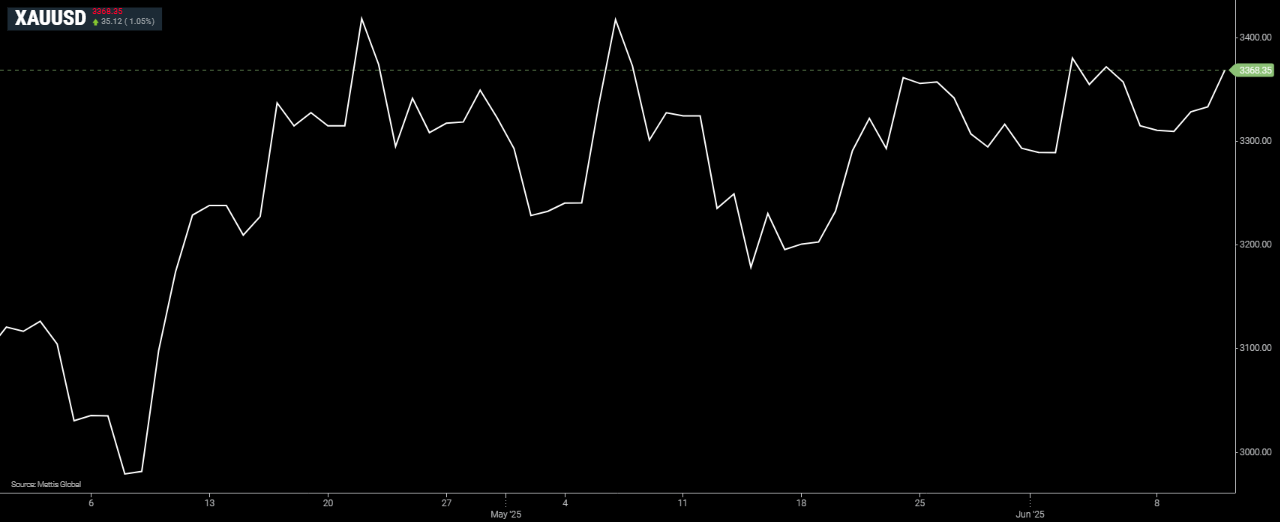

Gold rises on Middle East tensions, Fed rate cut expectations

MG News | June 12, 2025 at 12:41 PM GMT+05:00

June 12, 2025 (MLN): Gold prices rose on Thursday, bolstered by rising

tensions in the Middle East and a weaker dollar, while softer-than-expected

U.S. inflation data boosted expectations of Federal Reserve rate

cuts.

Spot gold was up 1.07% at $3,368.88 an ounce, as of [12:20

pm]. U.S. gold futures gained 1.5% to $3,395.

Rising geopolitical risks aided safe-haven assets, with

President Donald Trump announcing on Wednesday that U.S. personnel

were being moved out of the Middle East due to heightened security risks amid

rising tensions with Iran.

The U.S. dollar index fell to a near two-month

low, making greenback-priced bullion more attractive to overseas buyers.

The weakness in the dollar index serves as a strong

catalyst, said Kelvin Wong, a senior market analyst, Asia Pacific at OANDA,

adding that a “bullish breakout” of the $3,346 resistance triggered technical

buying.

Meanwhile, U.S. consumer prices increased less

than expected in May, driven by cheaper gasoline, though inflation could

accelerate due to import tariffs.

The data prompted renewed calls from Trump for

significant rate cuts.

“We could potentially see the Fed moving more quickly than

anticipated, given the CPI data, which is not particularly alarming at this

juncture,” Wong said.

Traders now expect 50 basis points of rate cut by year-end.

Meanwhile, Trump said on Wednesday that Washington

and Beijing had agreed on a framework to restore a fragile truce in the

U.S.-China trade war, potentially avoiding higher tariffs.

Trump added he could extend a July 8 deadline for

trade talks with other nations before higher U.S. tariffs take effect, but did

not foresee such a need.

Elsewhere, spot silver was up 0.4% at $36.38 per

ounce, platinum rose 1.3% to $1,272.50, still hovering near a more

than 4-year high, while palladium was down 1% at $1,068.92.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,867.39 164.75M | 0.59% 1002.86 |

| ALLSHR | 103,339.12 391.50M | 0.60% 613.99 |

| KSE30 | 52,000.92 75.54M | 0.64% 330.50 |

| KMI30 | 246,108.73 63.06M | 0.77% 1877.91 |

| KMIALLSHR | 67,594.37 217.79M | 0.67% 452.54 |

| BKTi | 45,645.71 20.15M | 0.30% 134.46 |

| OGTi | 34,285.56 15.69M | 1.48% 498.52 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,730.00 | 90,250.00 87,745.00 | -710.00 -0.79% |

| BRENT CRUDE | 61.41 | 61.50 61.07 | 0.29 0.47% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.00 1.11% |

| ROTTERDAM COAL MONTHLY | 97.30 | 0.00 0.00 | 0.60 0.62% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.71 | 57.80 57.38 | 0.27 0.47% |

| SUGAR #11 WORLD | 15.10 | 15.27 14.83 | 0.25 1.68% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|