From Debt to Shared Destiny

Riaz Andy | November 09, 2025 at 01:17 AM GMT+05:00

November 09, 2025 (MLN): President Trump’s attempt to redraw the global economic order through tariffs, trade realignments, and tighter capital flows may seem disruptive, but it follows an old pattern.

Throughout history, civilizations have intervened when debt threatened to consume the very people it was meant to empower.

The Code of Hammurabi capped interest and allowed debt relief; Solon’s 'shaking off of burdens' in Athens canceled debts to restore balance; and the Torah called for a Sabbatical Year to release debtors. This is a self-correcting phenomenon, which is once again in motion.

Across civilizations, debt was a moral relationship, a bond of trust, not merely a financial instrument. This balance began to shift after the Renaissance, when the Medici banks of Florence monetized trust, turning personal credibility into a tradable asset.

In 1694, with the founding of the Bank of England to finance

wars, the world’s first national debt was born. A promise to repay was no

longer personal. It had become institutional. Debt was no longer just a tool of

survival; it had become a tool of statecraft.

From 1694 onward, debt and power became inseparable. The ability to borrow fueled Britain’s expansion, Europe’s wars, and the Industrial Revolution.

Nations with central banks could wage war, build infrastructure, and project influence far beyond their means. By the end of the Second World War, global finance had evolved into a system where debt no longer followed production.

The promise to repay

had transformed into a grow forever.

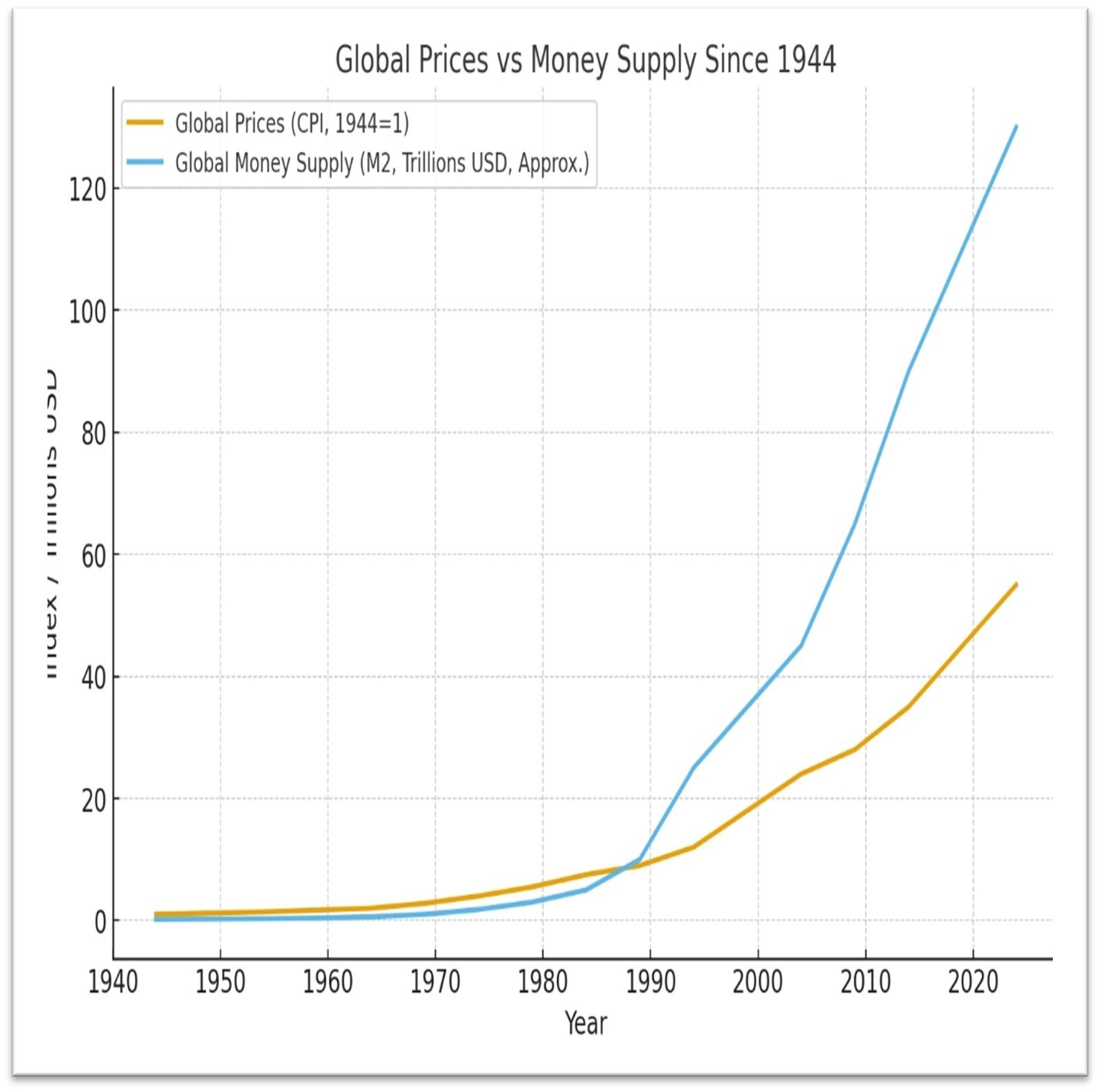

The United States emerged as the engine of global growth after the Second World War. The Bretton Woods Agreement established a new order centered on the U.S. dollar. Credit was extended to rebuild the shattered world and to anchor global currencies to the dollar, which was backed by gold.

However, the system required constant

adjustments. When President Nixon ended the gold standard in 1971, he removed

the final curb on credit, ushering in a new era of boundless money.

That era produced both growth and fragility. Paul Volcker inherited inflation fueled by cheap post-war credit.

To restore credibility, he sharply raised interest rates, taming inflation but triggering global recessions and debt crises.

His successor, Alan

Greenspan, reversed the course. Deregulation and low interest rates turned

credit into a growth model. The world prospered, but each boom brought a deeper

bust.

The 2008 financial crisis exposed the system’s fragility, and Bernanke responded with Quantitative Easing. Central banks created trillions to buy bonds and rescue markets. QE prevented sovereign collapse but entrenched a dependency on cheap money.

The

pandemic prompted another wave of liquidity, which was followed by mounting

inflation. In response, the Federal Reserve adopted Volcker-like policies,

producing effects similar to those seen before Greenspan’s era.

It is no coincidence that Bitcoin emerged soon after the 2008 financial crisis, the first decentralized response to a system dominated by centralized authority and excess.

Since then, blockchain, tokenization, and

decentralized finance (DeFi) have sought to answer an age-old question through

new code. Can we build a financial system rooted in shared verification rather

than hierarchical control?

J. Scott Davis of the Federal Reserve Bank of Dallas

highlighted that when nations grow through debt inflows, they tend to

experience short-lived booms followed by inflationary cycles. In contrast,

capital invested as equity fosters sustainable growth and financial stability.

In the end, Islam’s prohibition of interest is not merely a religious injunction. It is guidance from the Creator of all beings for a better future.

Growing gradually, likely to achieve greater equality and

sustainability. Therefore, we must redefine finance. The next financial age

cannot rest on promises to repay, but it must rest on promises to share.

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,496.10 196.19M | -2.30% -3714.58 |

| ALLSHR | 94,227.01 359.74M | -1.95% -1870.28 |

| KSE30 | 48,330.20 95.67M | -2.92% -1451.54 |

| KMI30 | 224,687.33 101.59M | -2.56% -5909.78 |

| KMIALLSHR | 60,839.09 199.88M | -2.16% -1344.18 |

| BKTi | 45,489.96 23.93M | -2.22% -1033.26 |

| OGTi | 32,083.47 15.22M | -1.82% -594.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,400.00 | 71,645.00 67,860.00 | -3130.00 -4.38% |

| BRENT CRUDE | 93.32 | 94.64 83.16 | 7.91 9.26% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 129.00 123.00 | 3.55 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 91.27 | 92.61 78.24 | 10.26 12.67% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes