Oil prices edge up, Iran tensions ease

MG News | January 19, 2026 at 02:54 PM GMT+05:00

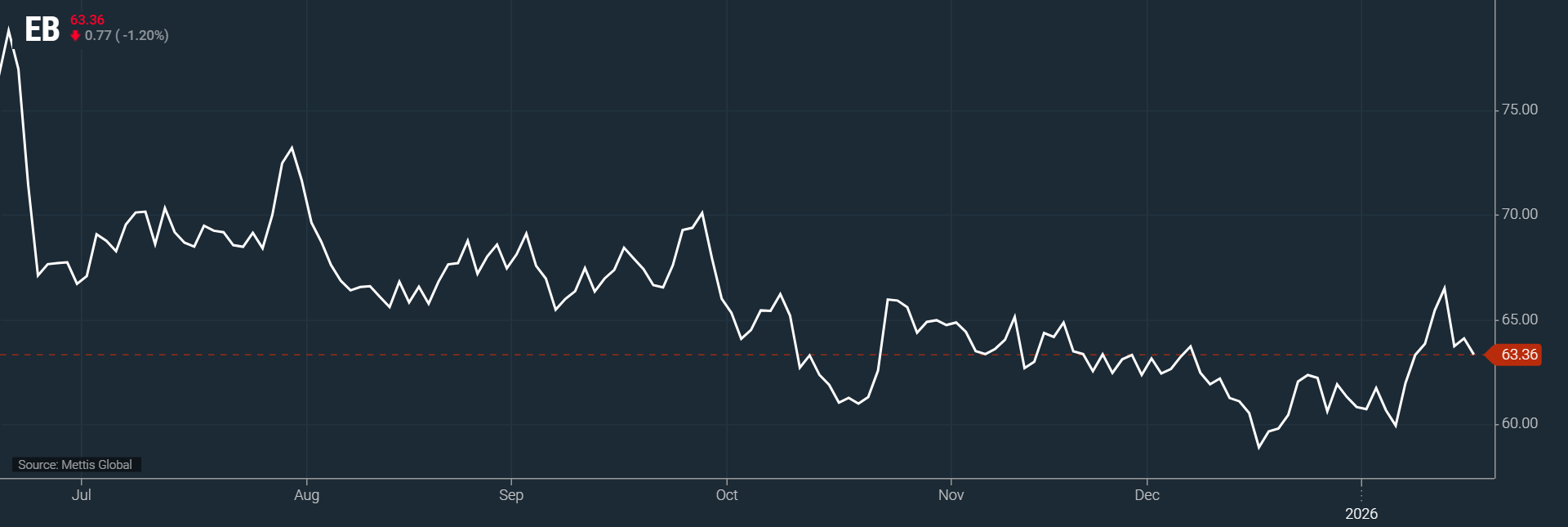

January 19, 2026 (MLN): Oil markets inched higher on Monday, following gains from the previous session, as violence in Iran subsided, reducing concerns over a potential U.S. strike on one of OPEC’s largest producers.

The calming of unrest in Iran eased fears of disruptions to

global oil supplies.

Brent crude futures rose by $0.77, or 1.20%, to settle at

$63.36 per barrel, according to Mettis Global data.

Meanwhile, West Texas Intermediate (WTI) futures advanced

$0.67, or 1.13%, to reach $58.77 per barrel by 2:50 pm PST.

Iran’s recent crackdown on protests, sparked by economic

hardship and reportedly resulting in thousands of deaths, has largely quelled

civil unrest.

This reduced the likelihood of immediate U.S. intervention,

which had previously posed a risk to oil flows from the Middle Eastern

producer.

The shift in risk perception followed statements from U.S.

leadership suggesting de-escalation in Iran, calming markets and prompting a

partial unwind of speculative pressure on crude prices, according to CNBC.

Market participants also reacted to U.S. crude stock data,

which revealed a significant inventory build of 3.4m barrels in the week ending

January 9 well above expectations. This increase reinforced near-term supply

pressures and tempered further price spikes.

Globally, traders are closely monitoring Venezuelan oil

production, where the U.S. is moving to expand operations in the country’s

underutilized fields. While this could support medium-term supply, immediate

output gains remain uncertain.

In Asia, China’s refinery throughput and crude output both hit record levels in 2025, showing strong demand and supporting global consumption fundamentals.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 187,761.69 450.87M | 1.44% 2662.86 |

| ALLSHR | 112,676.86 1,195.52M | 1.05% 1167.51 |

| KSE30 | 57,522.35 166.78M | 1.38% 784.61 |

| KMI30 | 264,743.45 175.88M | 1.48% 3870.74 |

| KMIALLSHR | 72,300.02 597.10M | 1.14% 811.71 |

| BKTi | 54,499.63 44.60M | 1.50% 808.03 |

| OGTi | 38,644.55 21.80M | -0.07% -27.90 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 93,095.00 | 95,600.00 92,040.00 | -2570.00 -2.69% |

| BRENT CRUDE | 63.66 | 64.39 63.26 | -0.47 -0.73% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.25 -2.53% |

| ROTTERDAM COAL MONTHLY | 97.90 | 0.00 0.00 | 0.15 0.15% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.90 | 59.56 58.53 | -0.44 -0.74% |

| SUGAR #11 WORLD | 14.99 | 15.00 14.60 | 0.42 2.88% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Summary of Foreign Investment in Pakistan

Summary of Foreign Investment in Pakistan