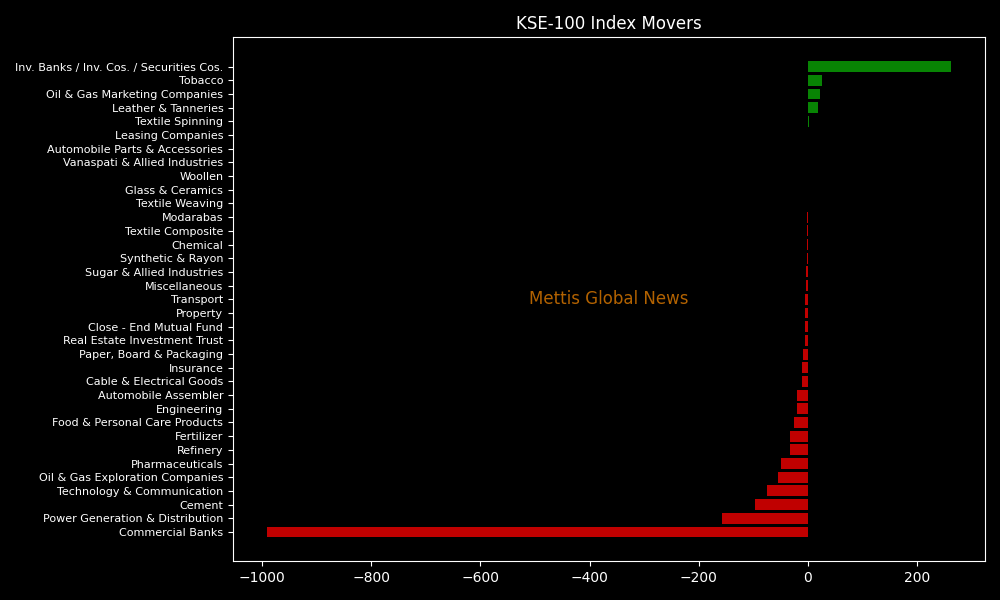

Sector-wise, KSE-100 Index was let down by Commercial Banks (-990.78pts), Power Generation & Distribution (-156.83pts), Cement (-97.21pts), Technology & Communication (-74.00pts), and Oil & Gas Exploration Companies (-54.89pts).

While the index was supported by Inv. Banks / Inv. Cos. / Securities Cos. (+261.94pts), Tobacco (+26.62pts), Oil & Gas Marketing Companies (+21.69pts), Leather & Tanneries (+18.90pts), and Textile Spinning (+1.29pts).

In the broader market, the All-Share Index closed at 51,718.76 with a net loss of 436.30 points or 0.84%.

Total market volume was 1,041.17 million shares compared to 1,504.58m from the previous session while traded value was recorded at Rs35.02 billion showing a decrease of Rs14.50bn.

There were 409,027 trades reported in 478 companies with 136 closing up, 300 closing down, and 42 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KEL | 5.62 | -7.57% | 194,902,598 |

| WTL | 1.96 | -6.22% | 97,551,530 |

| FCSC | 9.0 | -0.33% | 78,088,383 |

| BOP | 37.0 | -5.64% | 62,443,871 |

| TELE | 12.6 | -4.98% | 33,272,219 |

| FNEL | 14.75 | 9.99% | 29,300,149 |

| PACE | 21.48 | -2.45% | 28,501,915 |

| THCCL | 72.49 | -9.35% | 24,649,598 |

| TREET | 32.31 | -4.07% | 20,802,227 |

| PIBTL | 15.61 | -1.20% | 19,283,734 |

To note, the KSE-100 has gained 37,677 points or 29.99% during the fiscal year, whereas it has increased 48,177 points or 41.85% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes