Oil steady as OPEC+ pauses output hike

MG News | November 04, 2025 at 02:16 PM GMT+05:00

November 04, 2025 (MLN): Oil markets showed little movement on Tuesday as OPEC+ opted to pause production increases in the first quarter of 2026, keeping a close eye on global supply-demand dynamics.

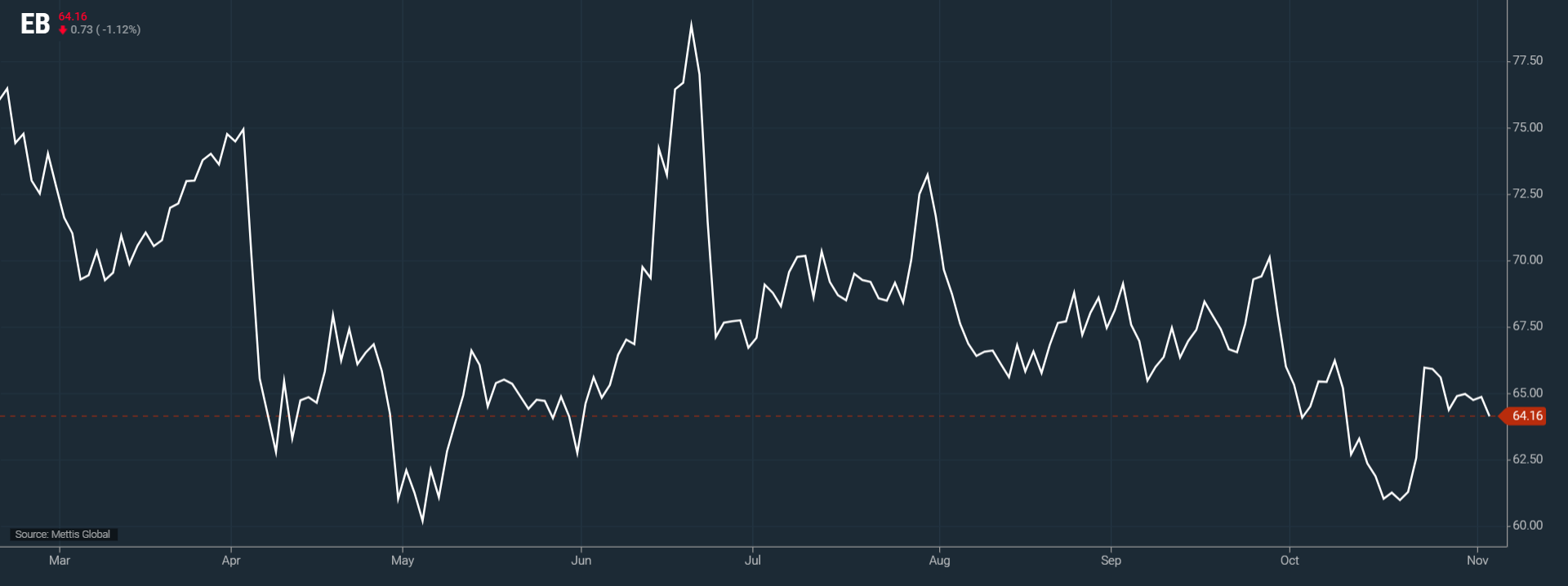

Brent crude futures went up by $0.73, or 1.12%, to $64.16

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.83, or 1.36%, to $60.22 per barrel by [2:15 am] PST.

On Sunday, the Organization of the Petroleum Exporting

Countries and its allies, collectively known as OPEC+, approved a modest output

increase for December but decided to maintain steady production levels in the

first quarter of next year.

Since April, OPEC+ has raised output targets by

approximately 2.9m barrels per day around 2.7% of global supply but slowed the

pace from October amid ongoing concerns of oversupply.

Bank of America analysts noted that the decision shows

OPEC+’s acknowledgment of potential oversupply and signals an attempt to

prevent oil prices from dropping below $50 per barrel, a threshold likely to

reassure investors.

Meanwhile, top executives from Europe’s leading energy

companies challenged predictions of a supply glut in 2026, citing rising demand

and easing production constraints.

U.S. Department of Energy Deputy Secretary James Danly also

dismissed fears of a surplus next year, suggesting a more balanced market

outlook.

Sources within OPEC+ indicated that Russia advocated for the

output pause, citing difficulties in boosting exports due to Western sanctions.

In October, the U.S. and the U.K. imposed restrictions on

Russia’s major oil firms, Rosneft and Lukoil. Despite these measures, JP Morgan

analysts stated that sanctions would not prevent Russian oil producers from

continuing operations, although they acknowledged an elevated risk of supply

disruption.

Traders are now awaiting U.S. crude inventory figures from

the American Petroleum Institute (API), expected later in the day, to gauge

near-term market trends.

Preliminary polling by Reuters suggests U.S. stockpiles may have increased last week, adding another layer of uncertainty for oil markets.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes