Pakistan's govt bank debt more than triple emerging market average

MG News | October 11, 2024 at 11:45 AM GMT+05:00

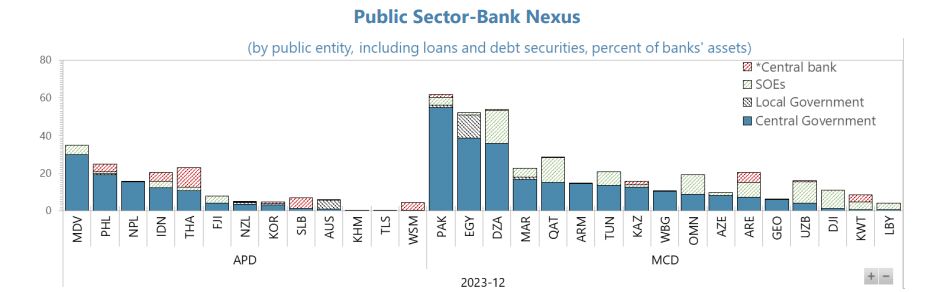

October 11, 2024 (MLN): With limited access to external funding, Pakistan's government debt through banks has surged to around 60% of their assets, triggering a red alert as it is more than three times the average for emerging market economies, Executive Directors of the International Monetary Fund (IMF) said in the latest report.

On the other side, commercial banks, having a limited depositor base, have mainly financed the government’s additional demand for funds through liquidity provided by the State Bank of Pakistan (SBP) via Open Market Operations (OMOs).

With government credit more attractive than private lending, this has significantly crowded out the latter.

Moreover, the balance sheets of the three parties, the sovereign (government), commercial banks, and the central bank have become highly interconnected.

This complex tripartite relationship means that developments or actions in one domain (e.g., fiscal, monetary policy and the banking sector) can have wide-ranging effects across the economy.

It also significantly affects the strength of monetary policy transmission by impinging the relationship between policy rates, private credit, and, private investment and consumption decisions.

There are multiple actions to limit this nexus.

Addressing the fiscal imbalances is key to first containing and then start unwinding the complicated interdependences.

Cash and debt management should make better use of idle public sector cash balances and strike a balance between the banks’ investment preferences and the government’s strategic medium-term objectives.

In particular, the authorities should closely monitor the health of the banking sector and prepare a contingency plan in case of a downside risk scenario.

In the medium-term, the structural impediments to financial sector and capital market development, including the extent of the informal economy should be addressed.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,565.00 | 69,740.00 66,385.00 | -915.00 -1.32% |

| BRENT CRUDE | 82.28 | 85.12 78.38 | 4.54 5.84% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 124.15 | 139.50 124.15 | 5.35 4.50% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 75.42 | 77.98 70.41 | 4.19 5.88% |

| SUGAR #11 WORLD | 13.93 | 14.20 13.91 | 0.02 0.14% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance