PSX Closing Bell: No Ceilings Here

MG News | December 03, 2024 at 03:56 PM GMT+05:00

December 03, 2024 (MLN): Bulls once again remained unstoppable, driving the Pakistan Stock Market to new highs on expectations of significantly broader rate cuts by the central bank after inflation eased to its lowest level in over 6.5 years.

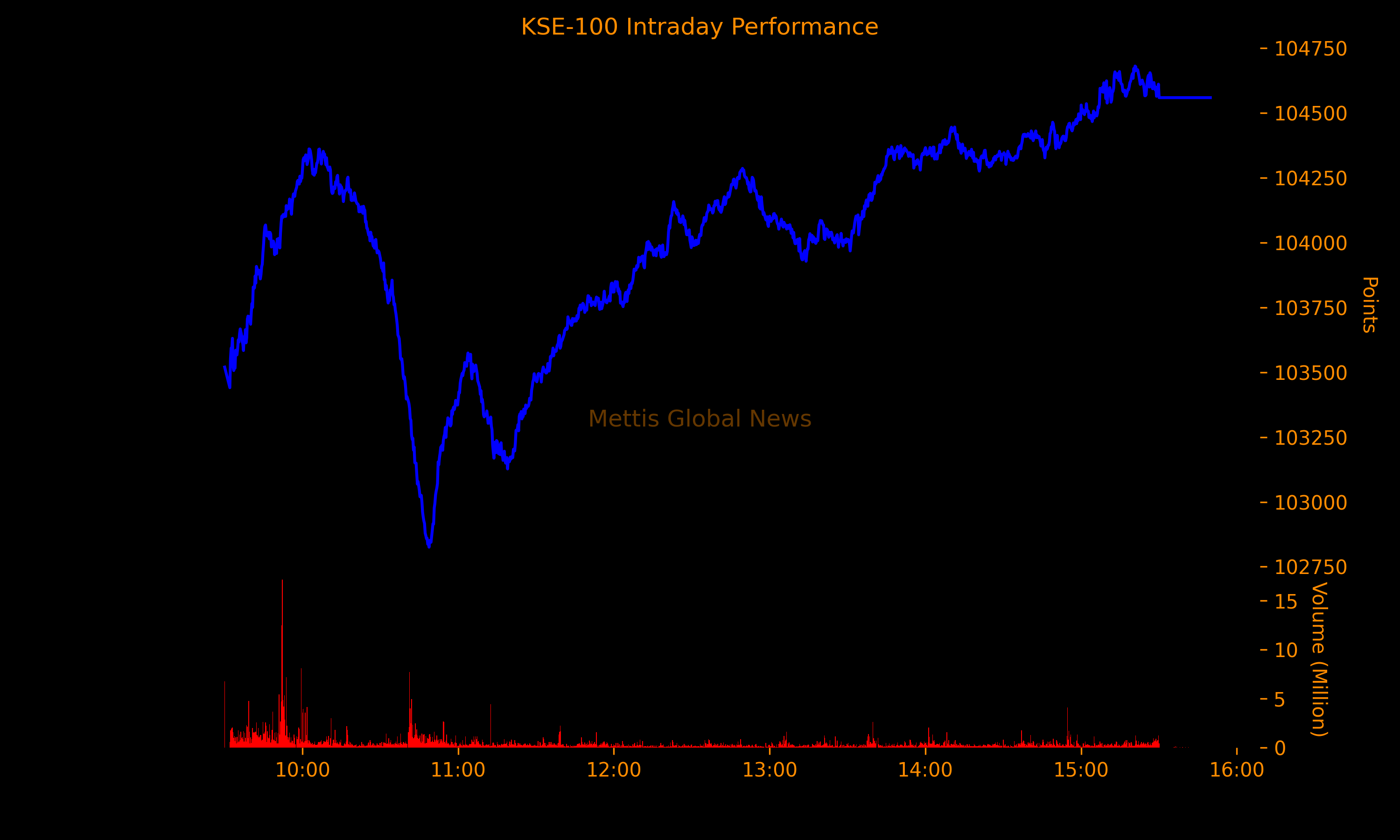

As a result, the benchmark KSE-100 Index concluded Tuesday's trading session at 104,559.07, showing an increase of 1,284.13 points or 1.24%.

The index traded in a range of 1,855.29 points showing an intraday high of 104,680.88 (+1,405.94) and a low of 102,825.59 (-449.35) points.

The day eventually started on a lower note with a slight drop, but eventually buying was restored after the Finance Ministry refuted all speculation of disruptions in the IMF program

The total volume of the KSE-100 Index was 756.59 million shares.

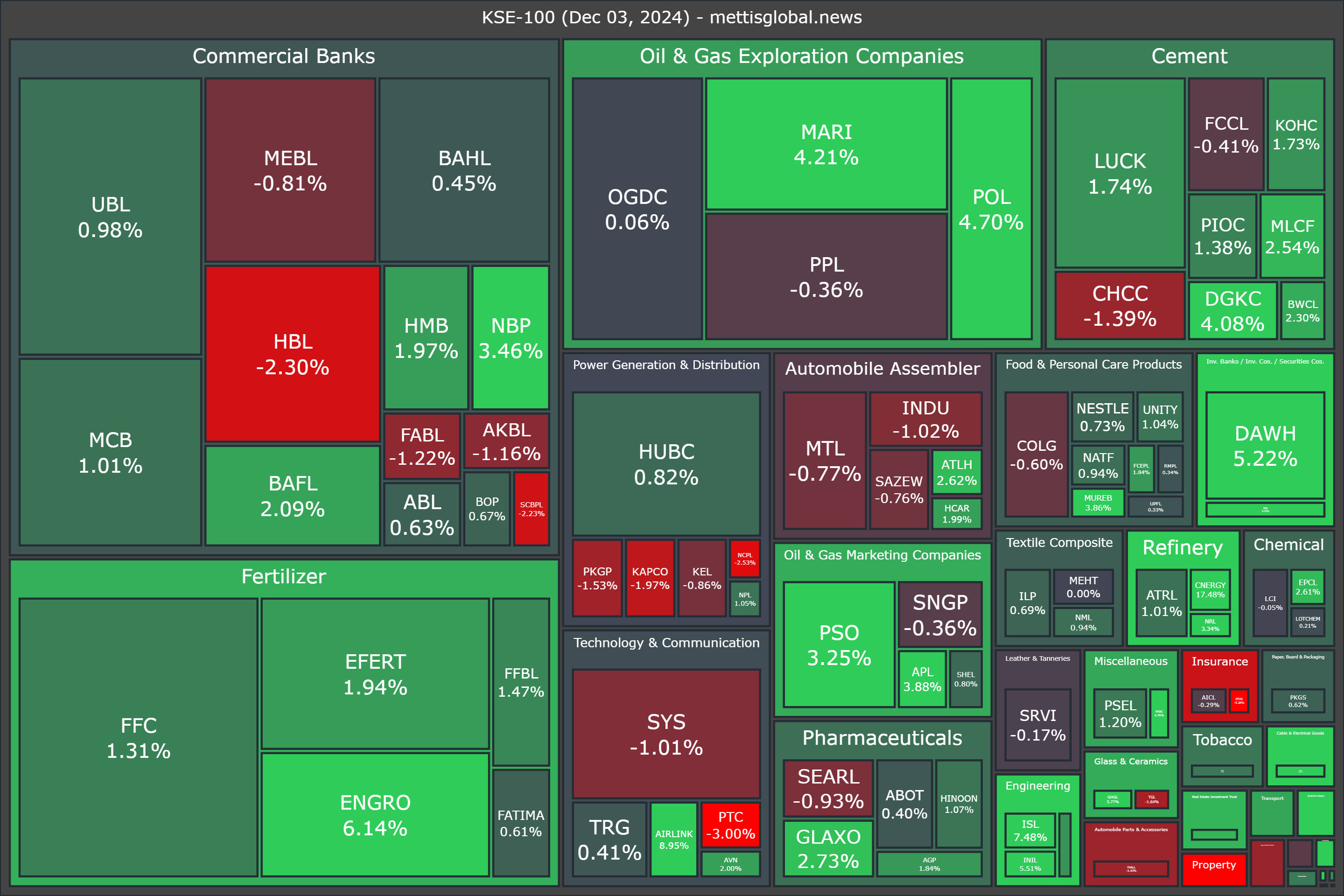

Of the 100 index companies 68 closed up, 31 closed down, while 1 were unchanged.

Top gainers during the day were CNERGY (+17.48%), POML (+10.01%), PAEL (+10.00%), AIRLINK (+8.95%), and ISL (+7.48%).

On the other hand, top losers were EFUG (-5.28%), JVDC (-4.77%), PTC (-3.00%), PGLC (-2.54%), and NCPL (-2.53%).

In terms of index-point contributions, companies that propped up the index were ENGRO (+192.14pts), MARI (+153.02pts), POL (+115.22pts), FFC (+99.40pts), and DAWH (+99.11pts).

Meanwhile, companies that dragged the index lower were HBL (-80.29pts), SYS (-32.53pts), MEBL (-28.21pts), CHCC (-15.84pts), and PPL (-13.28pts).

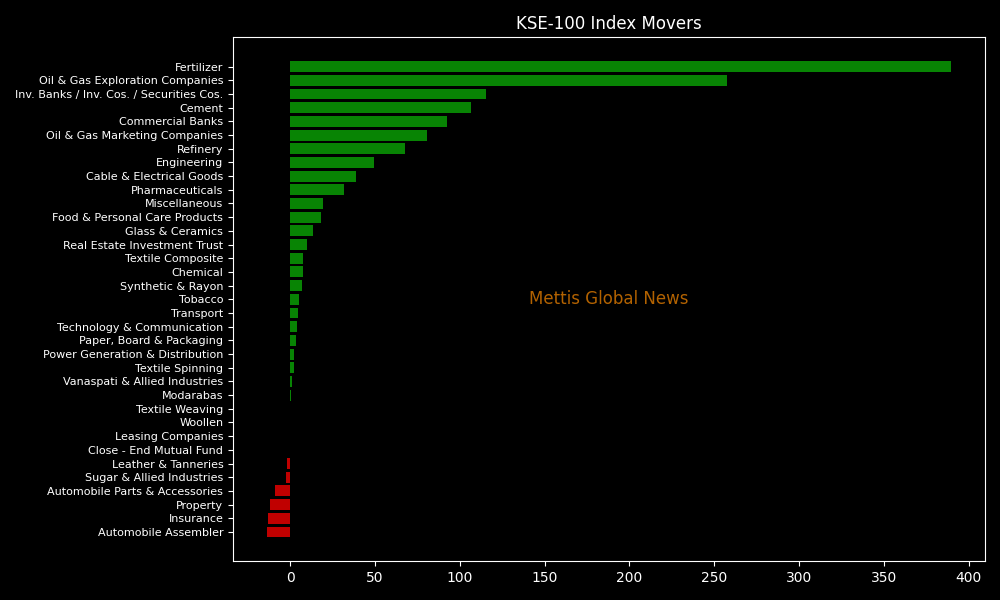

Sector-wise, KSE-100 Index was supported by Fertilizer (+389.39pts), Oil & Gas Exploration Companies (+257.27pts), Inv. Banks / Inv. Cos. / Securities Cos. (+115.72pts), Cement (+106.57pts), and Commercial Banks (+92.17pts).

While the index was let down by Automobile Assembler (-13.55pts), Insurance (-12.84pts), Property (-11.73pts), Automobile Parts & Accessories (-8.90pts), and Sugar & Allied Industries (-2.42pts).

In the broader market, the All-Share Index closed at 65,741.57 with a net gain of 719.56 points or 1.11%.

Total market volume was 1,766.47 million shares compared to 1,556.25m from the previous session while traded value was recorded at Rs56.62 billion showing an increase of Rs9.53bn.

There were 545,864 trades reported in 464 companies with 271 closing up, 159 closing down, and 34 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| CNERGY | 6.72 | 17.48% | 246,707,903 |

| WTL | 1.47 | 0.69% | 89,419,070 |

| HASCOL | 14.68 | 8.82% | 87,024,698 |

| PAEL | 30.48 | 10.00% | 67,806,935 |

| SSGC | 32.15 | 9.69% | 61,811,720 |

| POWER | 7.99 | 7.25% | 58,501,362 |

| KEL | 5.73 | -0.86% | 56,938,645 |

| PIBTL | 8.16 | 2.13% | 56,115,997 |

| PRL | 29.44 | 9.73% | 55,870,990 |

| SYM | 13.09 | 1.16% | 50,378,545 |

To note, the KSE-100 has gained 26,114 points or 33.29% during the fiscal year, whereas it has increased 42,108 points or 67.43% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,795.00 | 69,740.00 66,530.00 | -2685.00 -3.86% |

| BRENT CRUDE | 82.12 | 82.37 78.38 | 4.38 5.63% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 133.50 | 133.50 129.00 | 14.70 12.37% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 75.33 | 75.55 70.41 | 4.10 5.76% |

| SUGAR #11 WORLD | 14.04 | 14.04 13.94 | 0.13 0.93% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260303092753200_b3e945.webp?width=280&height=140&format=Webp)

Trade Balance

Trade Balance