KOHC to commission 28.5MW captive power plant by FY26

MG News | November 12, 2025 at 10:18 AM GMT+05:00

November 12, 2025 (MLN): Kohat Cement Company Limited

(PSX:KOHC) is set to commission a 28.5MW coal-fired captive power plant by the end

of FY26, with contractors already engaged and total project cost estimated at Rs8

billion.

This addition aims to enhance operational efficiency and

reduce dependency on the national grid, highlighted in the company’s corporate

briefing.

Alongside, KOHC has already installed a 15.3MW solar power

plant and plans to expand solar capacity to 20MW, strengthening its renewable

energy footprint.

Management also shared that development work is ongoing at

its Greenfield Cement Line in Khushab, with plant and machinery procurement

contingent upon a sustained improvement in domestic cement demand and economic

stability.

The company expects the cement industry to post double-digit

growth in FY26, supported by a low base effect, improved macroeconomic

indicators, and a revival in private construction activity.

In terms of energy efficiency, KOHC continues to maintain

one of the lowest power costs in the North region. The company’s average power

cost stood at Rs23/kWh in FY25, down from Rs28/kWh a year earlier, reflecting

lower reliance on the grid and increased use of waste heat recovery (WHR) and

solar energy.

The company’s fuel mix in FY25 included 49% local and 51%

imported coal, averaging Rs 40.6k/ton, while the current inventory is valued

around Rs41–42k/ton.

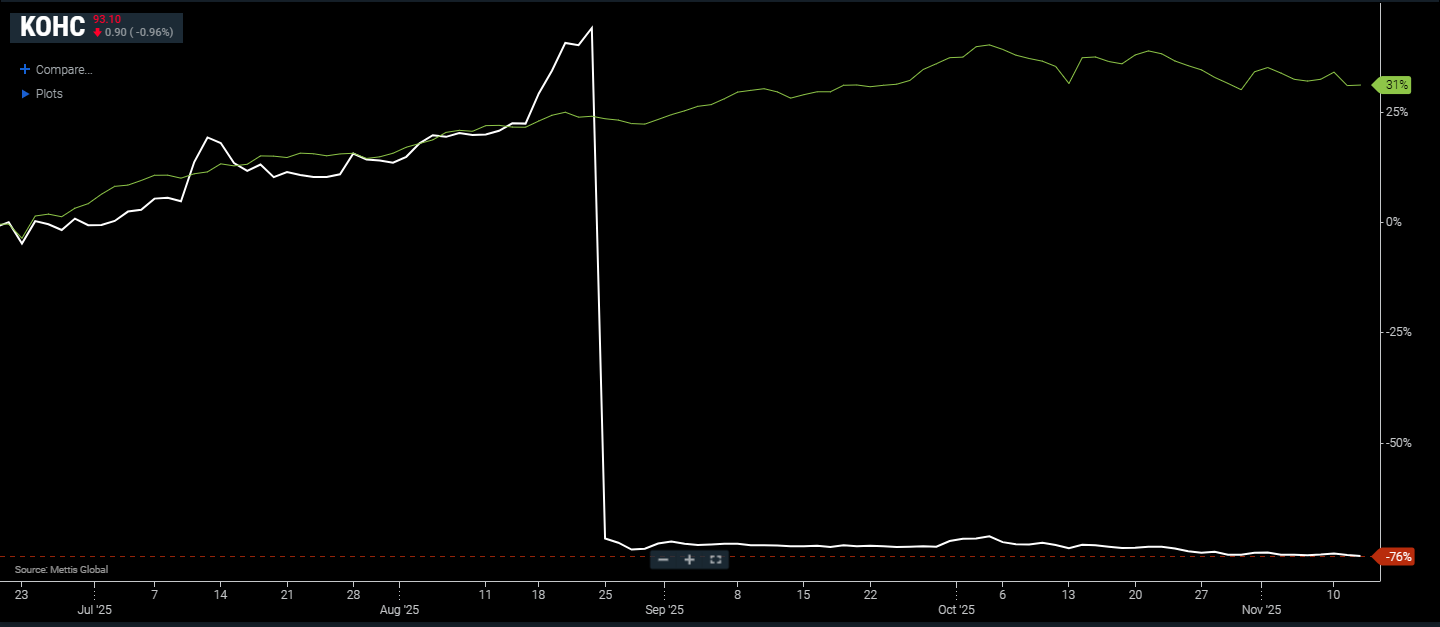

Financially, the company reported strong profitability in

FY25, with earnings rising 30% YoY to Rs11.6 bn (EPS: Rs12.6) compared to Rs8.9

bn (EPS: Rs9.7) in FY24, mainly due to improved margins and higher other

income.

Despite a 3% YoY decline in sales to Rs37.5 bn on lower

offtakes, profitability was supported by an 8% YoY increase in retention prices

to Rs16,121/ton and a reduction in COGS/ton to PKR 9,798.

In 1QFY26, earnings stood at Rs2.9 bn (EPS: Rs3.2)

versus Rs3.4 bn (EPS: Rs3.51) in the same period last year, as declining

retention prices offset higher dispatches.

With a robust balance sheet, strategic energy

diversification, and ongoing capacity enhancements, KOHC is well-positioned to

sustain profitability and capitalize on the expected recovery in cement demand

during FY26.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,535.00 | 74,365.00 67,615.00 | 5070.00 7.41% |

| BRENT CRUDE | 81.70 | 84.48 80.30 | 0.30 0.37% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 75.27 | 77.23 73.28 | 0.71 0.95% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction