Is it over for Bitcoin? From $126K to crisis mode

Hayyan Mansuri | February 04, 2026 at 01:20 PM GMT+05:00

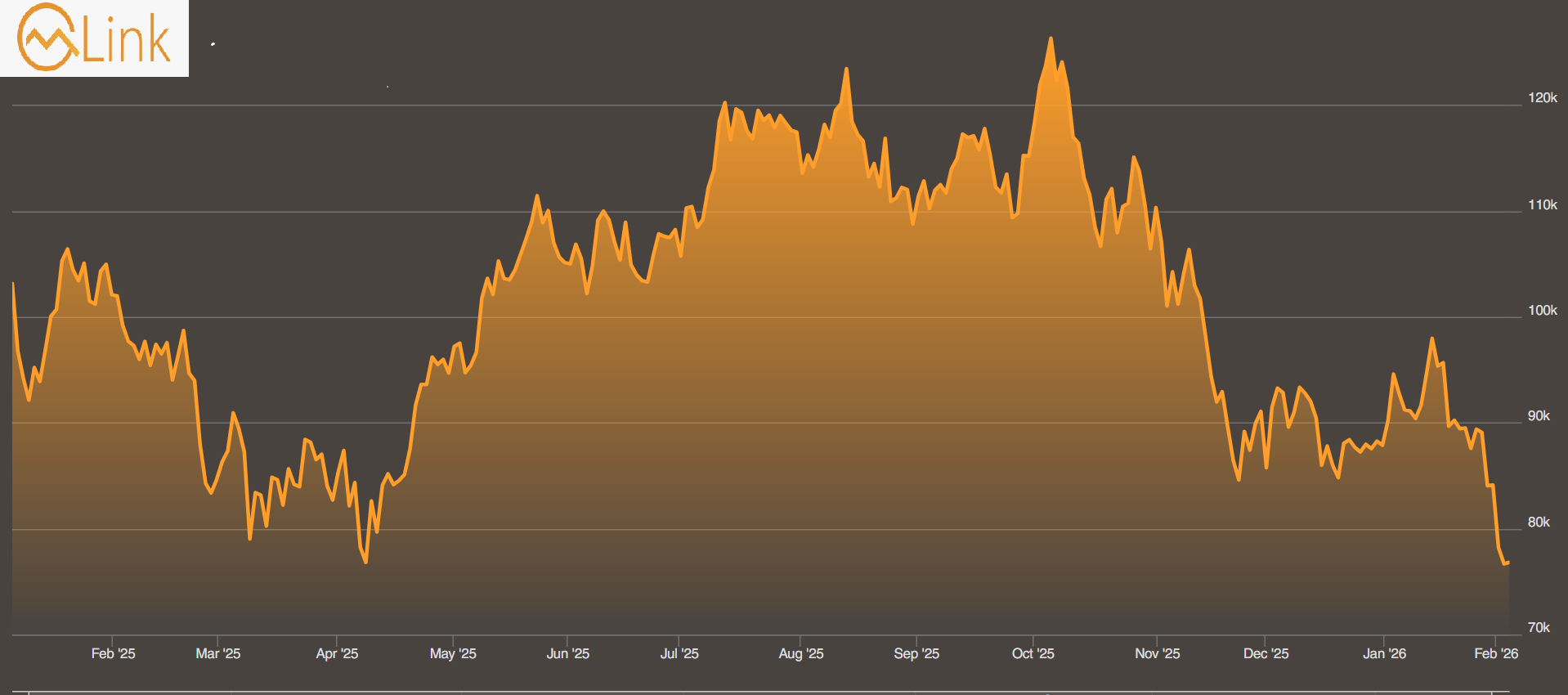

February 04, 2026 (MLN): Bitcoin was once digital gold. Now narratives are shifting faster than the price which, for context, has crashed 41% from $126,000 to $75,000 in four months.

Remember when it was the "safe haven" of the future?

Well, now that actual gold is surging while Bitcoin collapses, it's

suddenly a "risk asset."

The sharp downturn appears driven by escalating geopolitical tensions and a significant shift in safe-haven asset preferences.

In February 2025, Bitcoin was trading around $100,000, but by February 2026, it had fallen to approximately $75,000 a decline of about 25%.

Bitcoin Price Chart (Feb 25-Feb 26)

Notably, the selloff coincides with robust rallies in

traditional precious metals both gold and silver are posting substantial gains

as investors flee digital currencies in favor of time-tested stores of value.

The irony is unmistakable bitcoin, once hailed as the future

of money, is being abandoned for ancient metals as both gold and silver have

shown yearly gains of around 75% and 170% respectively.

What makes this collapse particularly striking is its

timing. Just over a year ago, when Donald Trump secured his return to the White

House in January 2025, cryptocurrency enthusiasts had every reason to

celebrate.

The incoming administration's pro-digital asset stance

promised a golden era for Bitcoin and its peers.

On March 6, 2025, Trump made good on that promise, signing an

executive order that established a Strategic Bitcoin Reserve. It was an

unprecedented move, one that granted governmental legitimacy to an asset class

that had long operated on the fringes of traditional finance.

This anchored prices near the $90,000 threshold and set the

stage for what would become a historic rally.

Combined with monetary easing from the Federal Reserve

through interest rate reductions, conditions appeared perfect for a sustained

surge.

Market momentum built throughout 2025, culminating in Bitcoin's historic climb to $126,198 on October 6.

The surge was driven by a confluence of factors a US government shutdown that pushed investors toward alternative assets, strong market momentum across the crypto sector, and the Trump administration's increasingly favorable stance on digital currencies.

Traders celebrated what seemed like validation of cryptocurrency's role as a

mainstream investment vehicle.

But the euphoria proved short-lived.

Rising geopolitical tensions across multiple fronts sent investors scrambling for traditional safe havens.

The situation deteriorated sharply in January, when President Trump announced Kevin Warsh as his choice to head the Federal Reserve, with tech sell offs also adding fuel to the fire.

The nomination sent shockwaves through

digital asset markets. Bitcoin, which had been holding near $89,000, quickly

tumbled into the above $70,000 range as investors rushed for the exits.

As prices crumbled, market analysts began issuing dire warnings.

Mike McGlone, who serves as senior macro strategist at Bloomberg, delivered a particularly grim projection in late 2025: he anticipates Bitcoin will sink to $50,000 before 2026 concludes, with an eventual destination of just $10,000.

Such forecasts, once dismissed as extreme, are gaining traction

as the selloff intensifies and broader financial markets show signs of stress.

The State of Crypto report notes that the cryptocurrency's well-known four-year halving cycle which historically triggered predictable boom-and-bust sequences is losing relevance as the asset evolves.

With annual supply growth now falling below 1%, actually lower than gold's inflation rate, Bitcoin appears to be shifting from speculative investment toward something resembling a macro-economic hedge.

This maturation process could mean less

dramatic price swings, but also potentially lower returns than early investors

experienced.

The question facing the market is whether this represents healthy evolution or the beginning of a prolonged decline.

As institutional

adoption grows and regulatory frameworks solidify, Bitcoin's wild west days may

indeed be over but whether that's bullish or bearish remains hotly debated.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market