PSX Closing Bell: Start Me Up!

By MG News | June 10, 2021 at 06:58 PM GMT+05:00

June 10, 2021 (MLN): Domestic equity market observed a bullish trend throughout the day today as the optimistic investors aided the benchmark KSE100 index to close at 48,251.49 with the notable gain of 473.87 points or 0.99%.

The index touched an intraday high of 48,288.29 on the back of positive news flows on upcoming federal budget which is expected to provide major relief to public and private sector to recover from pandemic hit economy.

Technology and commercial banking sector added major contribution to benchmark rally owing to possible tax cut for communication sector in upcoming finance bill and stellar growth in banks’ deposits and advances during May, a report by Aba Ali Habib cited.

Of the 96 traded companies in the KSE100 Index 69 closed up 23 closed down, while 4 remained unchanged. Total volume traded for the index was 296.57 million shares.

Sectors propping up the index were Technology & Communication with 155 points, Commercial Banks with 116 points, Fertilizer with 65 points, Food & Personal Care Products with 41 points and Textile Composite with 33 points.

The most points added to the index was by TRG which contributed 128 points followed by UNITY with 36 points, HBL with 32 points, UBL with 25 points and SYS with 24 points.

Sector wise, the index was let down by Power Generation & Distribution with 16 points, Oil & Gas Exploration Companies with 14 points, Automobile Assembler with 5 points, Engineering with 2 points and Glass & Ceramics with 1 points.

The most points taken off the index was by HUBC which stripped the index of 13 points followed by PPL with 13 points, INDU with 9 points, INIL with 8 points and DAWH with 7 points.

All Share Volume decreased by 315.81 Million to 1039.36 Million Shares. Market Cap increased by Rs.58.42 Billion.

Total companies traded were 417 compared to 416 from the previous session. Of the scrips traded 276 closed up, 117 closed down while 24 remained unchanged.

Total trades increased by 4,345 to 209,844.

Value Traded increased by 3.17 Billion to Rs.26.35 Billion

|

Top Ten by Volume |

|

|---|---|

|

Company |

Volume |

|

Worldcall Telecom |

329,074,500 |

|

K-Electric |

49,097,500 |

|

Hum Network |

43,158,500 |

|

Unity Foods |

41,825,496 |

|

Pace (Pakistan) |

34,539,000 |

|

Agritech |

23,801,000 |

|

Pakistan Telecommunication Company Ltd |

20,966,500 |

|

Byco Petroleum Pakistan |

19,878,500 |

|

Jahangi Sidd(R) |

19,767,000 |

|

TRG Pakistan |

19,715,193 |

|

Top Sector by Volume |

|

|---|---|

|

Sector |

Volume |

|

Technology & Communication |

457,284,893 |

|

Food & Personal Care Products |

79,080,876 |

|

Chemical |

64,110,590 |

|

Power Generation & Distribution |

58,599,425 |

|

Miscellaneous |

50,035,200 |

|

Inv. Banks / Inv. Cos. / Securities Cos. |

41,028,841 |

|

Cement |

38,756,001 |

|

Refinery |

30,548,300 |

|

Oil & Gas Marketing Companies |

29,074,566 |

|

Engineering |

27,679,511 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,759.88 97.90M |

-0.48% -643.31 |

| ALLSHR | 83,049.07 541.66M |

-0.17% -138.99 |

| KSE30 | 40,408.83 35.17M |

-0.60% -242.62 |

| KMI30 | 191,111.40 39.58M |

-0.51% -972.51 |

| KMIALLSHR | 55,739.34 277.74M |

-0.19% -108.35 |

| BKTi | 36,247.59 6.18M |

-0.48% -175.29 |

| OGTi | 28,278.08 7.25M |

-0.56% -159.53 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,235.00 | 109,545.00 108,625.00 |

20.00 0.02% |

| BRENT CRUDE | 70.10 | 70.13 69.85 |

-0.05 -0.07% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.28 | 68.31 67.78 |

-0.05 -0.07% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

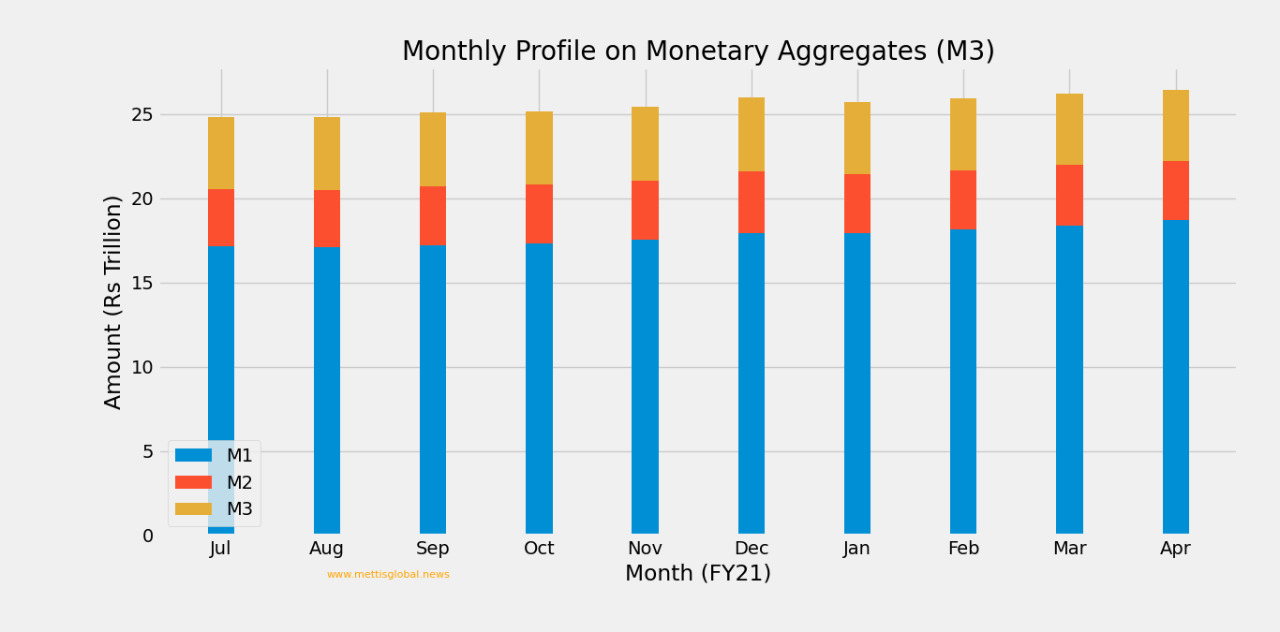

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|