By (Misbah Maqbool)

July 13, 2020 (MLN):

KSE 100 WEEKLY CHART

KSE 100 DAILY CHART

Last Friday KSE 100 index closed up 48 points on DoD and 1,139 points on WoW basis to 36,190 level. Currently market is in uptrend which will be intact until market trades below 33,700 index level. Market’s shorter period moving average is above its longer period moving average. MACD signal line is trading above its 9 day exponential moving average.

STRATEGY: Buying is advised with initial Stop Loss of 33,700.

Given below please find technical analysis view and charts of key scrips:

| KEY SCRIPS SHORT TERM TREND AND SUPPORT/RESISTANCE LEVEL | ||||||

| Symbols | Closing | Trend | Support/Resistance | MA Trend | MACD Trend | |

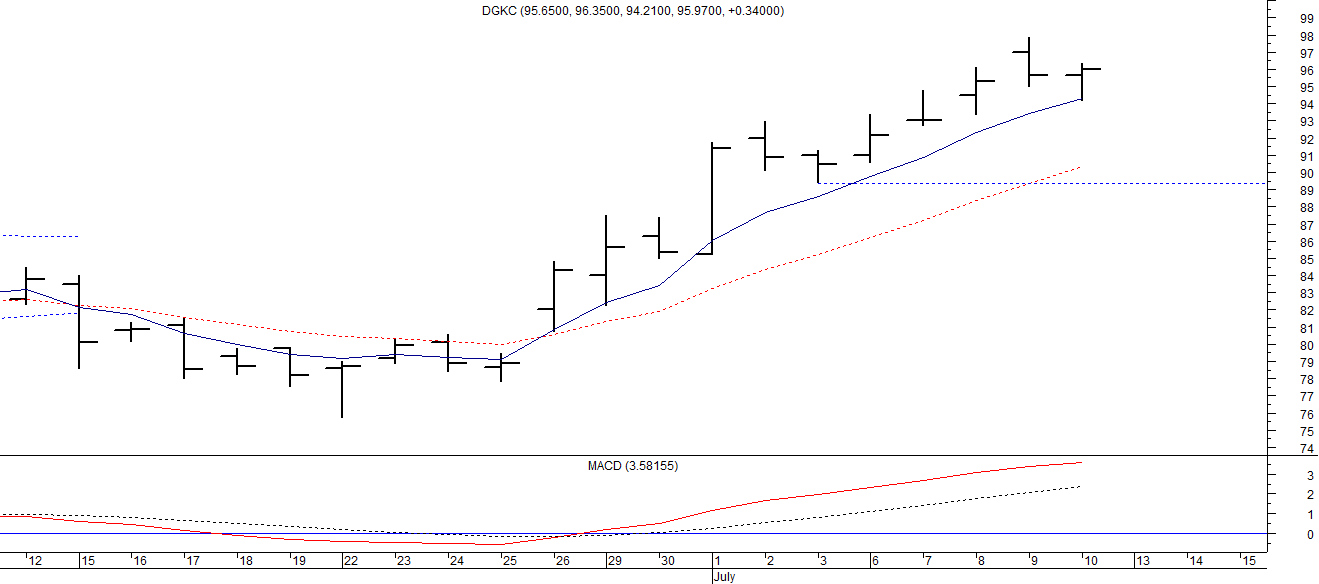

| DGKC | 95.97 | UP | 89.4 | UP | UP | |

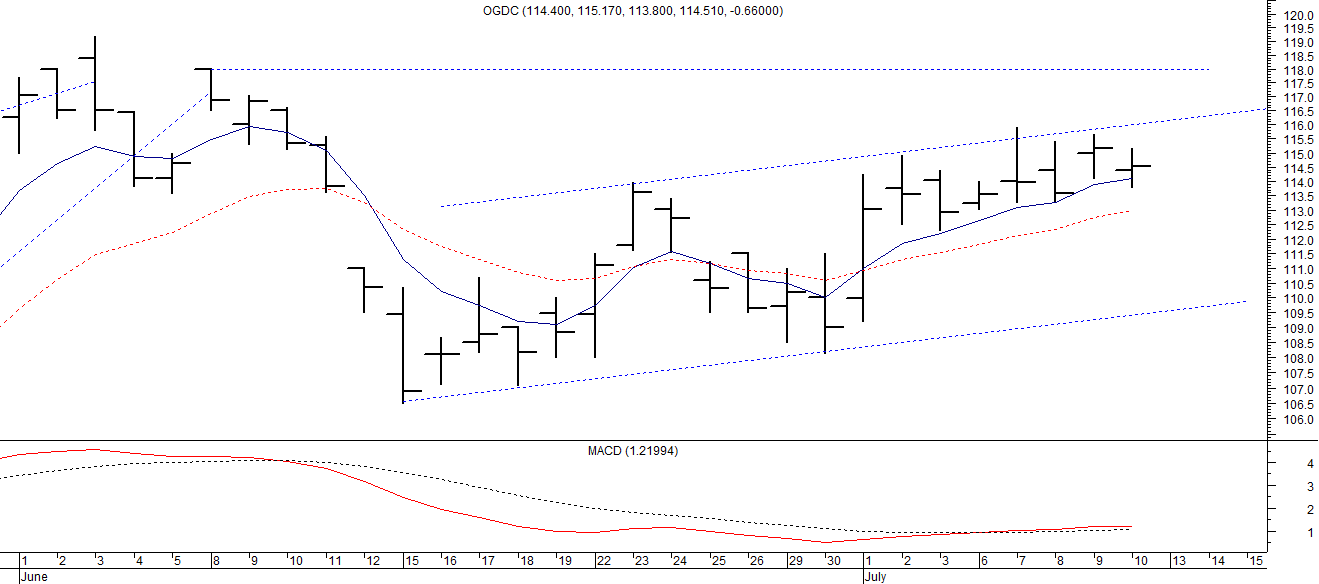

| OGDC | 114.51 | UP | 118 | UP | UP | |

| ISL | 56.58 | UP | 57.48 | UP | UP | |

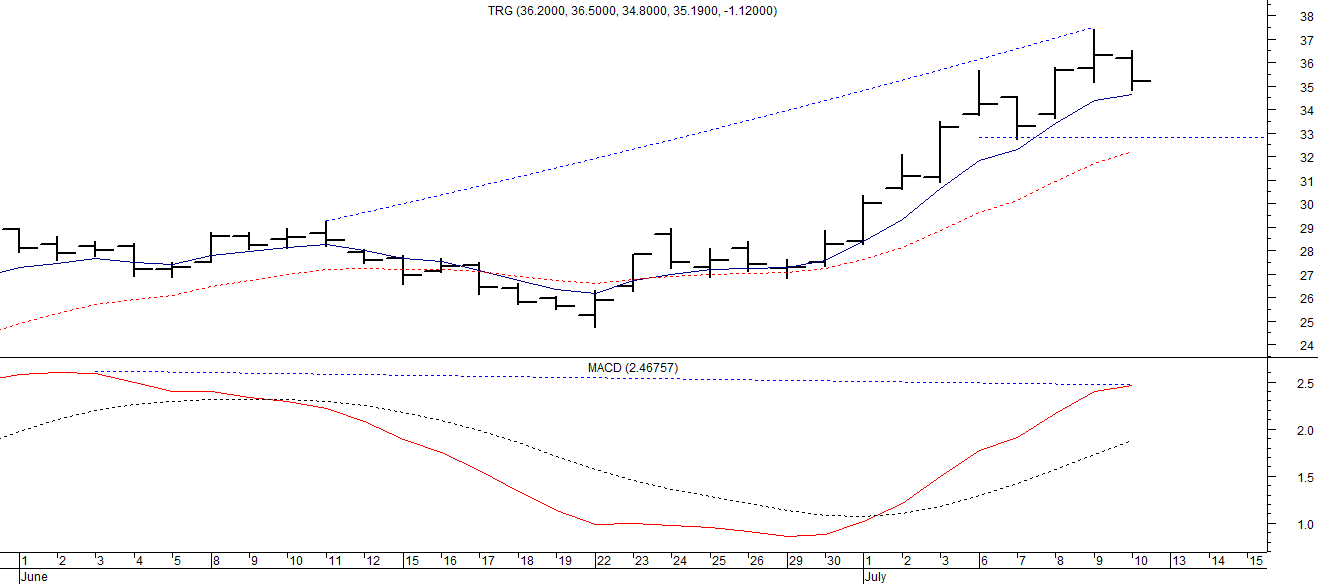

| TRG | 35.19 | UP | 32.75 | UP | UP | |

| Support/Resistance value are mentioned in black and red respectively | ||||||

DGKC

DGKC has support at Rs. 89.40 for near future. EMA cross and MACD cross are providing positive trend indication.

STRATEGY: Buying is advised with initial Stop Loss of Rs. 89.40.

OGDC

As mentioned in previous two write-ups, OGDC is going through its one and half month consolidation which will end once it will close above Rs. 118 level. Recovery from June mid is not impulsive in nature but it seems like it was a corrective upside move. It will be considered upside correction until it comes out from upper boundary of ascending channel.

STRATEGY: No action is recommended at this moment. Buying will be advised if close above Rs. 118. Selling will be advised if close below Rs. 108.

ISL

Shorter period EMA is above its longer period EMA. MACD is also showing positive trend. In near future its resistance level will be Rs. 57.48.

STRATEGY: Profit booking on 25 percent of holding is recommended. Build same holding if close above Rs. 57.48.

TRG

TRG stop loss level is at Rs. 32.75. MACD is providing negative divergence which is an indication of expected decline in near future.

STRATEGY: Profit booking is advised if it trades below Rs. 32.75.

“Misbah Maqbool is a MBA and CIM (Chartered Investment Manager). He has served over 20 years as Portfolio Manager in various Leading Financial Institutions namely National Bank of Pakistan, Pak Brunei Investment Company, Pak Oman Investment Company and Alfalah GHP Investment Management Limited.”

Disclaimer: The opinions in this article are the author’s and do not necessarily represent the views of Mettis Link News (MLN)

Copyright Mettis Link News