Monthly Review - Rupee Marches On

MG News | March 31, 2021 at 05:35 PM GMT+05:00

March 31, 2021 (MLN): After remaining largely calm for the past few months, the rupee-dollar parity recorded massive volatility during March as the local currency gained Rs5.3421 to close at Rs152.7586 on the 31st. This represented a 3.38% decline in dollar value compared to its closing value at the end of February.

The rupee continued its upward journey that started earlier in February, gaining Rs2.1219 against the greenback. Compared to the closing value of Rs166.7037 on March 31, 2020, the local currency has risen by a significant Rs13.9451.

March 2020 saw a polar opposite trend for the local currency as it lost Rs12.33 during the month. That was in the wake of the coronavirus which triggered an outflow of foreign investors from the capital markets, especially debt instruments.

The demand for dollars continues to be muted on account of third-wave concerns and curtailed international travel, as evidenced by services import under transport group plunging by 28% to $344.79 million during 7MFY21. Even health-related visits to foreign countries have taken a hit while the education-related appetite for the greenback has been impacted as well due to many universities going online.

On the other hand, supply-side dynamics are only getting more robust as the country raised $2.5 billion through Eurobonds just a day earlier. That came right after the International Monetary Fund disbursed a $499m tranche to the State Bank.

"The revival of the IMF program and the approval of $500 million by their board has lent support to the rupee. On top of that, inflows from other multilateral organizations, including $1.3 billion from the World Bank, have further improved the fundamentals," Malik Bostan, President of the Forex Association of Pakistan, had commented after March 30 closing. According to him, with demand for the greenback low, the exchange companies have added to the dollar supply and are depositing around $7-8 m a day into the interbank.

While healthy remittances in excess of $2bn have continued unabated throughout the fiscal year, of late they haven’t been enough to keep the current account in positive as it has been consistently registering deficits since December.

However, remittances have been breaching the $2bn mark for as many as nine months and the Roshan Digital Accounts were launched in September 2020 and started attracting inflows early on. So, it begs the question, what has fundamentally changed now compared to some months ago?

“The fundamentals are more or less the same as some months ago and there has been no change as such. That said, they are fairly strong: the imports are low, and inflows are coming in, creating an excess supply of dollars which has helped the rupee make gains,” said the Head of FX at an Islamic bank.

On whether this trend of rupee’s appreciation will last, the banker said: “As for sustainability, it's hard to tell but from the looks of it, the rupee seems poised to continue the upward trajectory unless there is a drastic change in supply-side or the SBP starts buying for example. With Ramazan just around the corner, we can expect this course to remain in place as inflows have traditionally been higher during the holy month.”

“The local currency is expected to trade around Rs151 by the end of April and may even hover in the range of Rs148-150 by the close of the fiscal year,” he added.

However, exporters aren’t pleased. The steep decline in dollar prices has made it difficult for them to do their costing. “There should be some stability in the exchange rate as movements of this sort make it impossible for us to plan ahead, especially when there hasn’t been any change in fundamentals as such,” commented Fawad Anwer, CEO of Al Karam Textiles.

With much of the current and coming months’ orders booked in advance, roughly 50% at a forward rate, the impact of the rupee’s appreciation is likely to be reflected in the exports data of the first quarter of FY22, he said. According to Anwer, textile proceeds can take a hit of even up to 20% if the parity stays put, citing the globally competitive nature of the sector.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,750.00 | 119,440.00 118,225.00 | 455.00 0.38% |

| BRENT CRUDE | 72.63 | 73.17 71.75 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.25 | 69.79 68.45 | 0.04 0.06% |

| SUGAR #11 WORLD | 16.42 | 16.58 16.40 | -0.17 -1.02% |

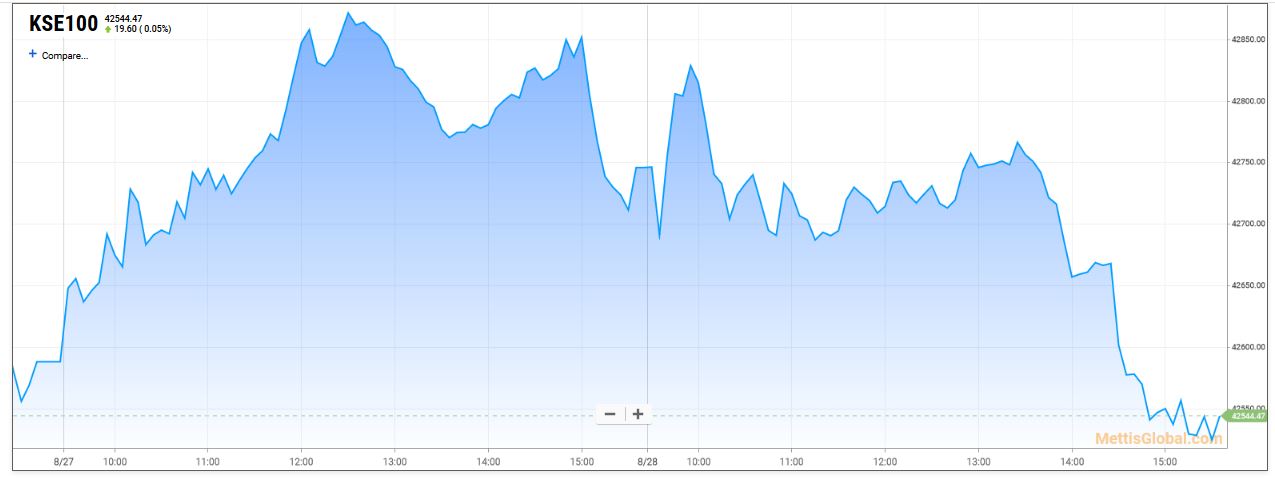

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|