Euro zone yields rise as finance ministers meet again on rescue package

By MG News | April 09, 2020 at 01:27 PM GMT+05:00

April 9, 2020: Yields across the core euro zone bond markets rose slightly on Thursday, with those in the peripheral markets advancing higher, as investors waited to see whether European finance ministers would be able to reach agreement on an economic rescue package.

The spread of the novel coronavirus has shut down most European economies, prompting officials to look for creative ways to revive growth, including issuing commonly shared debt known as "coronabonds".

But on Wednesday ministers had failed to agree on a rescue package to help economies recover from the impact of the coronavirus outbreak because of a feud between Italy and the Netherlands.

They will give it another go on Thursday, they said.

"It seemed that once again, the traditional dividing lines between north and south that dominated in the European sovereign debt crisis were at the forefront," said Jim Reid, strategist at Deutsche Bank.

The annual cost to Germany for jointly issuing debt with other euro zone states should amount to a maximum of around 0.36% of economic output, research by U.S. bank Jefferies showed on Wednesday, in one of the first cost estimates of the hotly disputed project.

Germany, together with Netherlands, failed to agree with the southern countries on which conditions coronabonds would be issued, believing it would lead to wealthier countries underwriting the debt of southern peers. Diplomatic sources and officials said a feud was blocking progress on half a trillion euros worth of aid.

The German 10-year Bund yield was last up 1 basis point at -0.302%. Yields in the Neterlands were flat .

Italian 10-year government bond, on the other hand, was trading up 4.4 bps at 1.70%, having jumped the day before to a three-week high of 1.75%.

The European Central Bank will on Thursday release minutes of the March 12 and March 18 meetings, where the central bank launched a barrage of new measures, though shied away from cutting rates.

"They may reveal in greater detail the pressure points that have worried policy makers, to the extent that they broke with previously thought sacrosanct limits of their QE (quantitative easing) programs," said Padhraic Garvey, regional head of research at ING.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 122,514.44 7.11M |

0.38% 467.98 |

| ALLSHR | 76,670.02 78.88M |

0.48% 366.81 |

| KSE30 | 37,332.47 2.41M |

0.35% 130.09 |

| KMI30 | 181,830.27 3.20M |

0.22% 403.96 |

| KMIALLSHR | 52,715.50 32.32M |

0.31% 163.55 |

| BKTi | 31,030.55 0.45M |

0.58% 177.63 |

| OGTi | 27,520.92 0.52M |

0.20% 54.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,215.00 | 108,330.00 107,145.00 |

610.00 0.57% |

| BRENT CRUDE | 68.07 | 68.18 67.82 |

0.34 0.50% |

| RICHARDS BAY COAL MONTHLY | 88.00 | 0.00 0.00 |

-2.90 -3.19% |

| ROTTERDAM COAL MONTHLY | 103.90 | 103.90 103.90 |

0.70 0.68% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.60 | 65.72 65.23 |

0.36 0.55% |

| SUGAR #11 WORLD | 16.38 | 16.60 16.24 |

-0.23 -1.38% |

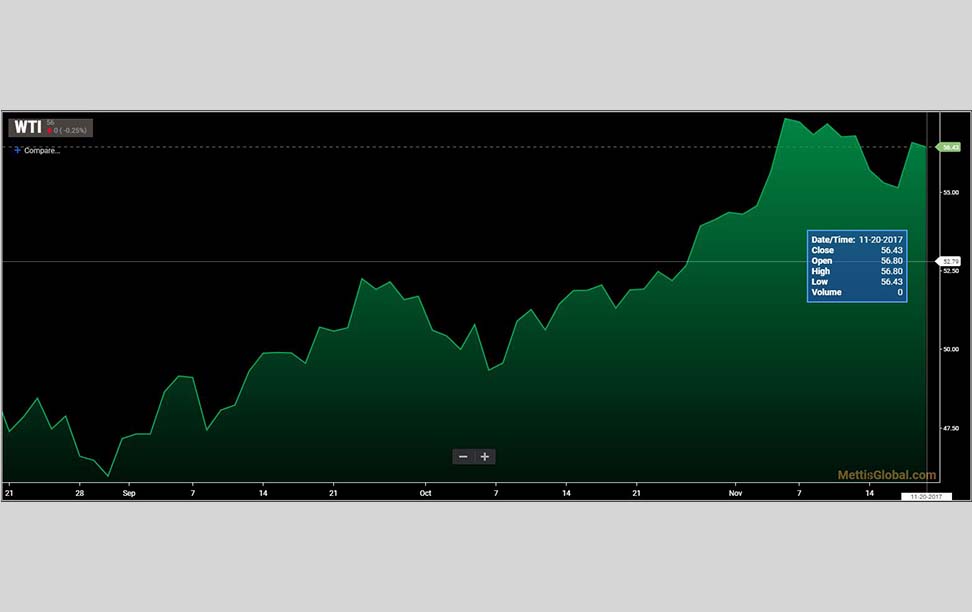

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile