KSE-100 slips amid NEPRA tariff, weak earnings & rollover pressure

MG News | October 24, 2025 at 11:33 AM GMT+05:00

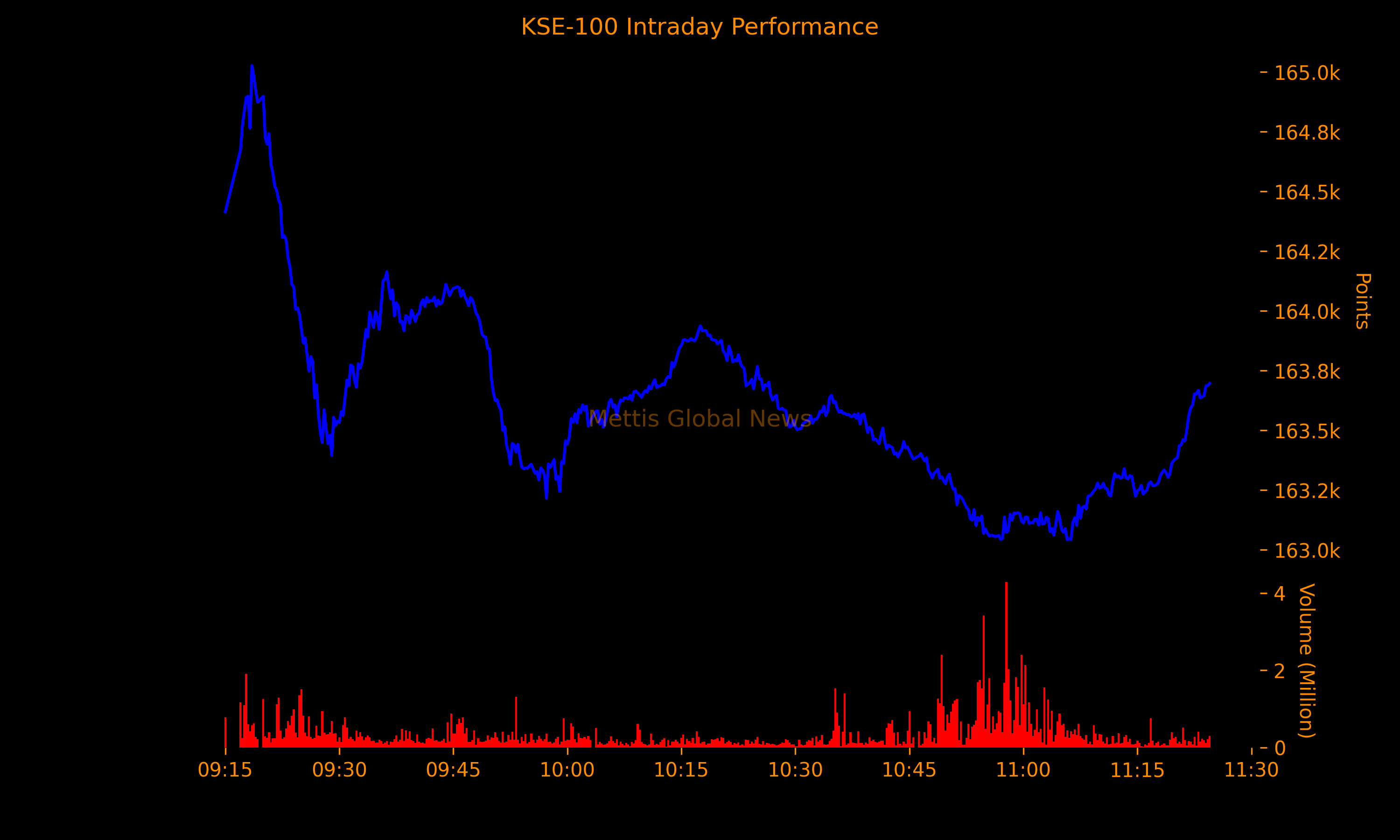

October 24, 2025 (MLN): The benchmark KSE-100 Index continued to trade in the red as of 11:25 am today, falling by 914 points or 0.56% to stand around 163,675.96, as investor sentiment weakened amid regulatory and corporate headwinds.

The index touched an intraday low of 163,045 points at 11:06 am, marking a decline of 1,548 points or 0.94%, reflecting persistent selling pressure across major sectors.

Market activity turned cautious after NEPRA’s extensive revisions to K-Electric’s Multi-Year Tariff (MYT) for FY2024–30 drew sharp criticism from the utility’s CEO, Syed Moonis Abdullah Alvi, who termed the “large-scale reductions and modifications” as unsustainable for operations.

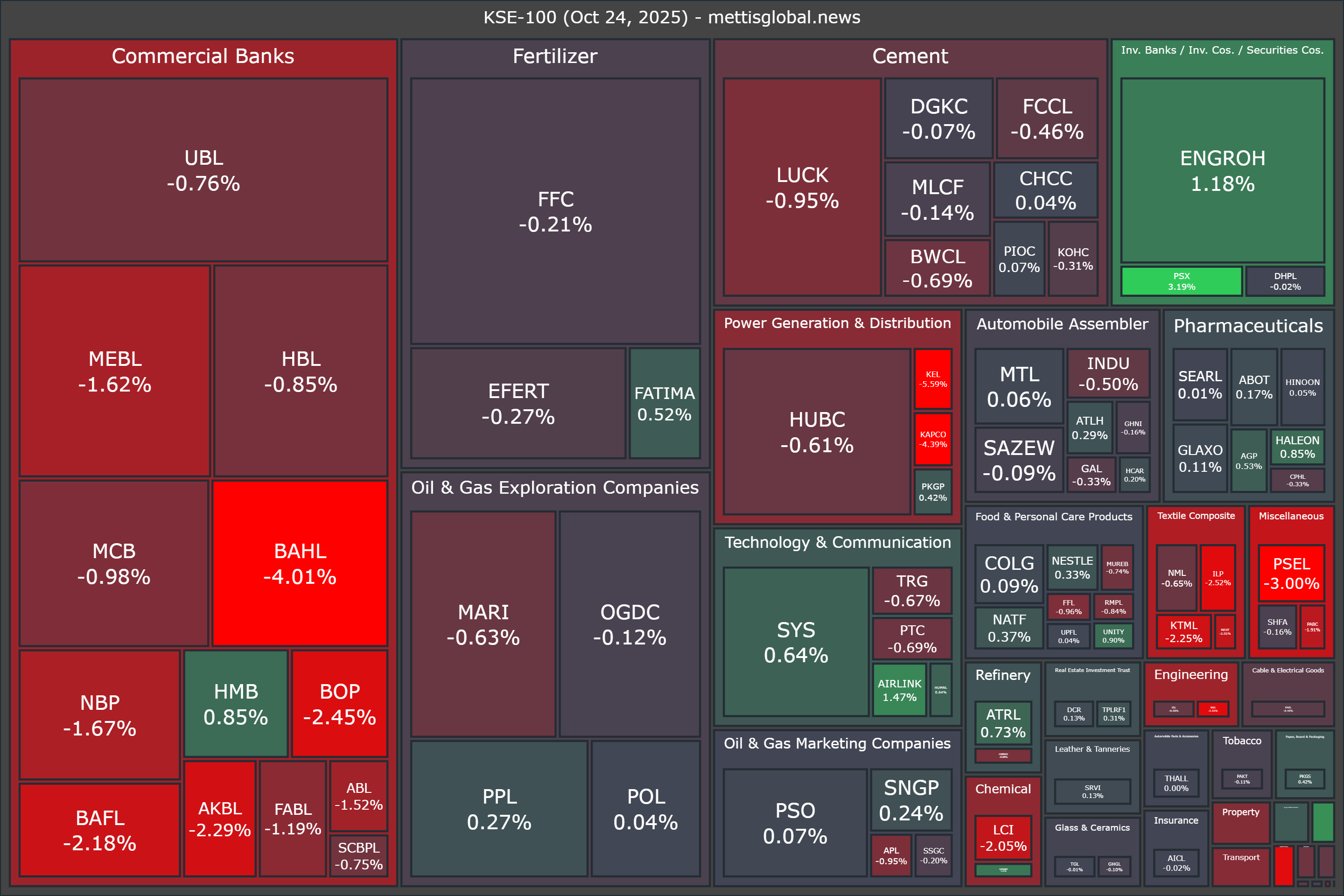

The development triggered a sell-off in K-Electric’s stock, which plunged 5.59%, leading the volume chart with over 109 million shares traded.

Adding to the pressure, weak corporate earnings further dampened investor confidence. Kot Addu Power Company Limited (KAPCO) reported a 99.6% year-on-year plunge in profit to just Rs4.88 million, while Bank Islami Pakistan Limited (BIPL) posted a 50% drop in nine-month earnings to Rs5.07 billion.

Selling was pronounced in the banking, power, and cement sectors, with major draggers including BAHL (-4.01%), MEBL, UBL, LUCK, and NBP. Meanwhile, PSX Limited (+3.19%), EngroH, and Airlink provided limited upside support.

Total market turnover stood at 416 million shares with a traded value of Rs11.65 billion, sharply lower compared to the previous session.

Analysts attribute the decline to a mix of profit-taking, disappointing earnings, and regulatory uncertainty following the revised KE tariff, as investors adopt a cautious stance ahead of rollover week.

At current levels, the KSE-100 remains up over 30% in FY25 and 42% in CY25, despite the ongoing correction.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes