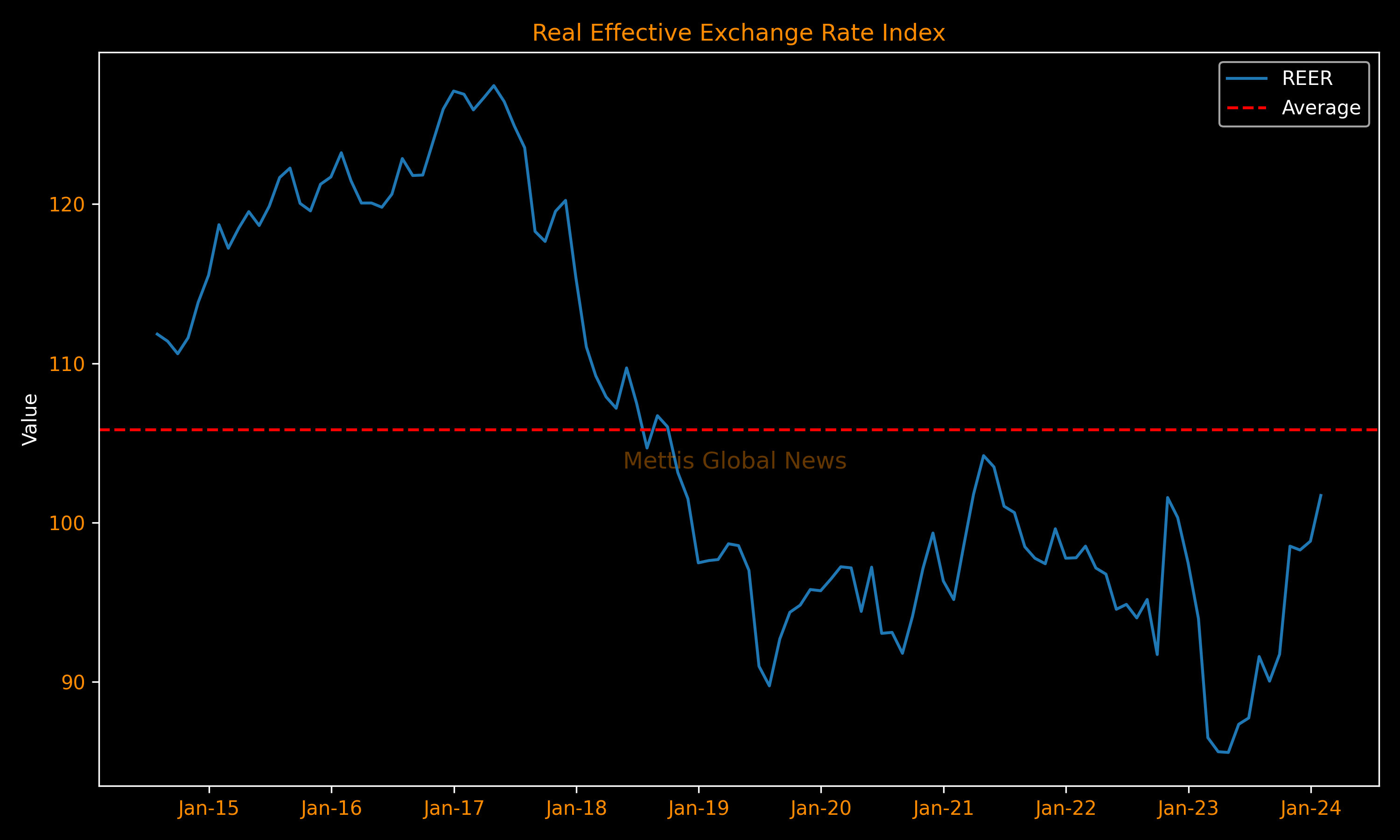

REER breaches 100 - will another Rupee depreciation bout help exports?

.png)

By A A H Soomro | February 20, 2024 at 04:37 PM GMT+05:00

February 20, 2024 (MLN): Almost exactly a year ago on March 03, 2023 PKR touched 281 against USD. It's almost been twelve months that rupee has been largely stable despite a hiccup mid way in open market that was timely tamed by danda-nomics.

Questions are now increasing once again on next round of Rupee depreciation. Many pundits believe currency still being artificially controlled.

As soon as the new government is tamed, clear indication has to be given to revive another IMF bailout at earliest. The last review can be done smoothly after recent gas price hike to push Pakistan tide the wave for a few months.

FX reserves are marginally inching upwards, profit repatriation is increasing, LCs are being mildly entertained, spread between interbank and open market is narrowed as well.

Unfortunately, Rupee depreciation in a country like Pakistan's has been an utterly failed took to reignite exports. Mixed evidence thus exists over it's utility to bring current account deficit in check.

These days CAD hovers near 1% of GDP but exports are not - and will not - respond elastically. We just make imports expensive, borrowing unaffordable through depreciation, monetary tightening and additional import duties.

$1.7bn growth in seven months is attributable to 1) $800 million Rice 2) $350m other exports, 3) $250m oil seeds, kernal and nuts 4) $200m freight savings 5) $180m petroleum products.

Clearly, none of these big ticket growth items are result of rupee being competitive against regional players. If anything, bouts of depreciation only increase uncertainty and inflation in the country.

Hence, with REER breaching century towards 101.7 (highest since April 2021) pressure on Rupee may be seen. Though not a leading indicator of pressure on Rupee, REER remains a broader index to take into the equation.

Especially when exports & foreign investment remain muted. There has been nominal growth in IT exports but not enough to move the needle of earnings enough dollars that 240m nation needs to feed themselves.

Elevated inflation has invariably put pressure on the currency competitiveness but pushing PKR to 300/USD with the advent of new IMF program would create another inflationary spiral instead of growing exports.

Adhering to fiscal, monetary and energy policies have brought confidence back from near default scenario thus remittance are roaring with right incentives in place.

PKR may sustain 280 levels a few more months but bears would be back - still not a preferred asset class compared to equity or fixed income.

The author is an independent economic analyst and writes on Twitter and Linkedin.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,762.66 104.29M |

-0.48% -640.53 |

| ALLSHR | 83,051.47 589.74M |

-0.16% -136.58 |

| KSE30 | 40,399.45 36.83M |

-0.62% -252.00 |

| KMI30 | 191,031.30 42.00M |

-0.55% -1052.62 |

| KMIALLSHR | 55,756.12 302.63M |

-0.16% -91.57 |

| BKTi | 36,236.93 6.53M |

-0.51% -185.95 |

| OGTi | 28,281.57 7.40M |

-0.55% -156.04 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,155.00 | 109,545.00 108,625.00 |

-60.00 -0.05% |

| BRENT CRUDE | 70.31 | 70.33 69.85 |

0.16 0.23% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.48 | 68.48 67.78 |

0.15 0.22% |

| SUGAR #11 WORLD | 16.13 | 16.15 16.08 |

0.00 0.00% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|