Oil dips as Ukraine talks, fed decision weigh on markets

MG News | December 09, 2025 at 12:37 PM GMT+05:00

December 09, 2025 (MLN): Oil prices declined on Tuesday, extending losses following Monday’s 2% drop as traders closely monitored ongoing peace negotiations to end Russia’s war in Ukraine and the imminent U.S. Federal Reserve interest rate decision.

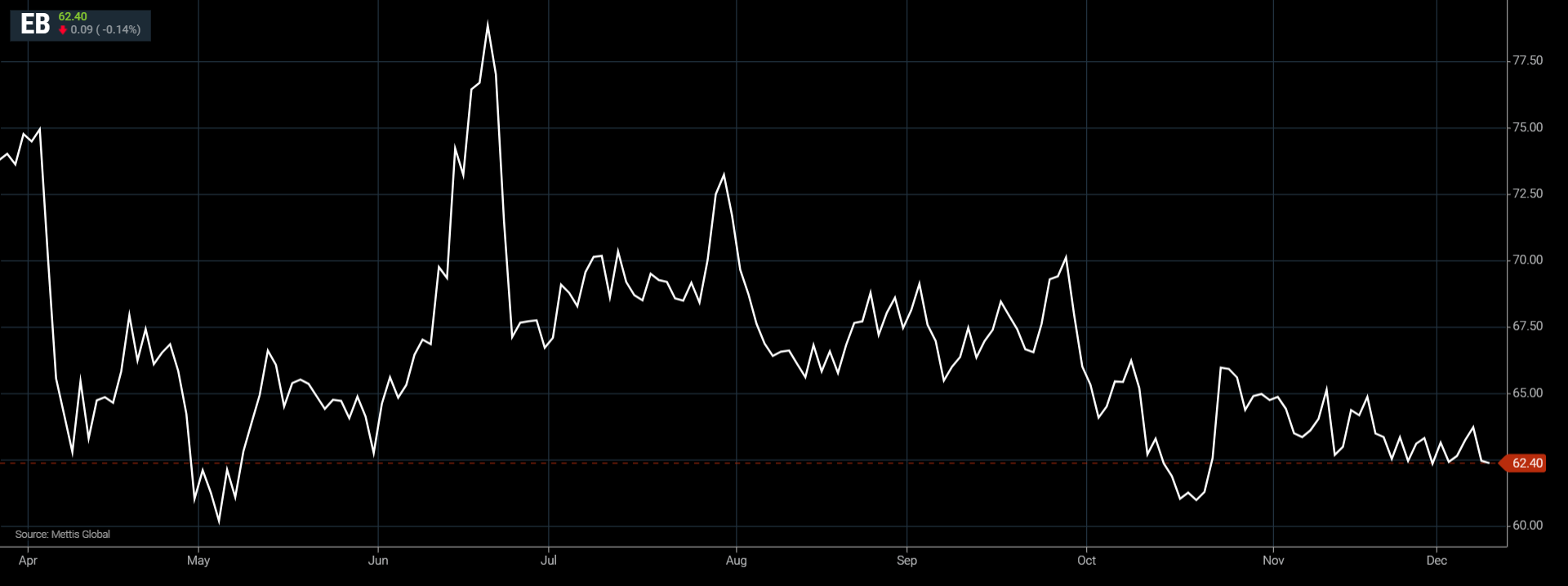

Brent crude futures decreased by $0.09, or 0.14%, to $62.40

per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.15,

or 0.25%, to $58.73 per barrel by [12:10 pm] PST.

Brent and WTI crude futures fell by more than $1 per barrel

on Monday after Iraq resumed production at Lukoil’s West Qurna 2 oilfield, one

of the largest in the world and easing earlier supply concerns according to

CNBC.

“Brent’s move back toward $62 per barrel shows the broader

December trend,” said Priyanka Sachdeva, senior market analyst at Phillip Nova.

“Concerns over potential Iraqi supply disruptions have subsided, and the market

is now focused on abundant supply and cautious demand forecasts.”

Diplomatic developments are also in focus, as Ukraine plans

to share a revised peace proposal with the U.S. following discussions in London

between President Volodymyr Zelenskiy and leaders from France, Germany, and

Britain.

Meanwhile, sources indicate that the Group of Seven (G7)

nations and the European Union are exploring the replacement of the Russian oil

price cap with a full maritime services ban, aiming to curb Moscow’s oil

revenues.

Investors are also weighing the Federal Reserve’s upcoming

policy declaration on Wednesday, with markets assigning an 87% chance of a

25-basis-point rate cut.

Lower interest rates generally support oil demand by

reducing borrowing costs, though analysts caution that the impact on prices may

be limited in the near term.

“While the anticipated Fed rate cut could provide short-term

support at the lower end of the $60–65 range, the overall market remains

influenced by expectations of oversupply in 2026,” added Sachdeva.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 151,973.00 479.70M | -9.57% -16089.17 |

| ALLSHR | 91,178.86 800.22M | -9.20% -9239.97 |

| KSE30 | 46,326.47 200.60M | -9.73% -4995.92 |

| KMI30 | 212,170.17 176.87M | -9.84% -23154.95 |

| KMIALLSHR | 58,382.38 455.91M | -9.19% -5909.79 |

| BKTi | 44,306.03 79.95M | -9.79% -4809.39 |

| OGTi | 29,106.80 28.46M | -9.93% -3209.99 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance