Weekly Market Roundup

Nilam Bano | January 25, 2025 at 06:17 PM GMT+05:00

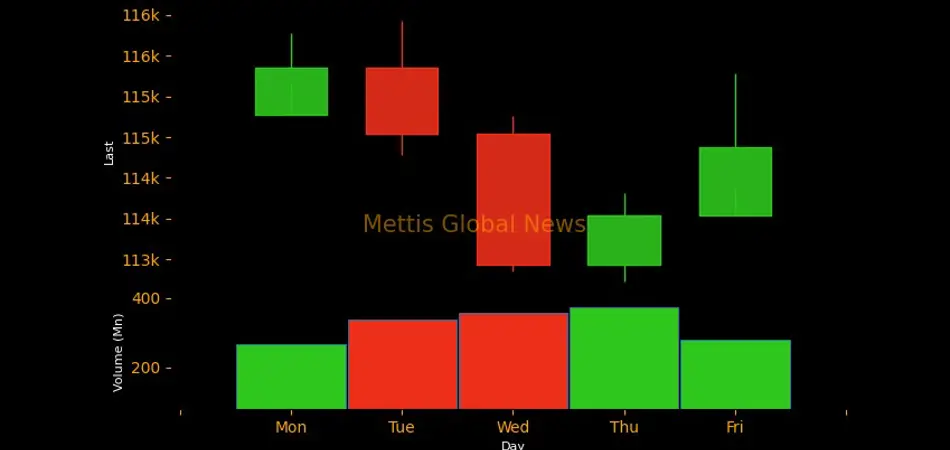

January 25, 2025 (MLN): The equity market kicked off the week on a positive note, buoyed by investor optimism over the continuation of monetary easing in the upcoming MPC meeting, with expectations of a 100-bps rate cut.

However, as the week progressed, market sentiment oscillated between profit-taking and bargain-hunting strategies, fueling volatility.

Consequently, the benchmark KSE-100 index shed 391.6 points (-0.34%) to close at 114,880.48.

Intraday swings were significant, with the index reaching a high of 116,424.85 (+1,544.37 points) and a low of 113,234.31 (-1,646.17 points).

Market cap

The KSE-100 market capitalization stood at Rs3.54 trillion, down 0.56% from the previous week’s Rs3.56tr. In USD terms, the market cap was recorded at $12.71 billion, compared to $12.75bn in the prior week, reflecting a decline of $46.13 million or 0.36%.

This week, the index return in USD terms turned negative at -0.35%, compared to last week’s positive return of 1.74%.

On the economic front, in a much-needed boost to the country's financial stability, Pakistan managed to secure a $1bn loan from two Middle Eastern banks at an interest rate of 6%-7%.

Similarly, in a major win for the textile industry, Pakistani exporters successfully secured $3bn export orders at Heimtextil, the world's largest textile trade fair held in Frankfurt, Germany.

Meanwhile, in a significant step towards modernizing Pakistan’s port infrastructure, Hutchison Ports proposed a $1bn investment plan, including an initial $200m in Foreign Direct Investment (FDI), aimed at enhancing the country’s position in global trade.

Pakistan's deal with Saudi Arabia to sell a stake in the copper and gold mining project controlled by Barrick Gold Corp. is still under negotiation, with key details yet to be finalized, including the location for mineral processing.

On the external front, the foreign exchange reserves held by the State Bank of Pakistan (SBP) saw a decline of $276.3m, or 2.36% week-on-week, reaching $11.45bn for the week ending January 17, 2025.

Meanwhile, on the fixed income side, the central bank conducted an auction for floating rate Pakistan Investment Bonds on Wednesday, successfully selling Rs126.3bn in 2, 5, and 10-year semiannual bonds, though falling short of the target of Rs150bn.

Additionally, the SBP sold Market Treasury Bills (MTBs) worth Rs325.bn during the week.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 46.44%.

Top Index Movers

During the week, Oil & Gas Exploration Companies, Power Generation & Distribution, Oil & Gas Marketing Companies, and Automobile Assemblers dragged the index down by -1224.54, -194.27, -113.92, and -80.99, respectively.

On the flip side, Fertilizer, Investment Banks, and Cement contributed 637.54, 338.54, and 164.64, respectively to the index.

Among individual stocks, MARI eroded -787.98 points from the index while OGDC, PPL, and HUBC dented the index by -198.25, -197.99, and -151.37, respectively.

Conversely, FFC, ENGROH, FCCL, and MEBL added 582.37, 348.83, 145.54 and 111.55, respectively.

FIPI/LIPI

This week, foreign investors were net buyers, purchasing equities worth $5.57m.

Among them, foreign corporates led the buying spree with $4.8m, while overseas Pakistanis bought securities worth $831.2 thousand.

On the other hand, foreign individuals sold securities worth $68.15 thousand.

Meanwhile, this week, local investors emerged as net sellers, offloading the equities worth $5.57m.

Among them, Banks/DFIs led the selling activity worth $14.11m while companies purchased securities worth $5.35m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,204.18 326.75M | -0.12% -200.31 |

| ALLSHR | 103,326.47 682.26M | -0.11% -115.78 |

| KSE30 | 52,323.58 93.96M | -0.17% -90.21 |

| KMI30 | 244,733.72 73.03M | 0.04% 87.89 |

| KMIALLSHR | 67,164.58 409.64M | 0.17% 114.30 |

| BKTi | 47,165.45 34.74M | -0.52% -248.09 |

| OGTi | 33,329.66 4.67M | -0.27% -90.09 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,160.00 | 90,610.00 87,910.00 | 2100.00 2.38% |

| BRENT CRUDE | 61.79 | 61.82 60.53 | 1.32 2.18% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 2.30 2.59% |

| ROTTERDAM COAL MONTHLY | 96.90 | 0.00 0.00 | 0.30 0.31% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.78 | 57.83 56.60 | 1.26 2.23% |

| SUGAR #11 WORLD | 14.97 | 15.01 14.83 | 0.15 1.01% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)