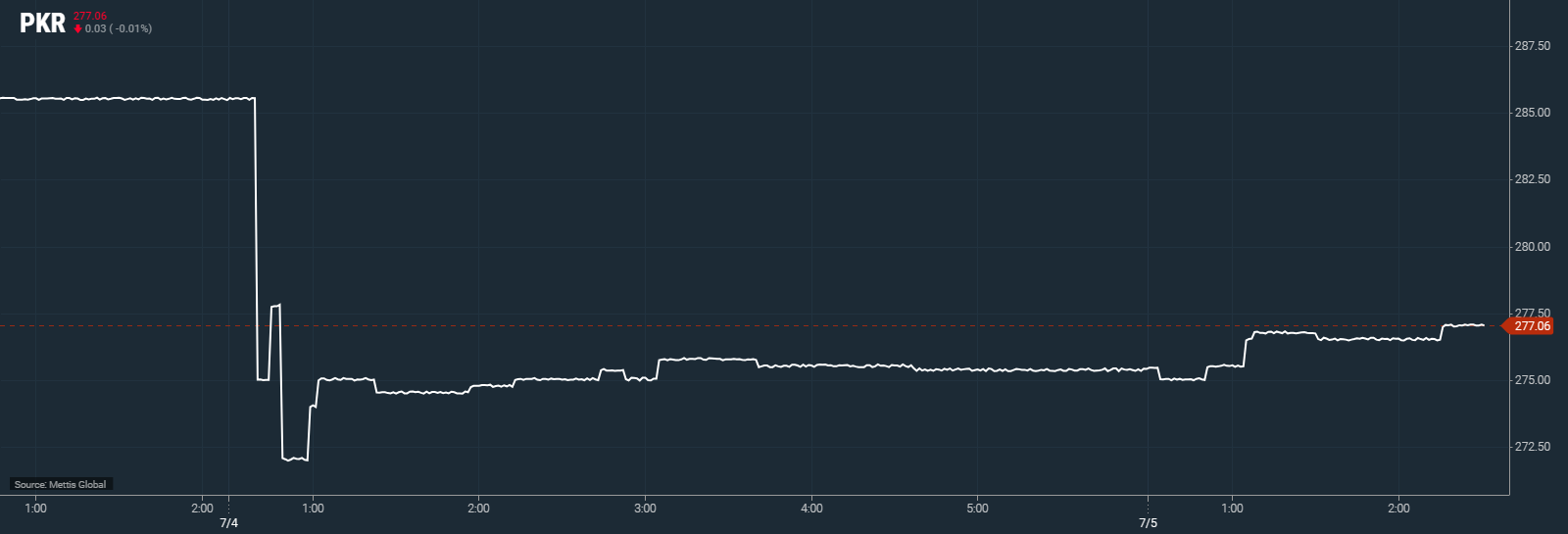

Pak Rupee recovers Rs 10 to PKR 276/USD - time to Rupee-fy

A A H Soomro | July 05, 2023 at 10:06 AM GMT+05:00

July 05, 2023 (MLN): Jubilations are in order right? Pakistan's international bonds are recovering their losses while PSX staged a roaring comeback. Expectations were also rife about movements in the PKR.

Joining the bandwagon of IMF-led celebration, currency also appreciated 3% in interbank. There is nearly Rs 30-35 appreciation from the bottom open market rates of PKR 310-315/USD. Thank goodness!

Tides do change within a week. Pakistanis are emotional beings - educated and less educated alike. In bad times, we expect the worst and in good ones, we expect better than the best. No wonder, sentiments changed in a jiffy after PM's meeting with IMF's MD, hurriedly enacted budgetary changes, increased monetary policy rate, and a much-needed USD 3B from IMF's SBA until March 24.

Now is the time for naysayers to take a break. They seem to have.

The de-dollarisation process has just begun. With the narrowing gap between interbank and open market, nearly current account surplus, and much more importantly, clarity over external financing during caretaker and beyond, confidence is back.

Dollar hoarders would learn the lesson the hard way and would stop betting on a one-way trajectory for the short term at least.

The next phase would share remittances flowing through official channels (govt can incentivize more) as spread in parallel currency markets decline and the initial rupee ascent of 9-10% in open market would force traders to put the money elsewhere.

We might see investors parking funds again in real estate, fixed income, and some spillover in the equity markets as well. Exporters holding money back should rupeefy their assets based on the newfound repair in IMF ties.

For any sustained economic clarity, much more is needed and can be done. But don't expect the caretaker and newcomers to do it in a jiffy.

Under IMF's garb, we have no choice but to live within our means and grow the means; exports and direct taxes. If exporters get timely refunds and competitive energy rates, growth is imminent to fund imports.

Also at a 22% policy rate - and likely no change until the end of 1QCY24 - imports wouldn't eat much of dollars either. The best case is to unlock funding from UAE, Saudi, IDB, AIIB, WB and ADB etc to grow FX reserves back to USD 15-17B. And take a solemn oath to not throw any more dollars into unproductive consumption.

We need to chart a plan to repay our external loans while growing economy on the back of taxing wealth, reducing unwarranted expenses, reforming energy markets, throwing loss-making entities and growing value-added exports.

That would require much-calibrated efforts across the spectrum and a radical change in the mindset for the next few years. Lives of millions were put at stake as we toyed with default risks, there are miles to go before we grow.

The author is an independent economic analyst and writes at https://twitter.com/AAHSoomro and https://www.linkedin.com/in/aahsoomro

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,859.53 166.93M | 0.59% 995.00 |

| ALLSHR | 103,304.58 396.45M | 0.56% 579.45 |

| KSE30 | 52,002.23 76.88M | 0.64% 331.81 |

| KMI30 | 246,047.17 63.57M | 0.74% 1816.35 |

| KMIALLSHR | 67,556.90 219.97M | 0.62% 415.07 |

| BKTi | 45,674.00 21.03M | 0.36% 162.75 |

| OGTi | 34,272.09 15.72M | 1.44% 485.05 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,765.00 | 90,250.00 87,745.00 | -675.00 -0.75% |

| BRENT CRUDE | 61.42 | 61.50 61.07 | 0.30 0.49% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.00 1.11% |

| ROTTERDAM COAL MONTHLY | 97.30 | 0.00 0.00 | 0.60 0.62% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.72 | 57.80 57.38 | 0.28 0.49% |

| SUGAR #11 WORLD | 15.10 | 15.27 14.83 | 0.25 1.68% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|