PSX Closing Bell: Levitating

MG News | November 24, 2023 at 05:19 PM GMT+05:00

November 24, 2023 (MLN): The Pakistan Stock Exchange (PSX) started the day on a bullish note, as its benchmark KSE-100 index soared to 59,502 points in the first hour of trading.

However, the market soon faced resistance from sellers, stripping the index down to the low 59,000s.

The rest of the session continued to see a tug of war between buyers and sellers, with the index fluctuating within a (+90.36 to +602.44) point range, touching an intraday high of 59,502.28 and a low of 58,990.21.

The index by the session's end settled at 59,086.35, above the key 59,000 mark, with a marginal increase of 186.51 points or 0.32% DoD.

On a weekly basis, the KSE-100 index surged by 2,023 points or 3.55% WoW and marked its 8th consecutive weekly gain.

The total volume of the KSE-100 Index was 289.17 million shares.

Of the 100 index companies 33 closed up, 46 closed down, 0 were unchanged, while 21 remained untraded.

The positivity continues to be fueled by hopes of better economic conditions, following the International Monetary Fund (IMF)’s preliminary approval for the release of the next loan tranche under the current $3 billion loan program.

Upon approval, Pakistan will have access to SDR 528 million, which is around $700 million.

Moreover, in a recent development, the caretaker finance minister, Dr. Shamshad Akhtar said that Pakistan is likely to receive funds worth $1.5 billion from global lenders upon the IMF's approval of the loan tranche under the $3bn SBA.

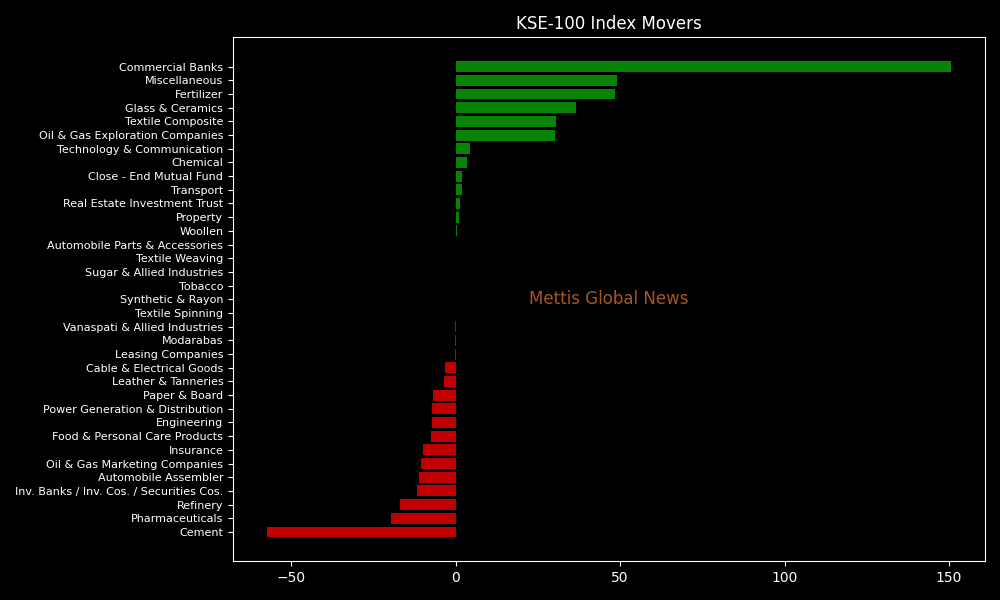

KSE-100 index was supported by Commercial Banks with 150.58, Miscellaneous with 48.96, Fertilizer with 48.55, Glass & Ceramics with 36.72, and Textile Composite with 30.53 points.

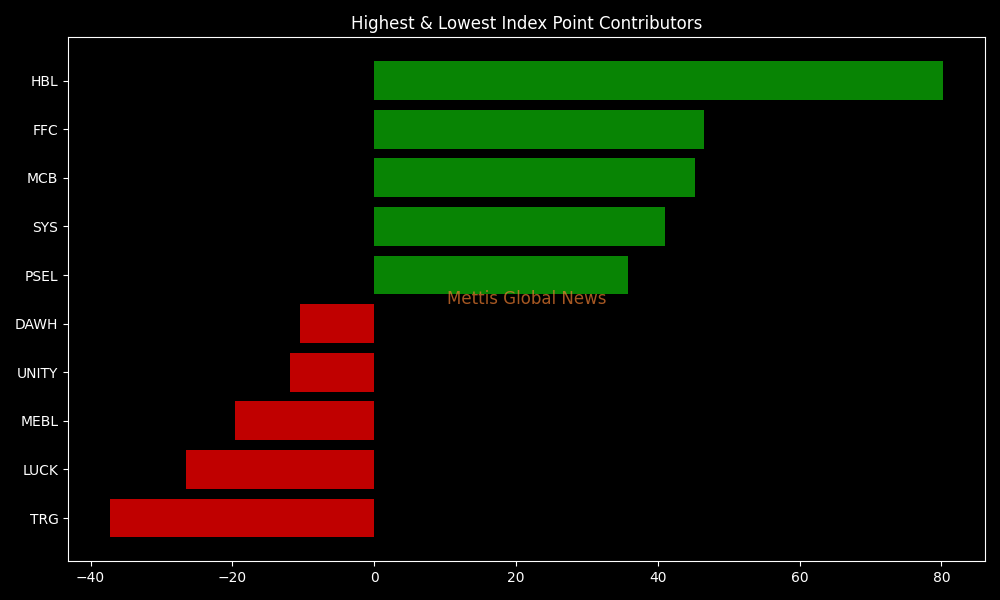

Companies adding points to the index were HBL with 80.26, FFC with 46.48, MCB with 45.29, SYS with 41.04, and PSEL with 35.77 points.

KSE-100 Index was let down by Cement with 57.36, Pharmaceuticals with 19.57, Refinery with 16.98, Inv. Banks / Inv. Cos. / Securities Cos. with 11.74, and Automobile Assembler with 11.3 points.

Companies dragging the index lower were TRG with 37.29, LUCK with 26.55, MEBL with 19.69, UNITY with 11.92 and DAWH with 10.42 points.

In the broader market, the All-Share index closed at 39,559.21 with a net gain of 85.29 points.

Total market volume was 658.425 million shares compared to 669.250 from the previous session while traded value was recorded at Rs22.02 billion showing a decrease of Rs3.22bn.

There were 247,259 trades reported in 385 companies with 164 closing up, 202 closing down and 19 remaining unchanged.

| Company | Volume |

|---|---|

| WTL | 66,805,684 |

| PIBTL | 38,907,000 |

| TPLP | 27,443,716 |

| KEL | 16,748,465 |

| CNERGY | 16,214,049 |

| KOSM | 16,108,000 |

| PRL | 15,400,511 |

| PIAA | 14,865,500 |

| FFL | 14,218,078 |

| BOP | 13,552,909 |

To note, the KSE-100 has gained 17,634 points or 42.54% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 18,666 points, equivalent to 46.18% in the KSE-100.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,294.00 377.01M | -0.17% -327.78 |

| ALLSHR | 113,032.11 685.67M | -0.21% -233.35 |

| KSE30 | 57,667.69 93.20M | -0.11% -63.67 |

| KMI30 | 265,841.79 163.88M | -0.27% -729.75 |

| KMIALLSHR | 72,640.35 470.48M | -0.20% -144.50 |

| BKTi | 54,280.52 20.94M | -0.09% -51.20 |

| OGTi | 39,313.76 15.79M | 0.41% 161.83 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,640.00 | 90,125.00 87,875.00 | -25.00 -0.03% |

| BRENT CRUDE | 64.11 | 64.33 63.89 | -0.81 -1.25% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.85 -2.09% |

| ROTTERDAM COAL MONTHLY | 98.75 | 98.75 98.75 | 1.40 1.44% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.70 | 59.93 59.46 | -0.66 -1.09% |

| SUGAR #11 WORLD | 14.73 | 14.98 14.70 | -0.23 -1.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Lending and Deposit Rates

Lending and Deposit Rates