PSX continues historic bull run as foreign investors flock to Pakistan

Abdur Rahman | May 17, 2024 at 03:49 PM GMT+05:00

May 17, 2024 (MLN): Pakistan stock market’s historic bull run—which started last year with International Monetary Fund (IMF) loan deal—has been further fueled amid strong foreign buying spree, renewed bets for interest rate cuts due to improvement in economic conditions, and official talks for a new IMF program.

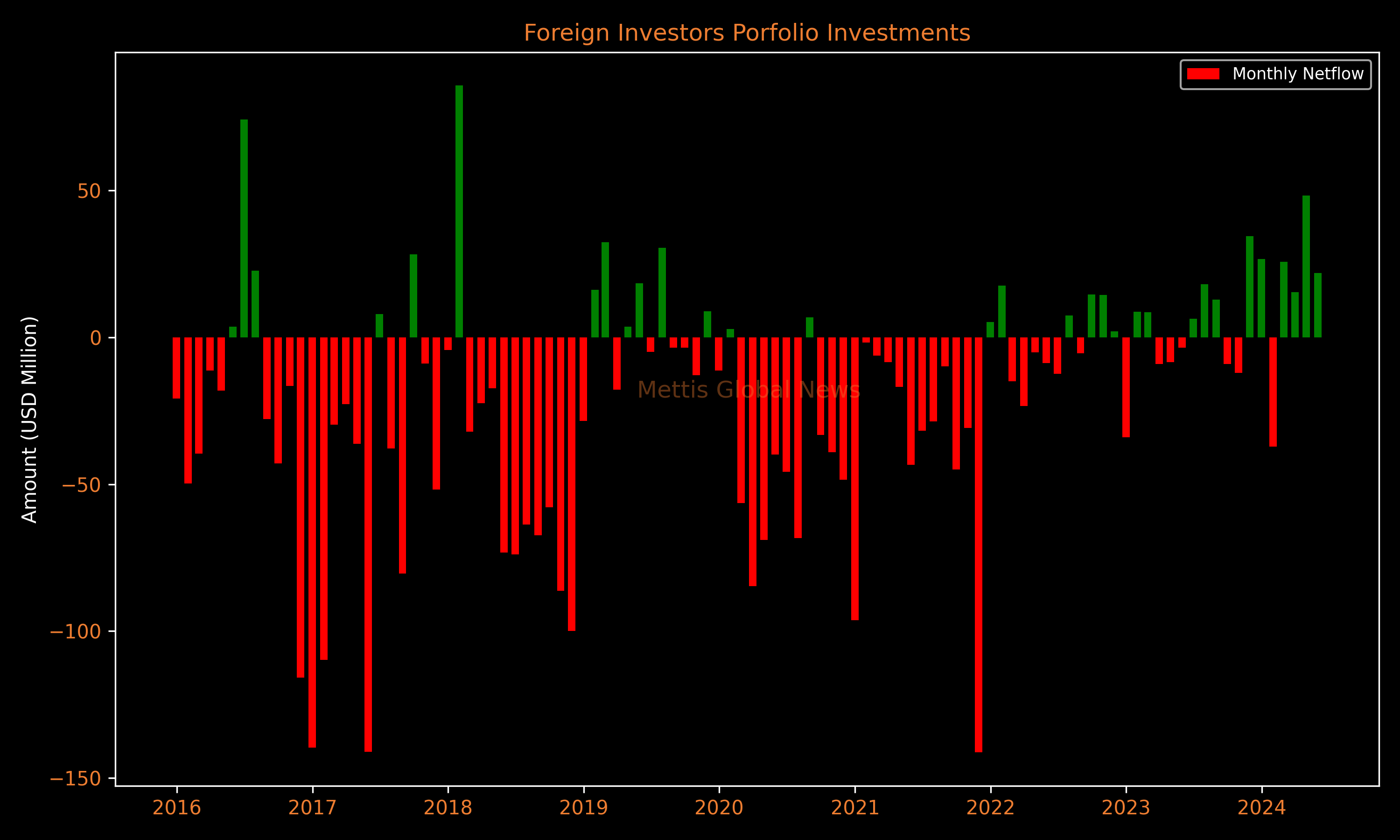

Foreign investors have been heavily accumulating debt-ridden nation’s stock throughout the fiscal year 2024.

Foreign buying in the current month to date has amounted to $21.95 million, on its way to record longest monthly buying streak since at least 2016, according to NCCPL data.

In the current fiscal year, foreign buying has amounted to a substantial $145m, as against an outflow of $5.5m in the same period last year.

The benchmark KSE-100 index has surged 33,478 points or 80.8% during the fiscal year 2024 to a record 74,930.

In USD terms, the 100-index has jumped 85.7% in fiscal year to date, putting it as one of the best performing markets worldwide.

The economic journey in the ongoing FY2024 has been optimistic.

Recently, IMF Executive Board approved the second review under the SBA for Pakistan allowing for an immediate disbursement of $1.1 billion.

Furthermore, Pakistan and IMF has initiated discussions on further engagement with the Fund, with the country looking for a larger and longer deal.

Wall Street bank Citi expects Pakistan to reach an agreement with the IMF for a new four-year program of up to $8 billion by end-July.

Economic growth is showing signs of recovery while inflation is trending downward.

Following a fourth consecutive decline in weekly inflation, the CPI-based inflation for May is expected to fall to about 13-14% YoY, expanding real interest rates to 8-9%.

These improvements in economy are primarily due to favorable external conditions and sound prudent policy management.

Both fiscal and external sectors have demonstrated resilience.

The market confidence is also upbeat, reflected in the notable performances of Pakistan Stock Exchange (PSX).

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,511.60 243.32M | 0.15% 253.06 |

| ALLSHR | 100,074.33 412.80M | 0.32% 317.67 |

| KSE30 | 50,911.66 80.09M | -0.01% -6.21 |

| KMI30 | 231,840.08 95.98M | -0.40% -931.69 |

| KMIALLSHR | 63,817.44 240.04M | 0.06% 36.76 |

| BKTi | 49,490.29 49.69M | 0.94% 459.13 |

| OGTi | 32,635.57 3.78M | -0.18% -58.16 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile