Euro zone bond yields stabilise; markets focus on ECB policy hints

MG News | March 03, 2021 at 02:17 PM GMT+05:00

March 3, 2021: Euro zone government bond yields were little changed on Wednesday, as the market calmed after its recent yield spike and market participants focused on comments from European Central Bank policymakers.

Bets that the U.S. stimulus would boost inflation and growth pushed yields higher last week, but markets changed course on Monday, with bonds rallying.

The German 10-year Bund yield was flat on Wednesday, at -0.344% at 0822 GMT, around 14 basis points below its Feb. 26 spike of -0.203%.

"Markets seem to be establishing an equilibrium below the -0.30% level in 10y Bund yields. This stabilization is being accompanied by a notable - and welcome - drop in intra-day volatility as well as an ongoing outperformance vs. USTs," Commerzbank's head of interest rates strategy, Michael Leister, wrote in a note to clients.

European Central Bank policymaker Fabio Panetta said that the ECB should "not hesitate" to increase the volume of its bond-buying to rein in yields.

Striking a dovish tone, Panetta argued that the risk of providing too little policy support far outweighed the risk of doing too much.

Market participants are waiting for further hints from ECB policymakers who are due to speak today, before the quiet period, in which they will avoid making comments that could influence expectations before its monetary policy meeting on March 11.

Elsewhere, Italy is expected to launch its first-ever green BTP, which will expire in April 2045. The proceeds of the bond will finance environmental projects.

At 0825 GMT, Italy's 10-year yield was down around one basis point on the day at 0.675%.

The spread between Italian and German 10-year yields narrowed, to 101.3 bps.

Euro zone PMI services data for February is due at 0900 GMT.

German Chancellor Angela Merkel is expected to agree to a gradual relaxation of coronavirus curbs with regional leaders, but the rules can be tightened again if infections jump, according to draft plans seen by Reuters.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,915.00 | 119,740.00 116,460.00 | -1380.00 -1.17% |

| BRENT CRUDE | 73.38 | 73.63 71.75 | 0.87 1.20% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.22 | 70.51 68.45 | 1.01 1.46% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

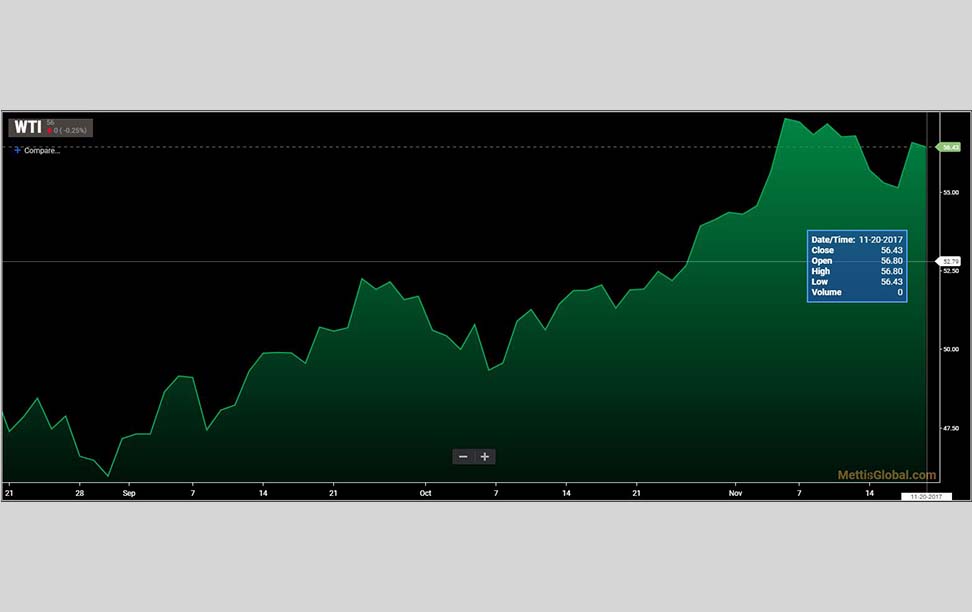

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|