February 28, 2021 (MLN): The highlights of the important economic and business events that took place during the last week are in order so as to become acquainted with the recent developments in Pakistan’s economic and public policy.

Events of Importance through the Week:

Pakistan remained in FATF’s grey list, however, the Financial Action Task Force (FATF) Thursday appreciated Pakistan for the significant progress made on the entire action plan as Pakistan completed with 24 out of 27 items rated as largely addressed and the remaining 3 items partially addressed.

On Friday, Pakistan, Qatar sign a 10-year LNG supply agreement as per which Qatar will provide Pakistan three million tons of Liquified Natural Gas (LNG) for 10 years

On Thursday, the National Electric Power Regulatory Authority (NEPRA) reserved its decision into fuel price adjustments (FCA) for month of January on a petition filed by Central Power Purchase Agency (CPPA-G) on behalf of power distribution companies.On Friday, the Economic Coordination Committee (ECC) of the Cabinet approved revocation of Neelum Jhelum surcharge with immediate effect.

On Wednesday, Fitch Solutions made downward revisions to Pakistan’s coal power growth forecasts for the ongoing quarter, given the slow progress on China-Pakistan Economic Corridor coal-powered projects of late, and increasing downside risks to the sector from the moratorium on coal.

On the upside, Kyrgyzstan has shown interest in getting access to Gwadar and Karachi ports by using the rail and road links being constructed under China-Pakistan Economic Corridor.

Furthermore, Ministry of Commerce on Friday informed that on February 24, 2021, Pakistan joined the Madrid Trademark System of World Intellectual Property Organization (WIPO)..

Financial Results:

Apart from this, several listed companies announced their financial results amid the ongoing earnings season last week, some of which are as follows:

Lotte Chemical Pakistan (LOTCHEM) earned Rs. 2.12 billion (EPS: 1.4) during the year ended December 31, 2020, i.e. nearly 61% lower as compared to the earnings of same period last year.

Pakistan Petroleum Limited (PPL) disclosed its financial performance for 1HFY21 as per which the company posted a mere 6.79% YoY increase in net profits to Rs 26 billion (EPS: Rs 9.59/sh) as opposed to the profits of Rs 24.4 billion (EPS: 8.98/sh) reported in the corresponding period last year.

Hub Power Company Limited (HUBC) posted earnings of Rs. 16.88 billion (EPS: 12.60) for the half-year ended December 31, 2020, i.e. around 48% higher than the earnings recorded in same period of last year.

Indus Motor Company Limited (INDU), announced its financial results for 1HFY21 today, wherein the company reported more than twofold increase in net profits to Rs 4.8 billion from Rs 2.3 billion in the corresponding period last year.

Standard Chartered Bank earned profits of Rs. 13.13 billion (EPS: 3.39) during the year ended December 31, 2020, i.e. around 18% lower as compared to the earnings recorded in same period of last year.

General Tyre and Rubber Company (GTYR) posted net profits of Rs 405.9 million during 1HFY21, which is 13.8x higher than the profits of Rs 29.29 million earned in the corresponding period last year.

Nestle Pakistan Limited earned 21% higher profits in CY20 compared to CY19. The net profits of the company during the year recorded at Rs 8.9 billion as opposed to Rs 7.35 billion reported in 2019.

Nishat Chunian Power Limited (NCPL) witnessed a 32% YoY decline in net profits to Rs 1.42 billion during 1HFY21, compared to the profits of Rs 2 billion in the corresponding period last year.

Pioneer Cement Limited (PIOC) reported profits of Rs. 606.5 million (EPS: 2.67) for the half-year ended December 31, 2020, against losses of Rs. 111.6 million (LPS: 0.49) reported during the same period of last year.

Maple Leaf Cement Factory Limited earned profits of Rs. 1.62 billion (EPS: 1.48), as opposed to the losses of Rs. 1.76 billion (LPS: 2.42) recorded during the same period of last year.

United Bank Limited (UBL) unveiled its financial performance for the CY20, wherein the bank witnessed 9% YoY growth in consolidated profits to Rs 20.79 billion from Rs 19 billion earned in the previous year.

Oil and Gas Development Company Limited (OGDCL) reported 20.5% YoY decline in net profits to Rs 42.2 billion with Earnings per share (EPS) of Rs 9.82/sh during 1HFY21, against the profits of Rs 53 billion (EPS: Rs 12.35/sh) earned in the corresponding period last year.

Byco Petroleum earned net profits of Rs 621.95 million (EPS: Rs 0.12/sh) during 1HFY21, compared to the corresponding period last year when a company incurred a loss of Rs 22 million (LPS: 0.004/sh).

Habib Metropolitan Bank Limited (HMB) reported 77% YoY increase in CY20 profits to Rs 12.335 million against the profits of Rs 6.96 billion earned in CY19.

Hi-Tech Lubricants (HTL) disclosed its financial results today for the 1HFY21, wherein the company witnessed a turnaround in its bottom-line as it reported net profits of Rs 304.8 million compared to the loss of Rs 134.36 million in the same period last year.

Announcements

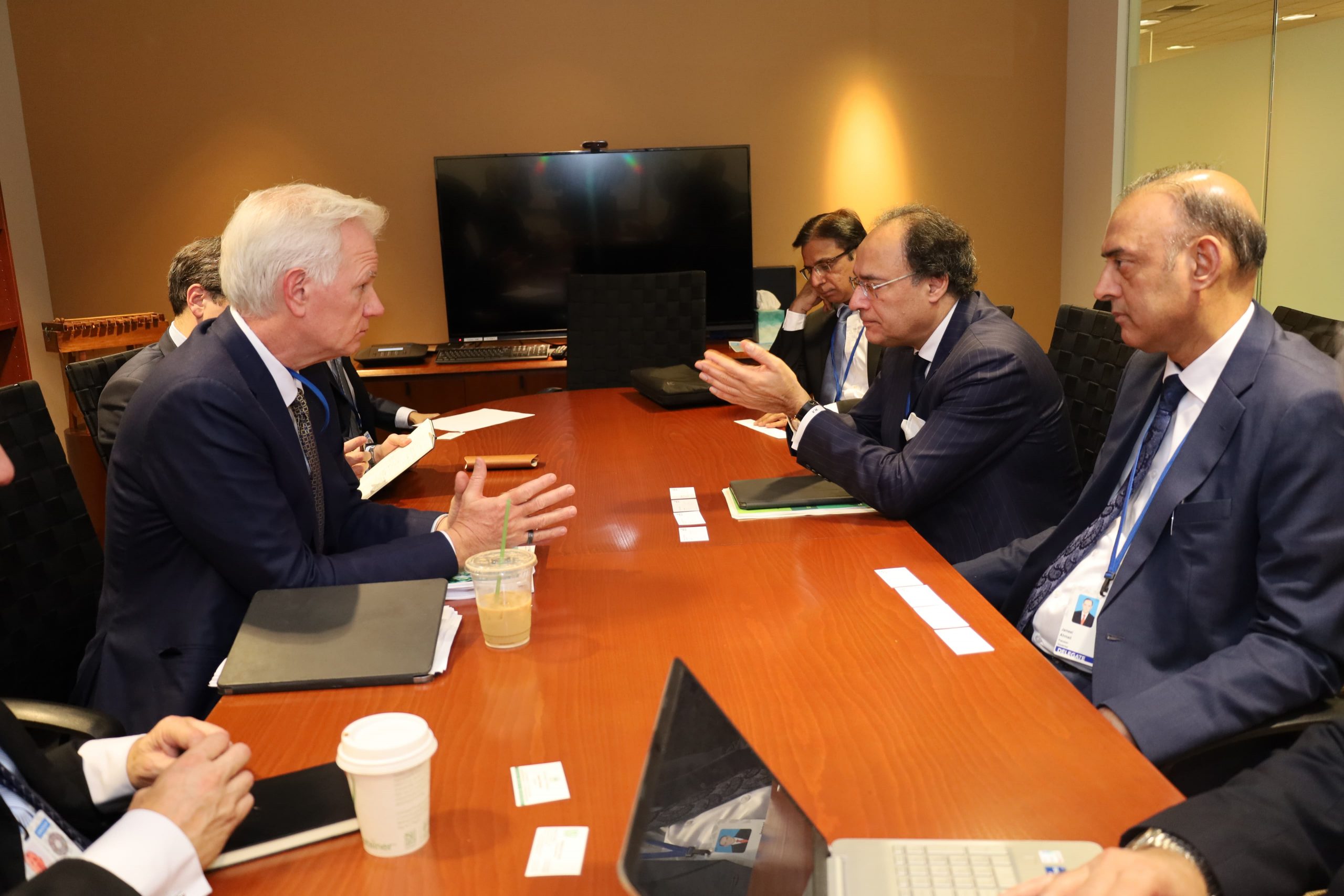

On the equity front, Pakistan State Oil Company Limited (PSO) signed a Long Term LNG Sales and Purchase Agreement (SPA) with Qatar Petroleum (QP), pursuant to Federal Cabinet’s approval of bilateral Government to Government Agreement (G to G) which shall augment cooperation in the Energy Sector between Pakistan and Qatar.

Azgard Nine Limited ceased to exercise control over the activities of Montebello S.R.L (MBL), previously a 100% owned subsidiary of the company, as a result of ongoing bankruptcy proceedings and management of the liquidation process of MBL by the Court appointed trustee.

The Board of Directors of Unity Foods Limited, in its meeting held on February 25, 2021, approved in-principle acquisition of 16,467,818 (31%) shares of Sunridge Food (Private) Limited at Rs. 28 per share.

The Board of Directors of Gul Ahmed Textile Mills Limited has authorized the company to re-formulate and propose the terms for a carve-out/hive-out of its local business segment (including retail business along with related assets) into a wholly owned subsidiary which was put on hold last year due to COVID Pandemic, along with a reorganization of other related assets by means of a merger / demerger and upon finalization of the same by the management, be presented to the BoD for their consideration.

The Economic Coordination Committee of the Cabinet removed the cap on the distribution of dividend by Mari Petroleum Company Limited (MPCL).

The SECP granted the extension of ninety days to make a Public Announcement of Offer (PAO) by AKD Securities, on the behalf of the acquirers, ARY Communications Limited and ARY Digital FZLLC, which now may be made till May 05, 2021.

The Board of Directors of Hascol Petroleum Limited, in their Extraordinary Meeting held on February 23, 2021, granted its approval to raise the authorized share capital of the company from Rs. 10 billion to Rs. 50 billion.

Netsol Technologies Limited issued a clarification to Pakistan Stock Exchange, wherein it has denied having any connection with a recent article containing price-sensitive information, written by an independent blogger that is being circulated on social media platforms.

Copyright Mettis Link News

39965