LSE Financial, DCCL execute major capital revamp

Nilam Bano | December 02, 2025 at 01:19 PM GMT+05:00

December 02, 2025 (MLN): To streamline operations and unlock shareholder value, LSE Financial Services Limited (LSEFSL) and Digital Custodian Company Limited (DCCL) have executed a comprehensive "Scheme of Compromises, Arrangement and Reconstruction."

The restructuring follows a sanction by the Lahore High Court earlier in October and was formally communicated to the Pakistan Stock Exchange (PSX) today.

The scheme, certified by auditors Ilyas Saeed & Co., involves a complex set of manoeuvres designed to clean up balance sheets and redistribute assets directly to shareholders. The reconstruction focuses on four key pillars:

- Direct Asset Distribution: Shares of LSE Capital Limited (LSECL) currently held by DCCL and LSEFSL are being distributed directly to their respective shareholders.

- Unwinding Cross-Holdings: Shares of LSEFSL that were held by DCCL are also being distributed to DCCL shareholders.

- Liability Shift: Designated inter-company liabilities are moving from DCCL to LSEFSL.

- Capital Reduction: Both companies are seeing a reduction in their paid-up capital to reflect these transfers.

The most immediate impact for investors and analysts is the change in the capital structure. Both companies have effectively "slimmed down" their paid-up capital by roughly 24%.

| Metric | LSE Financial Services (LSEFSL) | Digital Custodian Company (DCCL) |

| Old Paid-up Shares | 35.67 Million | 52.26 Million |

| New Paid-up Shares | 27.00 Million | 40.00 Million |

| Capital Reduction | 24.32% | 23.47% |

| New Authorized Capital | 42.9 Million Shares | 129.0 Million Shares |

The "Scheme Effect" has significantly altered the asset base of both companies as of the sanction date, October 13, 2025:

LSEFSL: Total assets have adjusted from Rs 474 million down to Rs 333 million following the reconstruction.

DCCL: The company saw a sharper adjustment, with total assets moving from Rs 674 million to Rs 445 million.

Notably, DCCL shed significant liabilities, transferring Rs 37.2 million in trade and other payables out of its books, resulting in a leaner current liability profile of just Rs 10 million post-scheme.

Meanwhile, LSEFSL has absorbed new obligations, with its trade and other payables rising to Rs 47.5 million.

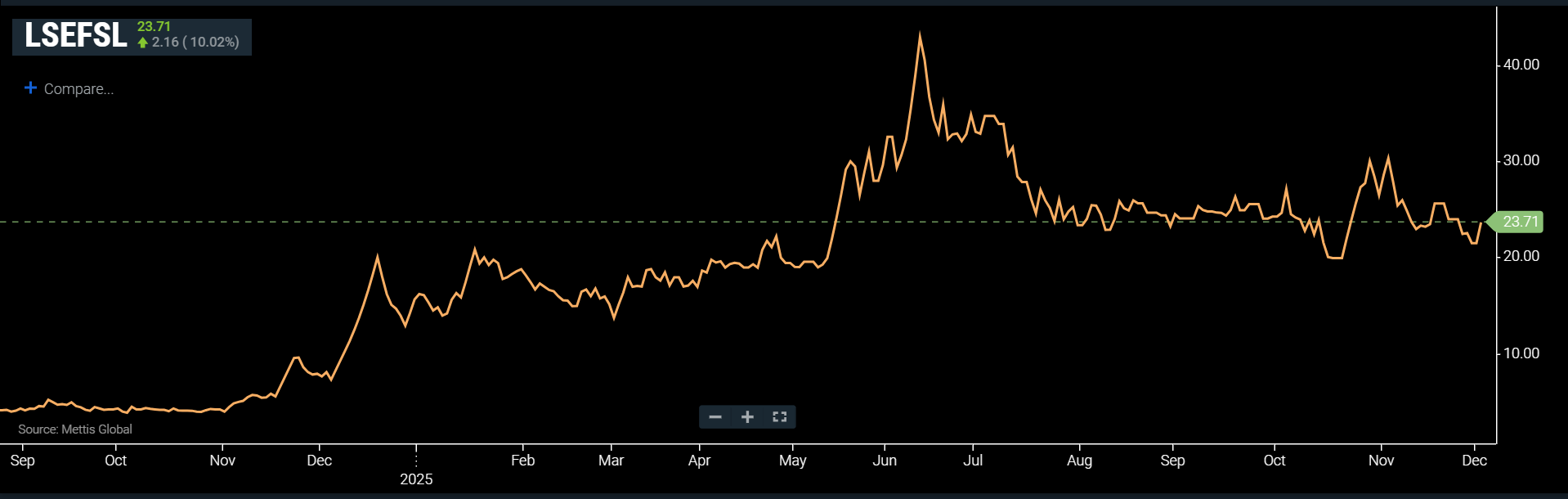

At the time of writing, the share of LSEFSL is being traded at Rs. 23.71, up Rs. 2.16 or 10.02%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,383.14 194.76M | 0.19% 320.94 |

| ALLSHR | 101,509.81 521.81M | 0.32% 324.61 |

| KSE30 | 51,255.49 84.66M | 0.09% 45.81 |

| KMI30 | 241,819.91 69.25M | 0.03% 74.44 |

| KMIALLSHR | 66,278.72 231.44M | 0.22% 145.30 |

| BKTi | 45,577.64 27.30M | 0.43% 194.51 |

| OGTi | 33,282.89 9.86M | -0.29% -95.46 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,355.00 | 87,675.00 86,500.00 | 1595.00 1.86% |

| BRENT CRUDE | 63.18 | 63.35 63.05 | 0.01 0.02% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.10 1.22% |

| ROTTERDAM COAL MONTHLY | 97.55 | 97.70 97.35 | -1.10 -1.12% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.38 | 59.67 59.26 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.74 | 15.20 14.73 | -0.47 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance