Market Roundup

The harmless sounding novel coronavirus COVID-19 turned out be as contagious and destructive for the financial markets as it potentially is for the people investing in them.

Financial markets across the world suffered their worst week since the financial crises of 2008 with many companies reporting their business and profits will be affected.

An estimated 6 trillion USD has been wiped out in 6 days with markets expected to fall further next week.

Equity Market Round:

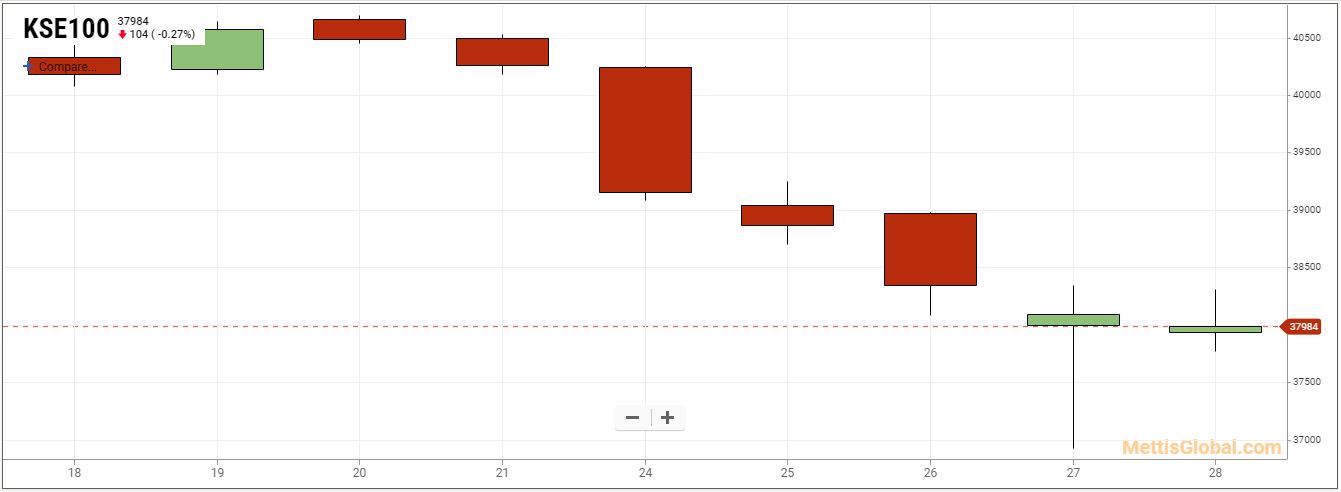

Pakistan, which has so far reported 4 cases, saw the stock exchange plunge by 2,265 points or 5.63 percent, its worst weekly performance since June 2017 as USD 2.837 Billion was wiped off the all share market capitalization.

Panic over the fallout from the virus coincided with the rollover week which exacerbated the situation and Moody’s report that Pakistan’s continued presence on FATF’s grey list being a credit negative for its banking sector further dented investor sentiment.

Positive news about IMF reaching a staff level agreement for the next installment under the EFF along with increase in SBP reserves, reduction in weekly SPI numbers and expectations that gradual reduction of inflation would lead to monetary easing sooner rather than later had little impact on the market.

Energy Stocks led the rout by taking out 766 points off the KSE100 index followed by commercial banks, Power Generation and Fertilizer sectors with 531, 232 and 198 points.

Figures released by NCCPL showed that foreign investors dumped USD 22 million worth of stocks during the week with foreign corporates doing bulk of the selling.

Local Insurance companies picked up USD 25.27 million worth of stocks, with Banks & DFIs picking up USD 7.7 million as Mutual Funds came under pressure because of redemptions and sold shares worth USD 11.559 Million.

Forex Roundup:

PKR closed marginally lower, losing 3 paisa over the course of the week and extending its losing streak to two consecutive weeks against the dollar, an event which hasn’t occurred since Oct 2019.

The dollar appreciated to 154.23 compared to 154.20 from the previous week.

10 day volatility decreased from 0.81 percent to 0.46 percent as the Dollar traded in a narrow range throughout the week touching a (Bid) high of 154.28 and a (ask) low of 154.20.

However, the second session (next day settlement) on Friday witnessed the dollar being quoted at a high of 154.65 before it fell to 154.50.

Fixed Income Roundup:

Softening weekly SPI numbers and expectations that the February inflation numbers will suggest easing in inflationary pressure set the tone as yields dropped across the board for all tenors.

Interest rates decreased by 4, 14 and 33 basis points for 3, 6 and 12 month T-Bills, while the longer term PIB rates decreased by 35, 30 and 16 bps for 3, 5 and 10 years.

Furthermore, as yields started to decrease and expectations of monetary easing built, the MTB auction held in the outgoing week witnessed increased participation in the 1 year T-Bill with over Rs. 1.1 Trillion in bids received by SBP, as market participants aimed to lock in their funds at high rates.

Further clarity on the direction of interest rates will be available this week as the PBS is expected to release February inflation numbers on Monday and SBP will conduct a PIB auction on Wednesday.

Copyright Mettis Link News

33097