Gold shatter records amid U.S-China trade clash

MG News | October 13, 2025 at 12:13 PM GMT+05:00

October 13, 2025 (MLN): Gold prices soared

to higher levels on Monday as investors flocked to safe-haven assets following

escalating trade frictions between the United States and China.

Silver also surged to a record high, bolstered by similar drivers and tightening market conditions.

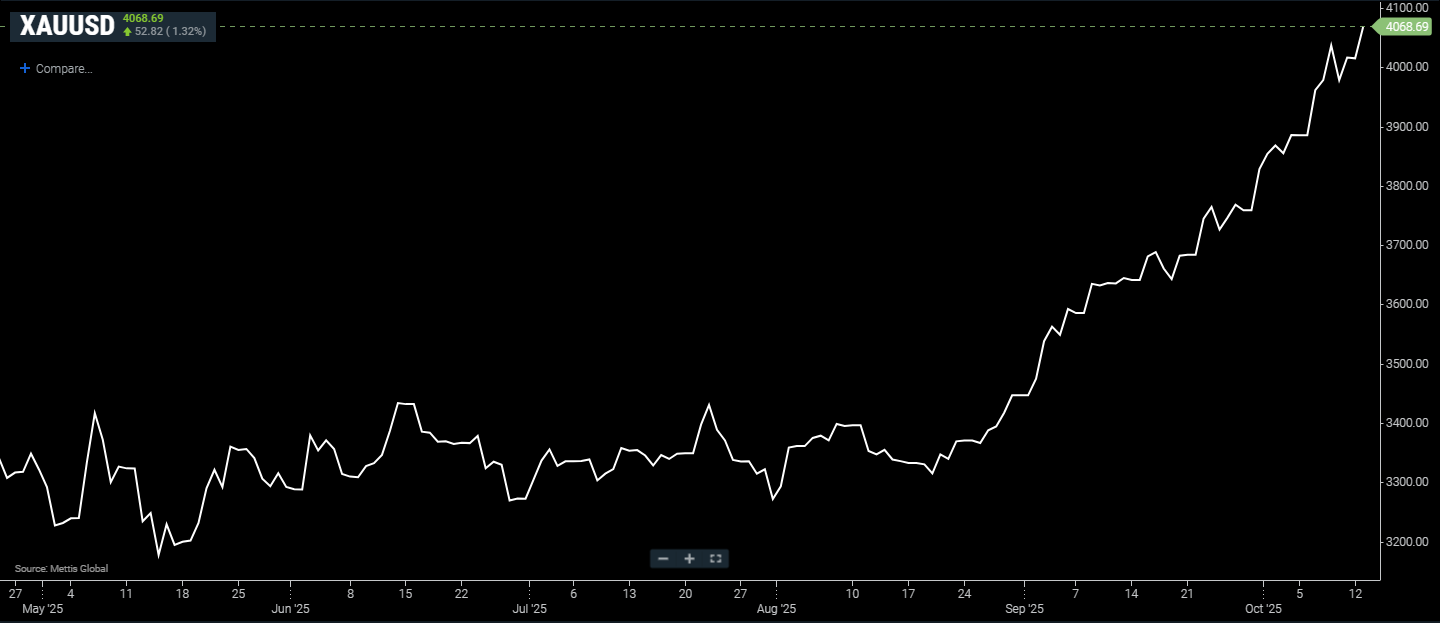

Spot gold was up 1.32%% at $4,068.69 an ounce as of [12:10 pm] PST, according to data reported by Mettis Global.

Benchmark U.S. gold futures for

December delivery climbed 2.3% to $4,093.50 per ounce, while spot silver

advanced 2.7% to an all-time peak of $51.70.

The rally came after President Donald

Trump threatened to impose 100% tariffs on Chinese imports and declared new

export controls on critical software, set to take effect November 1.

The move was a response to Beijing’s

restrictions on rare earth elements and equipment a policy China defended as

reasonable, though it refrained from implementing additional countermeasures.

Goldman Sachs noted that silver prices

could continue rising in the medium term, supported by private investment

inflows. However, the bank cautioned that silver remains more exposed to

short-term volatility and downside risk than gold.

Non-yielding gold has gained roughly

53% so far this year, propelled by geopolitical uncertainty, robust central

bank purchases, surging ETF inflows, and mounting expectations of Fed rate

cuts.

Market participants are currently

betting on a near-certain 25-basis-point reduction in October, followed by

another in December.

Fed Chair Jerome Powell is slated to

speak at the National Association for Business Economics (NABE) annual meeting

on Tuesday, with markets watching closely for new policy signals.

Several other Fed officials are also

scheduled to deliver remarks later in the week.

Meanwhile, President Trump attributed

his decision to lay off thousands of federal workers during the ongoing

government shutdown now stretching into its second week to congressional

Democrats.

The shutdown, which began on October

1, has delayed the release of key economic data.

On the geopolitical stage, Trump and

other global leaders are convening in Egypt on Monday to discuss potential

ceasefire measures for Gaza.

Among other precious metals, platinum rose 2.9% to $1,635.35 per ounce, while palladium advanced 3.6% to $1,452.50.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes