Weekly Market Roundup

By Abdur Rahman | June 07, 2024 at 10:27 PM GMT+05:00

June 07, 2024 (MLN): Bears dominated the Pakistan Stock market this week amid rumors of high tax imposition on capital markets in the upcoming budget.

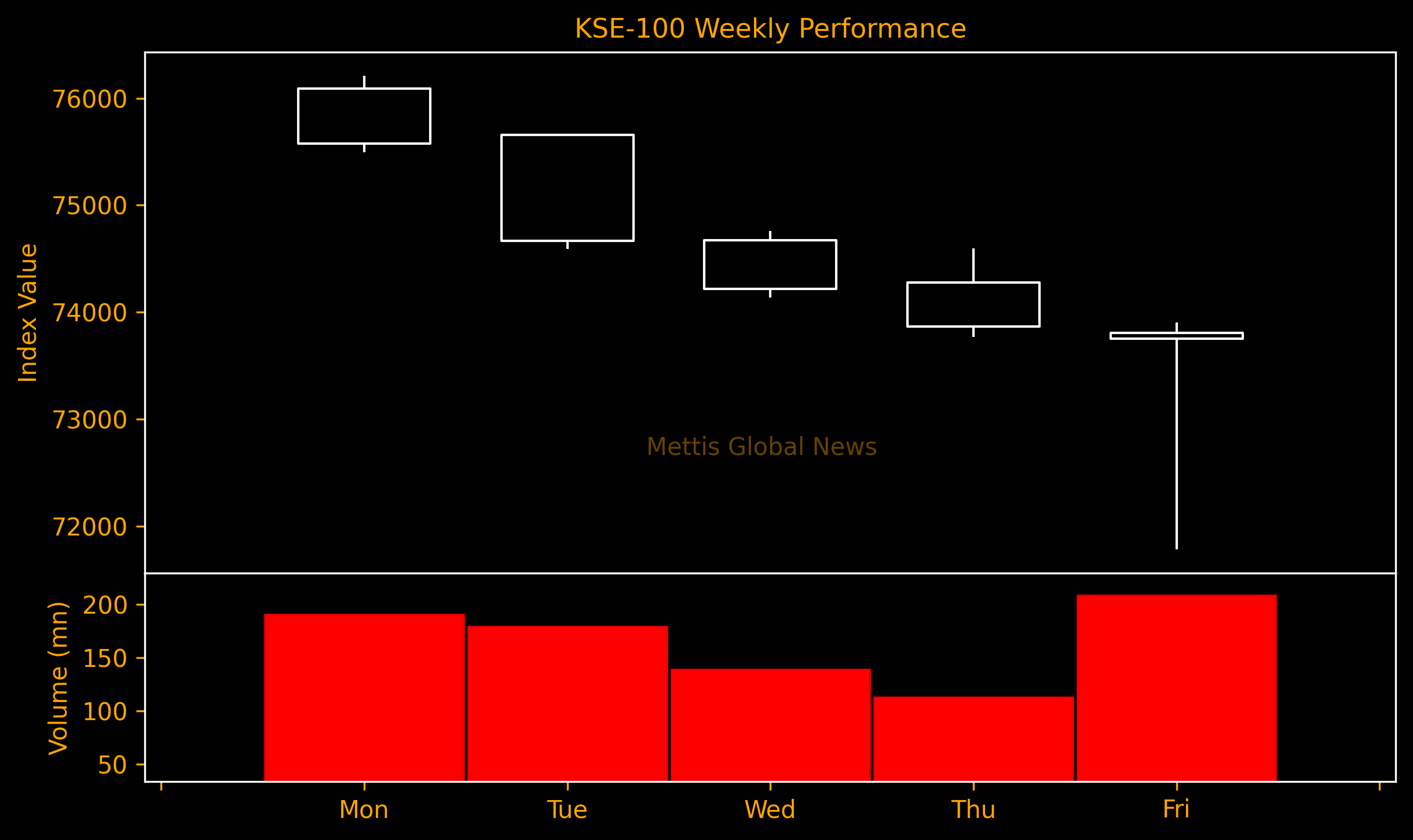

On Friday, intensified rumors triggered a bout of volatility and selloff, pushing the KSE-100 index below 72,000.

However, bulls stepped up and managed to close the week at 73,754.

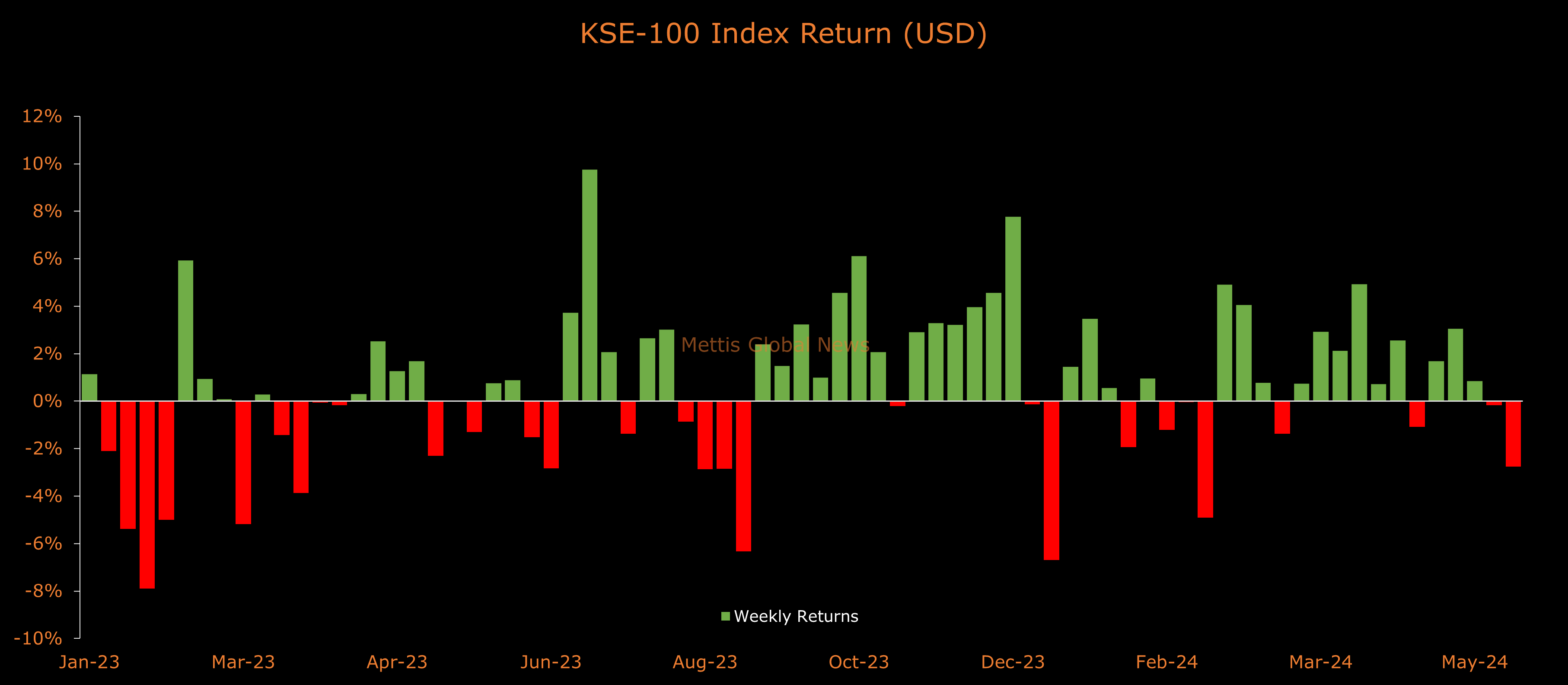

On a weekly basis, the KSE-100 index recorded a decline of 2,124 points, or 2.8% (USD terms also).

But it is still up 78% so far this fiscal year and 18% since January, largely owed to the International Monetary Fund rescue package right around Eid-ul-Adha last year that steered the country out of a sovereign debt default.

Throughout the week, KSE-100 traded in a wide range of 4,428 points, between a high of 76,210 (+331) and a low of 71,782 (-4,097) points.

PSX average traded volume was recorded at 423.32 million shares worth Rs17.17 billion, marking a decrease of 5.3% WoW in the number of shares while a rise of 0.4% WoW in traded value.

Meanwhile, the PSX market capitalization decreased by $939.62m or 2.6% to $35.6bn over the week. In PKR terms, market capitalization stood at Rs9.9 trillion.

Read: Mattias Martinsson voices concerns on Pakistan’s CGT plans

Investors are closely monitoring the monetary policy meeting scheduled for Monday, where the central bank is widely expected to begin an easing cycle after nearly four years.

The decision will come just before the federal budget 2024-25.

On the economic front, Pakistan received its highest ever monthly workers' remittance inflows in May, worth $3.24bn, a significant year-on-year increase of 54.2%.

Top Index Movers

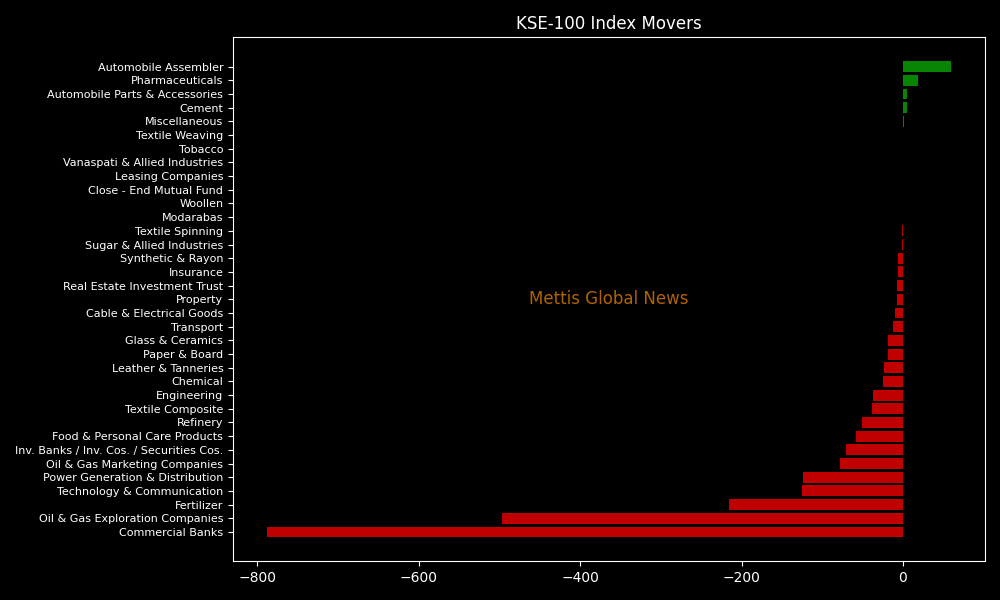

Sector-wise, top negative contributions came from Commercial Banks (788pts), Oil & Gas Exploration Companies (497pts), Fertilizer (215pts), Technology & Communication (125pts), and Power Generation & Distribution (124pts).

Contrary to that, the positive contributions came from Automobile Assembler (59pts), Pharmaceuticals (19pts), Automobile Parts & Accessories (6pts), Cement (5pts), and Miscellaneous (1pt).

The worst-performing stocks during the week were MEBL (227pts), OGDC (199pts), HBL (133pts), SYS (125pts), and MARI (122pts).

Whereas, MTL, LUCK, TRG, SEARL, and SHEL added 67, 34, 21, 13, and 10 points to the index respectively.

FIPI/LIPI

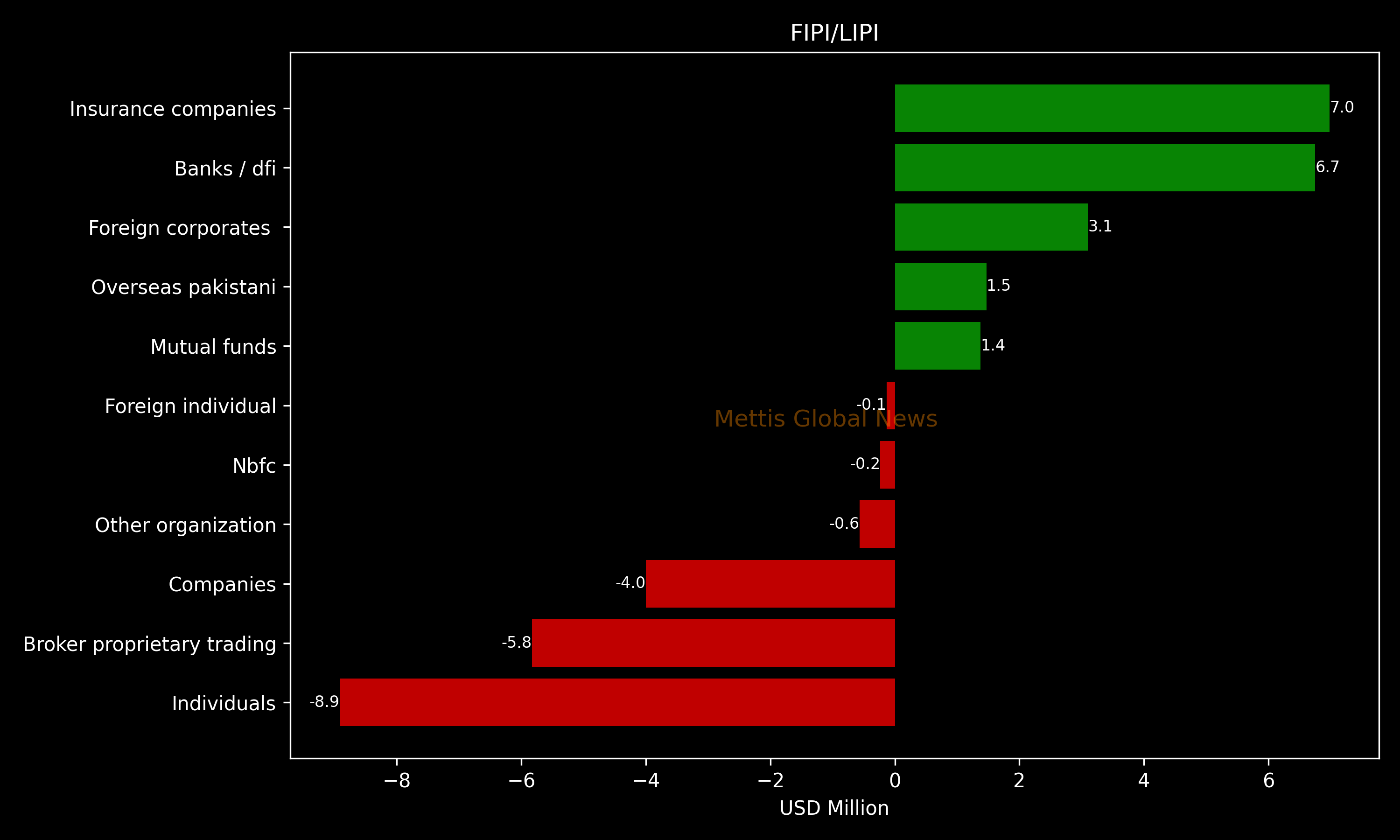

Foreign investors continued cherry-picking as they bought shares worth $4.44m.

Flow-wise, Insurance companies were the dominant buyers, with a net investment of $6.98m.

They allocated the majority of their capital, $2.36m, to Fertilizer, while divesting from the Technology and Communication sector, amounting to $0.15m in sales.

On the other hand, the leading sellers were Individuals, with a net sale of $8.92m.

Their most substantial sales activity was in Commercial Banks, amounting to $3.59m, while they acquired $0.49m of equities in the Oil and Gas Exploration Companies.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,737.17 99.32M |

-0.50% -666.03 |

| ALLSHR | 83,011.64 550.08M |

-0.21% -176.41 |

| KSE30 | 40,402.23 35.52M |

-0.61% -249.23 |

| KMI30 | 191,114.35 39.97M |

-0.50% -969.57 |

| KMIALLSHR | 55,720.63 281.24M |

-0.23% -127.07 |

| BKTi | 36,232.16 6.27M |

-0.52% -190.72 |

| OGTi | 28,278.03 7.31M |

-0.56% -159.57 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,210.00 | 109,545.00 108,625.00 |

-5.00 -0.00% |

| BRENT CRUDE | 70.12 | 70.15 69.85 |

-0.03 -0.04% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.29 | 68.31 67.78 |

-0.04 -0.06% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)